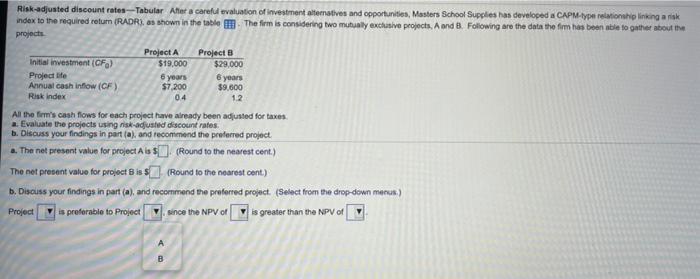

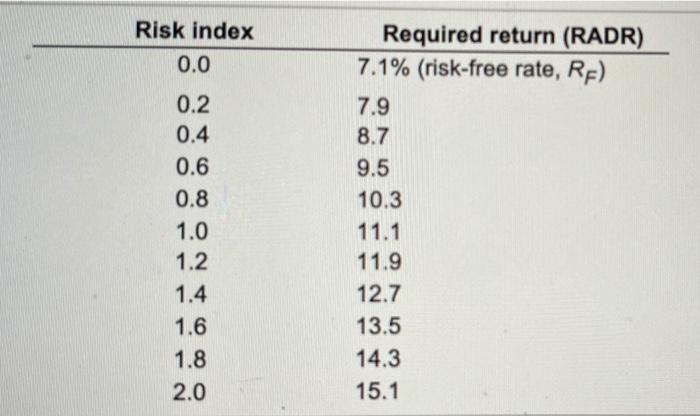

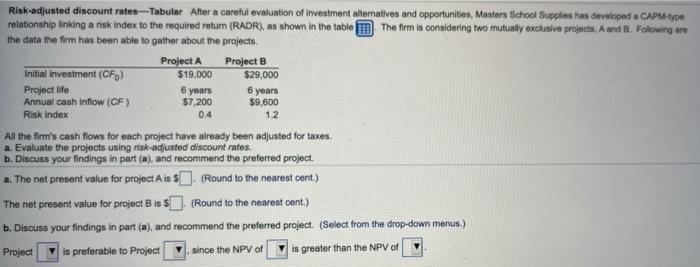

Risk-adjusted discount rates--Tabular After a careful evaluation of investment alternatives and opportunities, Masters School Supplies has developed a CAPM-type relationship linking anak index to the required retum (RADR), as shown in the table. The firm is considering two mutusly exclusive projects. A and B. Following are the data the firm has been able to gather about the projects Project A Project B Initial investment (CF) $19.000 $29,000 Project lite 6 years 6 years Annual cash inflow (CF) $7.200 $9.600 Risk Index 04 1.2 All the firm's cash flows for each project have already been adjusted for taxes - Evaluate the projects using risk-adjusted discount rates. b. Discuss your findings in partla), and recommend the preferred project .. The net present value for project is $(Round to the nearest cent.) The net present value for project is $(Round to the nearest cent.) b. Discuss your findings in part (a), and recommend the preferred project. (Select from the drop-down menus) Project is preferable to Project since the NPV of Wis greater than the NPV of B Risk index 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 Required return (RADR) 7.1% (risk-free rate, RF) 7.9 8.7 9.5 10.3 11.1 11.9 12.7 13.5 14.3 15.1 12 Risk-adjusted discount rates --Tabular After a careful evaluation of investment alternatives and opportunities, Masters School Supplies has developed a CAPM type relationship linking a risk index to the required return (RADR), as shown in the table The firm is considering two mutually exclusive projects, and a. Following are the data the firm has been able to gather about the projects. Project A Project B Initial investment (CF) $19.000 $29,000 Project life 6 years 6 years Annual cash inflow (CF) $7,200 $9,600 Risk Index 0.4 All the firm's cash flows for each project have already been adjusted for taxes, a. Evaluate the projects using risk-adjusted discount rates. b. Discuss your findings in part (a), and recommend the preferred project a. The net present value for project is $. (Round to the nearest cent.) The net present value for project Biss I (Round to the nearest cont.) b. Discuss your findings in part (a), and recommend the preferred project. (Select from the drop-down menus.) Project is preferable to Project V since the NPV of is greater than the NPV of