Question

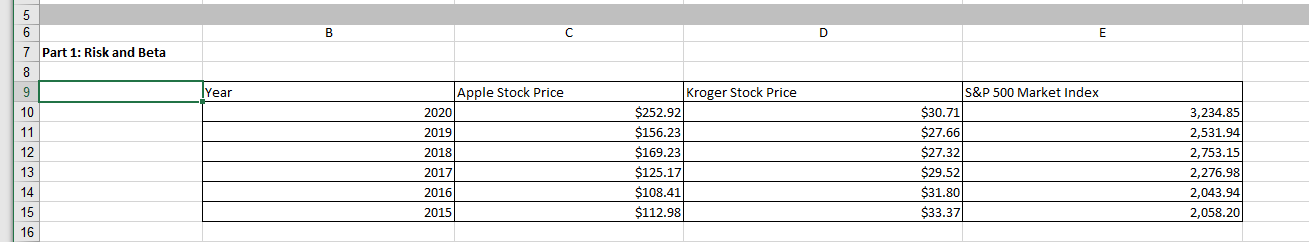

Risk and Return Use the following data to explore the risk-return relation and the concept of beta for Apple stock, Kroger stock, and the S&P

Risk and Return Use the following data to explore the risk-return relation and the concept of beta for Apple stock, Kroger stock, and the S&P 500 market index:

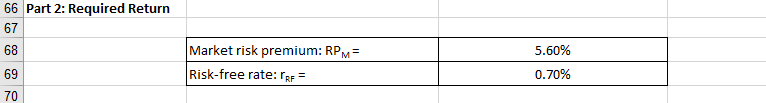

Part 2: Required Return

E. Calculate the expected return on the market according to: Expected Return on Market = Risk-Free Rate + Market Risk Premium. Also calculate the required return for Apple and Kroger according to: Required Return = Risk-Free Rate + (Beta)(Market Risk Premium).

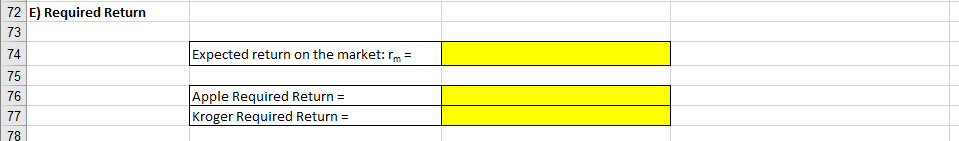

F. If you formed a portfolio that consisted of 60% Apple stock and 40% Kroger stock, calculate the beta.

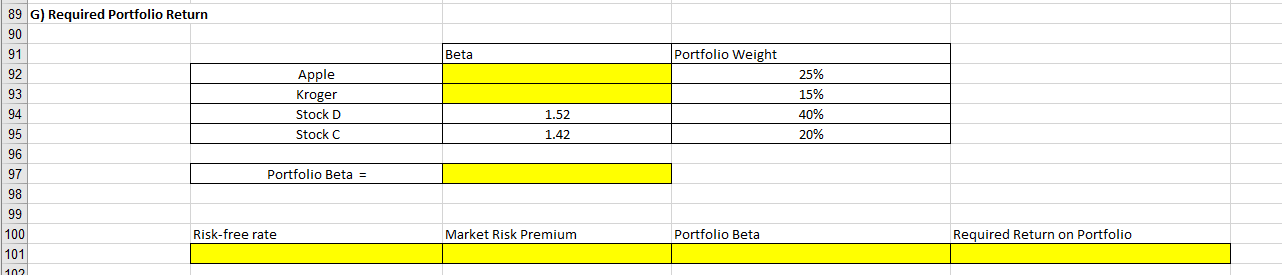

G. Calculate the portfolio beta of the four-stock portfolio and the required return on the portfolio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started