Answered step by step

Verified Expert Solution

Question

1 Approved Answer

risk and return analysis for Metcash (MTS:ASX) what more info should I add? I have calculated the portfolio values now I hve to do risk

risk and return analysis for Metcash (MTS:ASX)

what more info should I add?

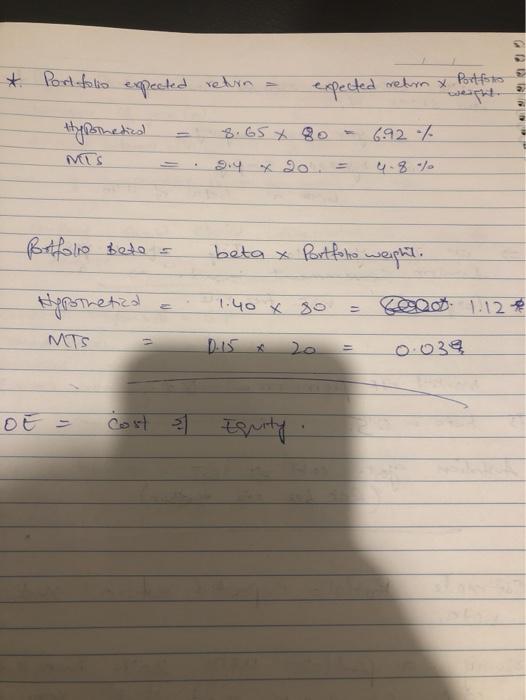

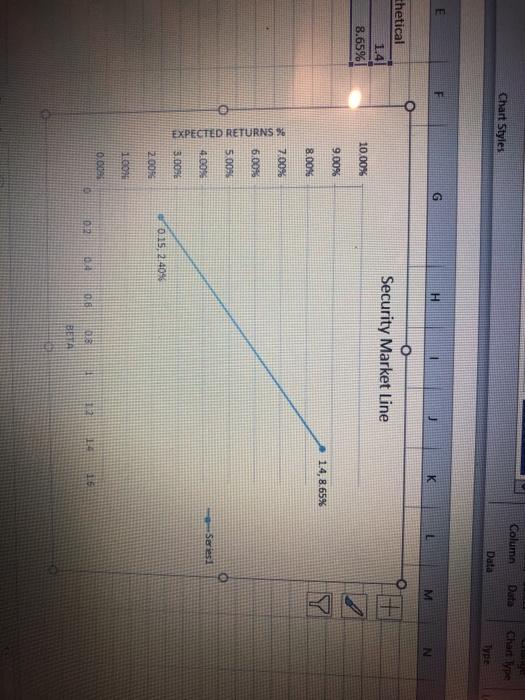

I have calculated the portfolio values now I hve to do risk and return analysis using those values and security market line graph. I have to compare Metcash and the hypothetical company.

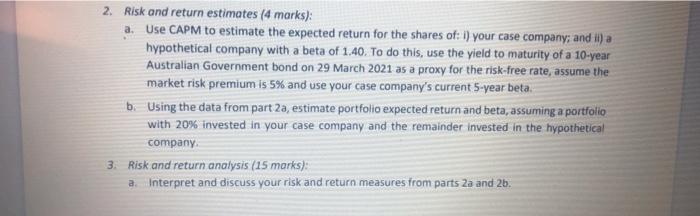

expected return x Portfoto * Portfolio expected returns Hypothetica 8.65 x 80 9.4 GU 692 / 4.8 % Portfolio Belo s beta x Portfoto weight. Hypothetica 1.40 X so Sooo 1.12 MTS 11 0.039 Cost s Equity LES Column Data Chart Styles Chan Type TVE Data F G H K M N thetical 1.4 8.65% Security Market Line 10.0095 9.00% 1.4, 8.65% Y 8.00% R 7.00% 6.00% EXPECTED RETURNS % 5.005 Series 4.0096 3.00 15, 2.40% 2.005 1.00 b.ba 02 04 0.8 13 16 1. BETA 2. Risk and return estimates (4 marks): a. Use CAPM to estimate the expected return for the shares of: i) your case company, and ii) a hypothetical company with a beta of 1.40. To do this, use the yield to maturity of a 10-year Australian Government bond on 29 March 2021 as a proxy for the risk-free rate, assume the market risk premium is 5% and use your case company's current 5-year beta. b. Using the data from part2a, estimate portfolio expected return and beta, assuming a portfolio with 20% invested in your case company and the remainder invested in the hypothetical company 3. Risk and return analysis (15 marks): a. Interpret and discuss your risk and return measures from parts za and 25. expected return x Portfoto * Portfolio expected returns Hypothetica 8.65 x 80 9.4 GU 692 / 4.8 % Portfolio Belo s beta x Portfoto weight. Hypothetica 1.40 X so Sooo 1.12 MTS 11 0.039 Cost s Equity LES Column Data Chart Styles Chan Type TVE Data F G H K M N thetical 1.4 8.65% Security Market Line 10.0095 9.00% 1.4, 8.65% Y 8.00% R 7.00% 6.00% EXPECTED RETURNS % 5.005 Series 4.0096 3.00 15, 2.40% 2.005 1.00 b.ba 02 04 0.8 13 16 1. BETA 2. Risk and return estimates (4 marks): a. Use CAPM to estimate the expected return for the shares of: i) your case company, and ii) a hypothetical company with a beta of 1.40. To do this, use the yield to maturity of a 10-year Australian Government bond on 29 March 2021 as a proxy for the risk-free rate, assume the market risk premium is 5% and use your case company's current 5-year beta. b. Using the data from part2a, estimate portfolio expected return and beta, assuming a portfolio with 20% invested in your case company and the remainder invested in the hypothetical company 3. Risk and return analysis (15 marks): a. Interpret and discuss your risk and return measures from parts za and 25 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started