Answered step by step

Verified Expert Solution

Question

1 Approved Answer

risk Management QUESTION SIX 5 In 2000, Hong Kong International Theme Parks Limited (HKTP), an entity jointly owned by The Walt Disney Company and the

risk Management

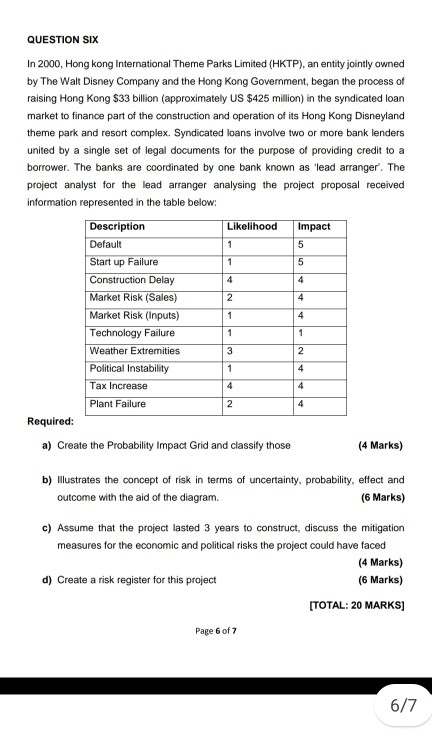

QUESTION SIX 5 In 2000, Hong Kong International Theme Parks Limited (HKTP), an entity jointly owned by The Walt Disney Company and the Hong Kong Government, began the process of raising Hong Kong $33 billion (approximately US $425 million) in the syndicated loan market to finance part of the construction and operation of its Hong Kong Disneyland theme park and resort complex. Syndicated loans involve two or more bank lenders united by a single set of legal documents for the purpose of providing credit to a borrower. The banks are coordinated by one bank known as 'lead arranger'. The project analyst for the lead arranger analysing the project proposal received information represented in the table below: Description Likelihood Impact Default Start up Failure Construction Delay Market Risk (Sales) Market Risk (Inputs) Technology Failure Weather Extremities 3 Political Instability Tax Increase Plant Failure Required: a) Create the probability Impact Grid and classify those (4 Marks) 1 1 5 4 4 2 4 1 4 1 1 2 1 4 4 4 2 4 b) Illustrates the concept of risk in terms of uncertainty, probability, effect and outcome with the aid of the diagram. (6 Marks) c) Assume that the project lasted 3 years to construct, discuss the mitigation measures for the economic and political risks the project could have faced (4 Marks) d) Create a risk register for this project (6 Marks) (TOTAL: 20 MARKS] Page 6 of 7 6/7 QUESTION SIX 5 In 2000, Hong Kong International Theme Parks Limited (HKTP), an entity jointly owned by The Walt Disney Company and the Hong Kong Government, began the process of raising Hong Kong $33 billion (approximately US $425 million) in the syndicated loan market to finance part of the construction and operation of its Hong Kong Disneyland theme park and resort complex. Syndicated loans involve two or more bank lenders united by a single set of legal documents for the purpose of providing credit to a borrower. The banks are coordinated by one bank known as 'lead arranger'. The project analyst for the lead arranger analysing the project proposal received information represented in the table below: Description Likelihood Impact Default Start up Failure Construction Delay Market Risk (Sales) Market Risk (Inputs) Technology Failure Weather Extremities 3 Political Instability Tax Increase Plant Failure Required: a) Create the probability Impact Grid and classify those (4 Marks) 1 1 5 4 4 2 4 1 4 1 1 2 1 4 4 4 2 4 b) Illustrates the concept of risk in terms of uncertainty, probability, effect and outcome with the aid of the diagram. (6 Marks) c) Assume that the project lasted 3 years to construct, discuss the mitigation measures for the economic and political risks the project could have faced (4 Marks) d) Create a risk register for this project (6 Marks) (TOTAL: 20 MARKS] Page 6 of 7 6/7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started