Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What It Means to Invest in Stocks? Common stock is considered to be one of the most popular investment vehicles for long-term wealth building. Investors

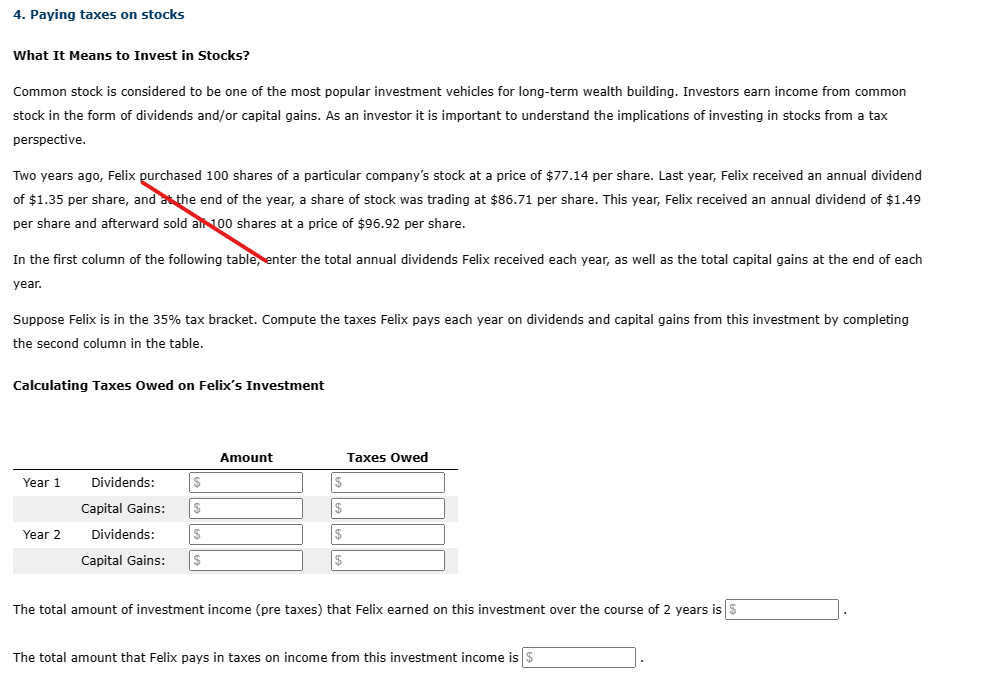

What It Means to Invest in Stocks? Common stock is considered to be one of the most popular investment vehicles for long-term wealth building. Investors earn income from common stock in the form of dividends and/or capital gains. As an investor it is important to understand the implications of investing in stocks from a tax perspective. Two years ago, Felix purchased 100 shares of a particular company's stock at a price of $77.14 per share. Last year, Felix received an annual dividend of $1.35 per share, and ak the end of the year, a share of stock was trading at $86.71 per share. This year, Felix received an annual dividend of $1.49 per share and afterward sold al1 100 shares at a price of $96.92 per share. In the first column of the following table,enter the total annual dividends Felix received each year, as well as the total capital gains at the end of each year. Suppose Felix is in the 35% tax bracket. Compute the taxes Felix pays each year on dividends and capital gains from this investment by completing the second column in the table. Calculating Taxes Owed on Felix's Investment The total amount of investment income (pre taxes) that Felix earned on this investment over the course of 2 years is The total amount that Felix pays in taxes on income from this investment income is

What It Means to Invest in Stocks? Common stock is considered to be one of the most popular investment vehicles for long-term wealth building. Investors earn income from common stock in the form of dividends and/or capital gains. As an investor it is important to understand the implications of investing in stocks from a tax perspective. Two years ago, Felix purchased 100 shares of a particular company's stock at a price of $77.14 per share. Last year, Felix received an annual dividend of $1.35 per share, and ak the end of the year, a share of stock was trading at $86.71 per share. This year, Felix received an annual dividend of $1.49 per share and afterward sold al1 100 shares at a price of $96.92 per share. In the first column of the following table,enter the total annual dividends Felix received each year, as well as the total capital gains at the end of each year. Suppose Felix is in the 35% tax bracket. Compute the taxes Felix pays each year on dividends and capital gains from this investment by completing the second column in the table. Calculating Taxes Owed on Felix's Investment The total amount of investment income (pre taxes) that Felix earned on this investment over the course of 2 years is The total amount that Felix pays in taxes on income from this investment income is Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started