Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Risk management strategies ND11:39 Question #1 Read the audited Balance Sheet of Al-Maha Petroleum Products Marketing Company SAOG for the year 2017, 2018 and 2019

Risk management strategies

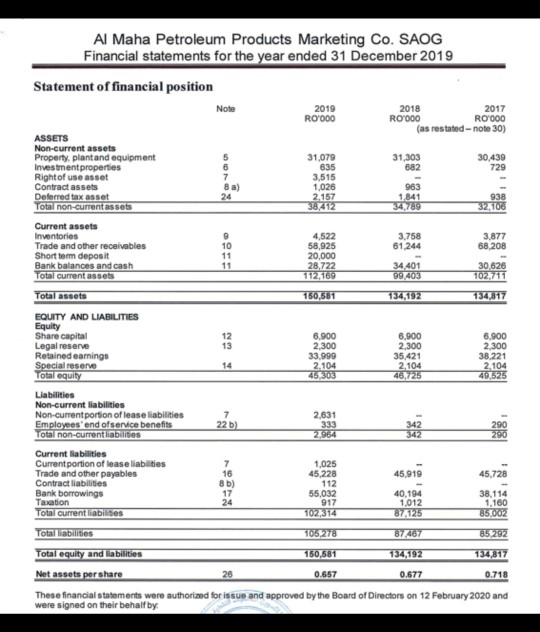

ND11:39 Question #1 Read the audited Balance Sheet of Al-Maha Petroleum Products Marketing Company SAOG for the year 2017, 2018 and 2019 (pasted in the last page of this assessment as "Annexure-A". Required: Using "Common Site Analysis Method", prepare the following analysis: a) Vertical Analysis of Al-Maha Petroleum (Marks) b) Horizontal Analysis of Al-Maha Petroleum 15 Marks! SHE Favourite Ft Delete More Al Maha Petroleum Products Marketing Co. SAOG Financial statements for the year ended 31 December 2019 Statement of financial position Note 2019 2018 2017 R0000 R0000 R0000 (as restated-note 30) ASSETS Non-current assets Property, plant and equipment 5 31,079 31,303 30,439 Investment properties 6 635 682 729 Right of use asset 7 3,515 Contract assets 8 a) 1,026 963 Deferred tax asset 24 2.157 1841 938 Total non-current assets 38,412 34,709 32,106 Current assets Inventories 9 4,522 3.758 3,877 Trade and other receivables 10 58,925 61 244 68.208 Short term deposit 11 20,000 Bank balances and cash 11 28,722 34 401 30,626 Total current assets 112,169 99 403 102,711 Total assets 160,681 134,192 134,817 EQUITY AND LIABILITIES Equity Share capital 12 6.900 6.900 6.900 Legal reserve 13 2,300 2,300 2.300 Retained earnings 33.999 35,421 38.221 Special reserve 14 2.104 2,104 2.104 Total equity 45.305 46,725 49,525 Liabilities Non-current liabilities Non-current portion of lease liabilities 2,631 Employees' end ofservice benefits 22b) 333 342 290 Total non-currentliabilities Current liabilities Current portion of lease liabilities 7 1,025 Trade and other payables 16 45,228 45,919 45,728 Contract liabilities Bank borrowings 17 55,032 40,194 38,114 Taxation 24 917 1,012 1,160 Total current liabilities 102,314 874125 85.002 Total liabilities 105,278 87,467 85 292 Total equity and liabilities 150,581 134,192 134,817 Net assets per share 26 0.657 0.677 0.718 These financial statements were authorized for issue and approved by the Board of Directors on 12 February 2020 and were signed on their behalf by 290 8b) 112 ND11:39 Question #1 Read the audited Balance Sheet of Al-Maha Petroleum Products Marketing Company SAOG for the year 2017, 2018 and 2019 (pasted in the last page of this assessment as "Annexure-A". Required: Using "Common Site Analysis Method", prepare the following analysis: a) Vertical Analysis of Al-Maha Petroleum (Marks) b) Horizontal Analysis of Al-Maha Petroleum 15 Marks! SHE Favourite Ft Delete More Al Maha Petroleum Products Marketing Co. SAOG Financial statements for the year ended 31 December 2019 Statement of financial position Note 2019 2018 2017 R0000 R0000 R0000 (as restated-note 30) ASSETS Non-current assets Property, plant and equipment 5 31,079 31,303 30,439 Investment properties 6 635 682 729 Right of use asset 7 3,515 Contract assets 8 a) 1,026 963 Deferred tax asset 24 2.157 1841 938 Total non-current assets 38,412 34,709 32,106 Current assets Inventories 9 4,522 3.758 3,877 Trade and other receivables 10 58,925 61 244 68.208 Short term deposit 11 20,000 Bank balances and cash 11 28,722 34 401 30,626 Total current assets 112,169 99 403 102,711 Total assets 160,681 134,192 134,817 EQUITY AND LIABILITIES Equity Share capital 12 6.900 6.900 6.900 Legal reserve 13 2,300 2,300 2.300 Retained earnings 33.999 35,421 38.221 Special reserve 14 2.104 2,104 2.104 Total equity 45.305 46,725 49,525 Liabilities Non-current liabilities Non-current portion of lease liabilities 2,631 Employees' end ofservice benefits 22b) 333 342 290 Total non-currentliabilities Current liabilities Current portion of lease liabilities 7 1,025 Trade and other payables 16 45,228 45,919 45,728 Contract liabilities Bank borrowings 17 55,032 40,194 38,114 Taxation 24 917 1,012 1,160 Total current liabilities 102,314 874125 85.002 Total liabilities 105,278 87,467 85 292 Total equity and liabilities 150,581 134,192 134,817 Net assets per share 26 0.657 0.677 0.718 These financial statements were authorized for issue and approved by the Board of Directors on 12 February 2020 and were signed on their behalf by 290 8b) 112

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started