Question

Rita owns a sole proprietorship in which she works as a management consultant. She maintains an office in her home (500 square feet) where she

Rita owns a sole proprietorship in which she works as a management consultant. She maintains an office in her home (500 square feet) where she meets with clients, prepares bills, and performs other work-related tasks. Her business expenses, other than home office expenses, total $5,600. The following home-related expenses have been allocated to her home office under the actual expense method for calculating home office expenses.

| Real property taxes | $ 1,600 |

|---|---|

| Interest on home mortgage | 5,100 |

| Operating expenses of home | 800 |

| Depreciation | 1,600 |

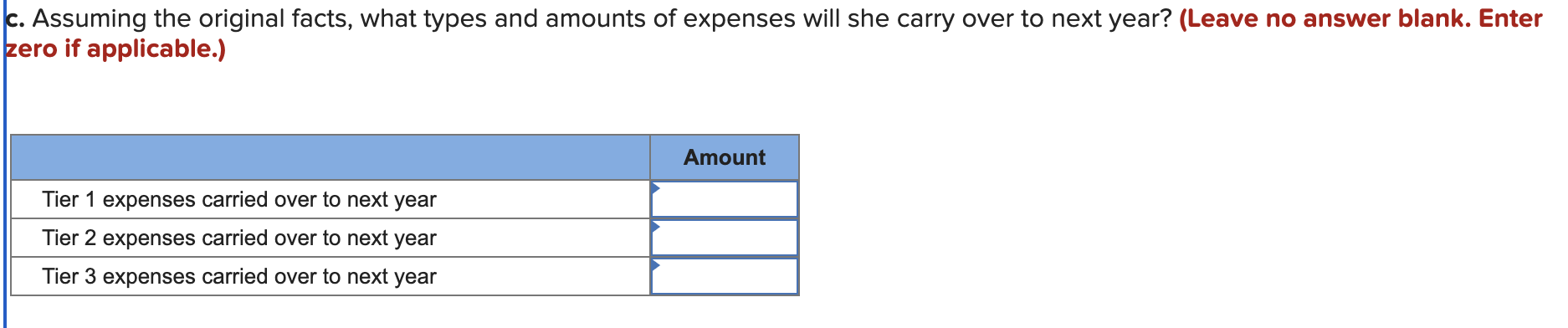

Also, assume that, not counting the sole proprietorship, Rita's AGI is $60,000. Rita itemizes deductions, and her itemized deduction for non-home business taxes is less than $10,000 by more than the real property taxes allocated to business use of the home. Assume Ritas consulting business generated $13,000 in gross income for the current year. Further, assume Rita uses the actual expense method for computing her home office expense deduction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started