Answered step by step

Verified Expert Solution

Question

1 Approved Answer

River Hawk Animal Sanctuary (RHAS) PART A Requirement 1 Explain management's incentive(s) to potentially misstate the company's earnings. Comment on the direction of the bias

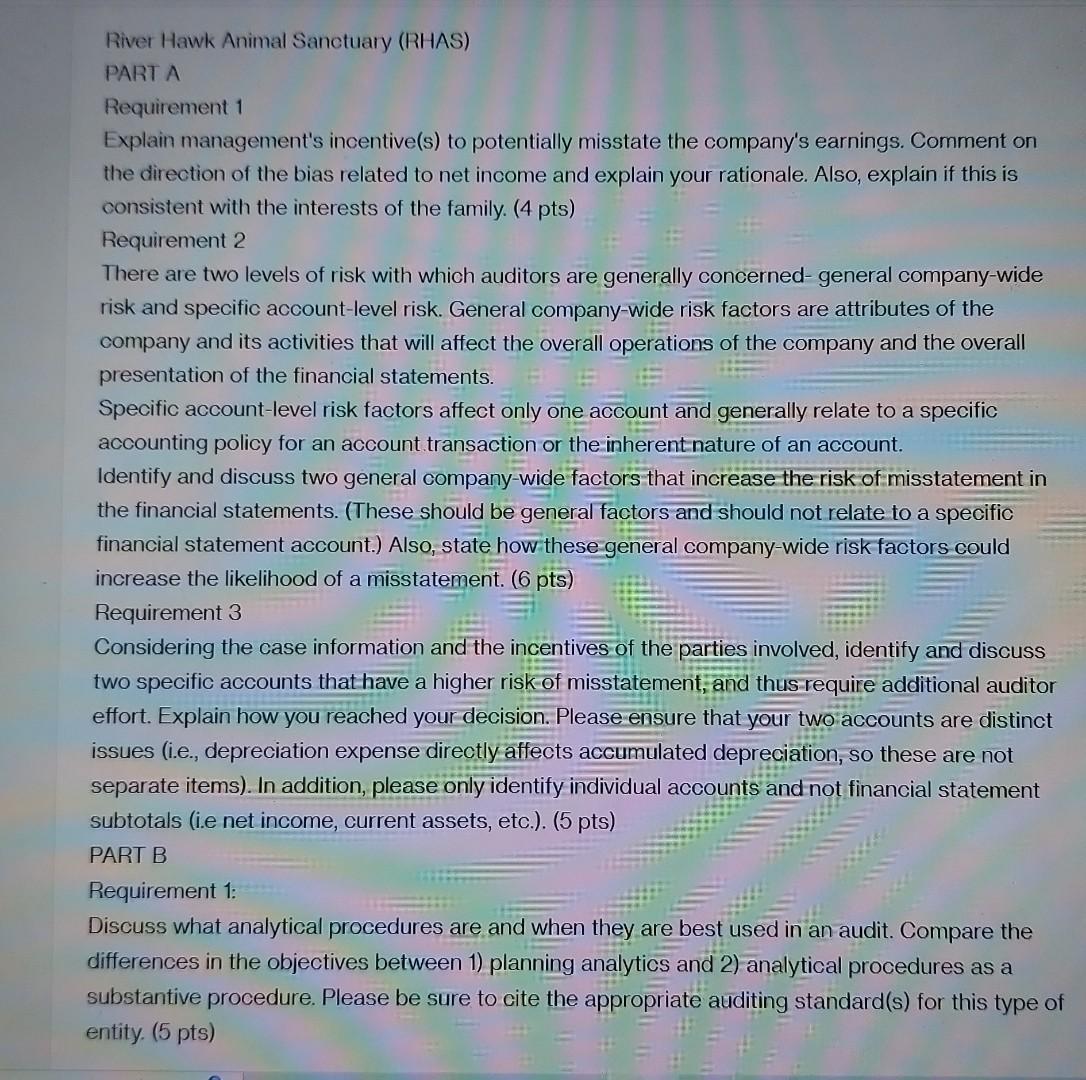

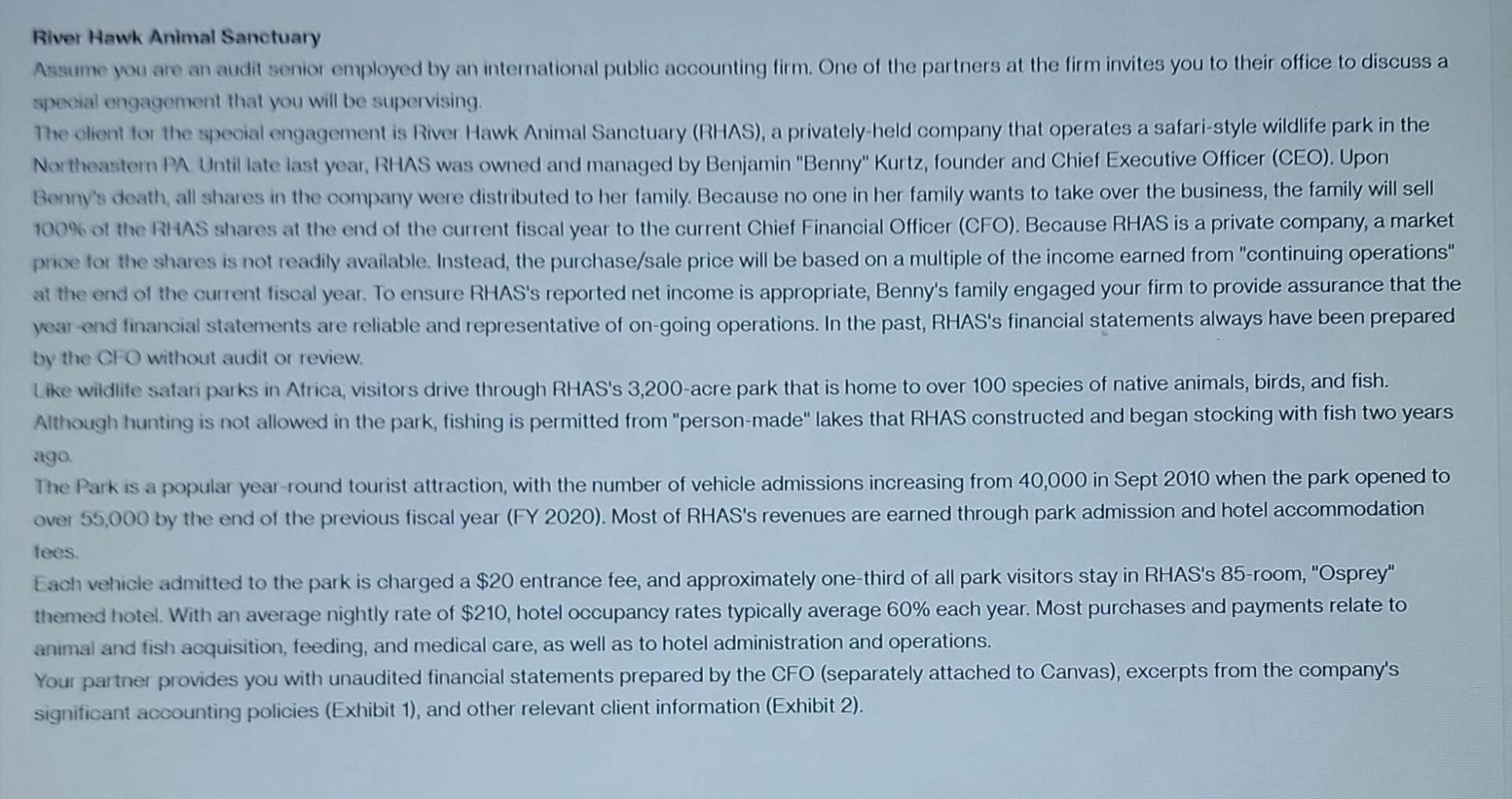

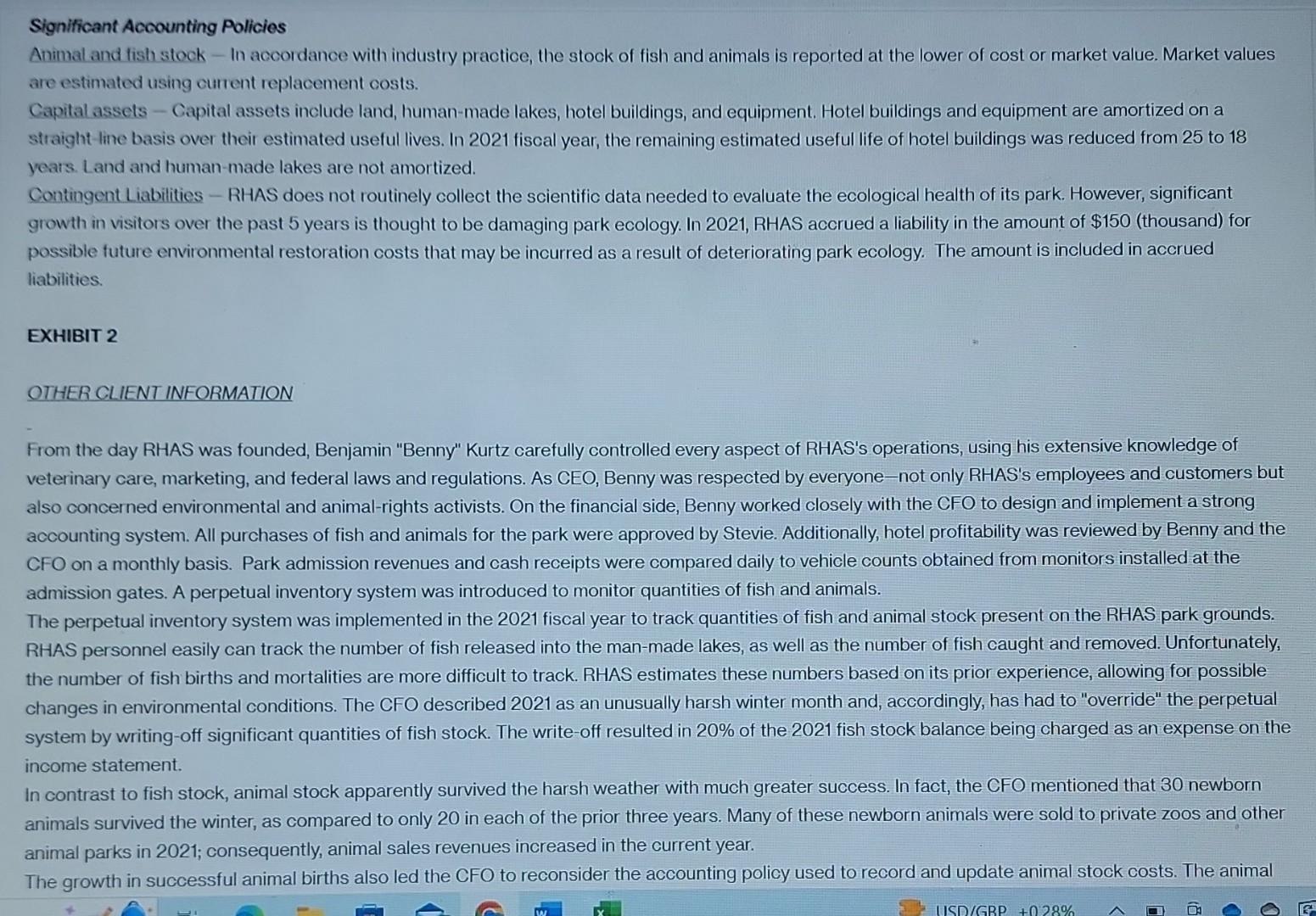

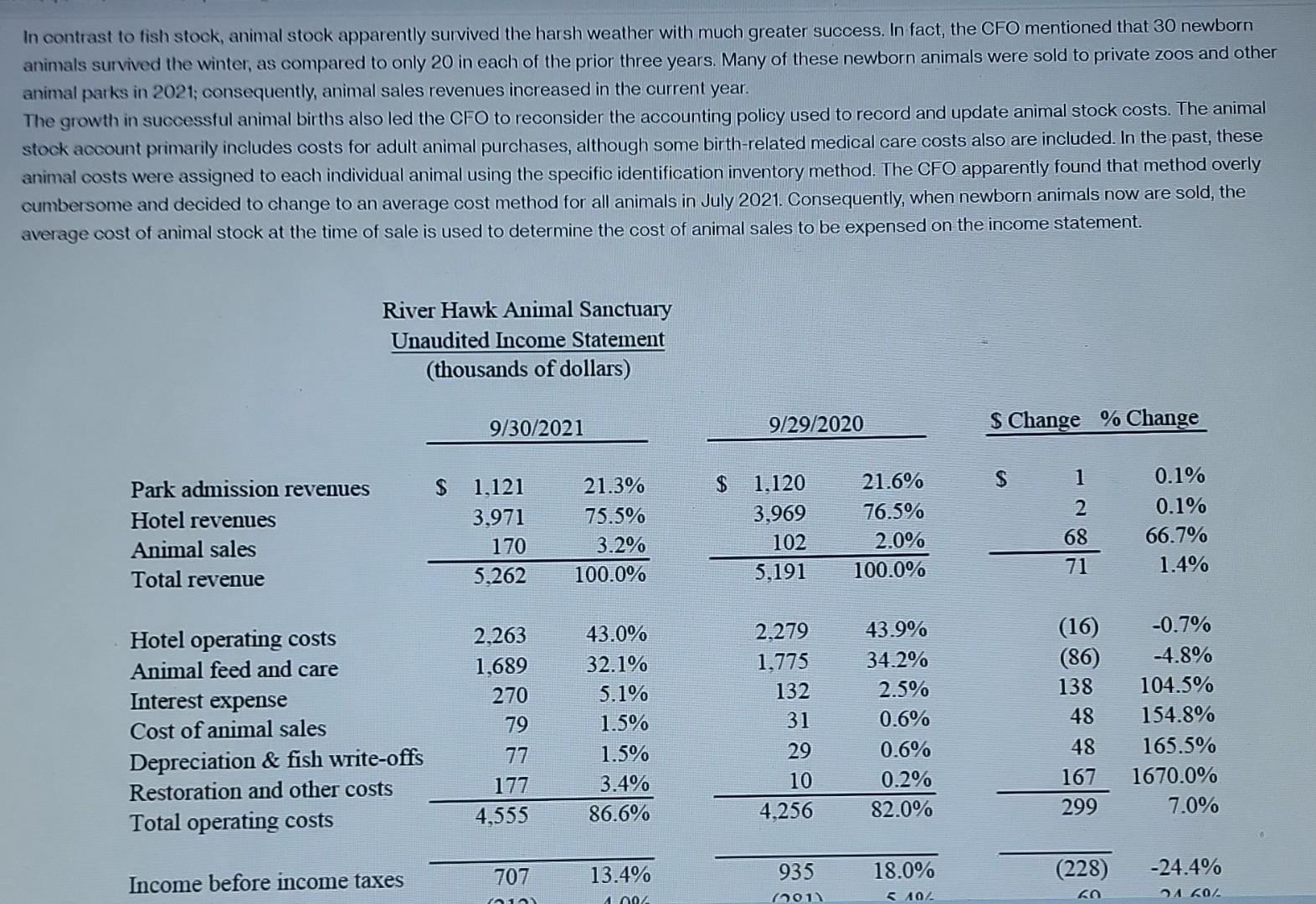

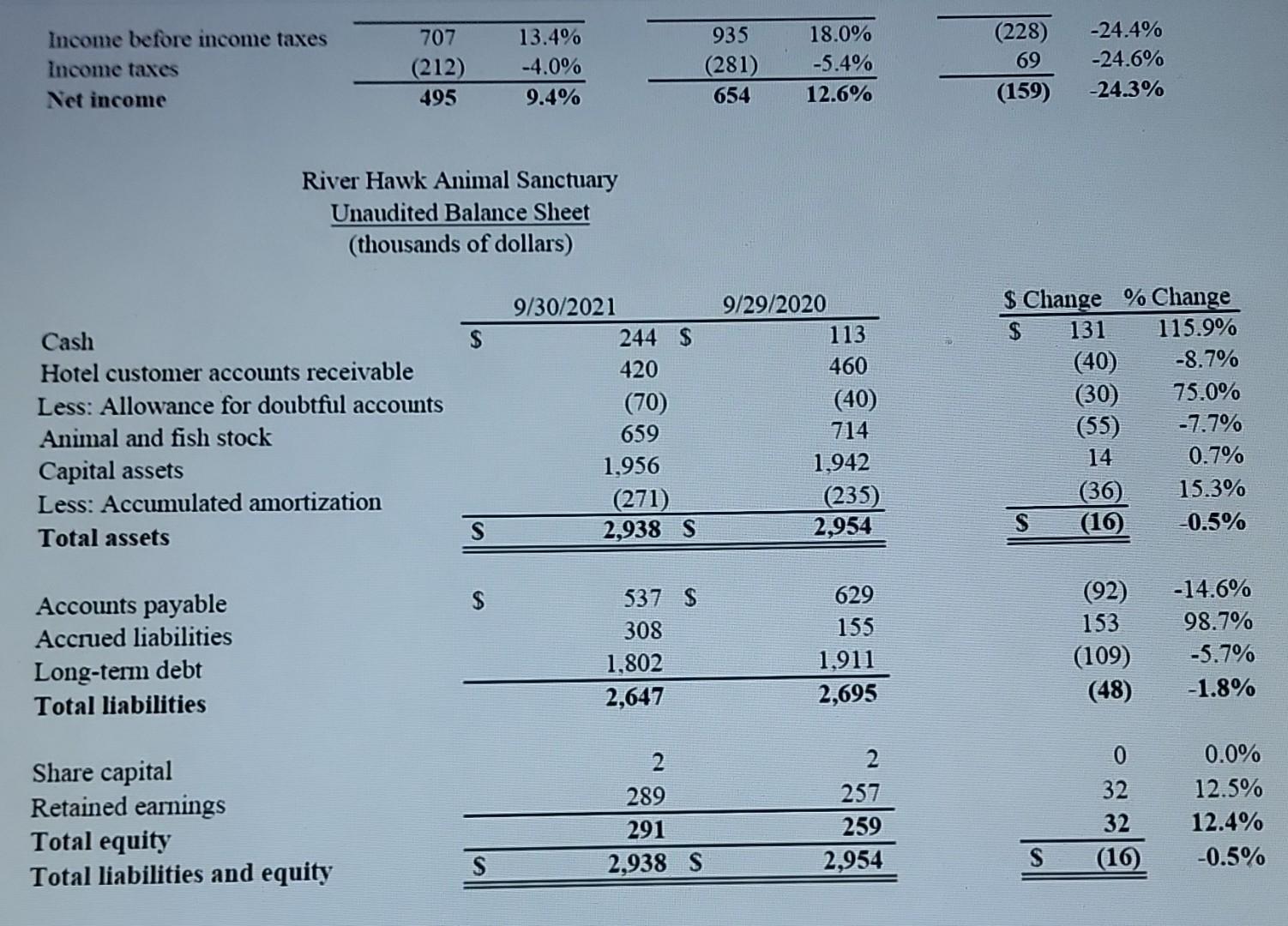

River Hawk Animal Sanctuary (RHAS) PART A Requirement 1 Explain management's incentive(s) to potentially misstate the company's earnings. Comment on the direction of the bias related to net income and explain your rationale. Also, explain if this is consistent with the interests of the family. (4 pts) Requirement 2 There are two levels of risk with which auditors are generally concerned-general company-wide risk and specific account-level risk. General company-wide risk factors are attributes of the company and its activities that will affect the overall operations of the company and the overall presentation of the financial statements. Specific account-level risk factors affect only one account and generally relate to a specific accounting policy for an account transaction or the inherent-nature of an account. Identify and discuss two general company-wide factors that increase the risk of misstatement in the financial statements. (These should be general factors and should not relate to a specific financial statement account.) Also, state how these general company-wide risk factors could increase the likelihood of a misstatement. ( 6 pts) Requirement 3 Considering the case information and the incentives of the parties involved, identify and discuss two specific accounts that have a higher risk-of misstatement; and thus-require additional auditor effort. Explain how you reached your decision. Please ensure that your two accounts are distinct issues (i.e., depreciation expense directly affects accumulated depreciation, so these are not separate items). In addition, please only identify individual accounts and not financial statement subtotals (i.e net income, current assets, etc.). (5 pts) PART B Requirement 1: Discuss what analytical procedures are and when they are best used in an audit. Compare the differences in the objectives between 1) planning analytics and 2) analytical procedures as a substantive procedure. Please be sure to cite the appropriate auditing standard(s) for this type of entity. (5 pts) River Hawk Animal Sanctuary Assume you are an audit senior employed by an international public accounting firm. One of the partners at the firm invites you to their office to discuss a special engagement that you will be supervising. The olient for the special engagement is River Hawk Animal Sanctuary (RHAS), a privately-held company that operates a safari-style wildlife park in the Northeastern PA. Until late last year, RHAS was owned and managed by Benjamin "Benny" Kurtz, founder and Chief Executive Officer (CEO). Upon Benny's death, all shares in the company were distributed to her family. Because no one in her family wants to take over the business, the family will sell 100% of the RHAS shares at the end of the current fiscal year to the current Chief Financial Officer (CFO). Because RHAS is a private company, a market price for the shares is not readily available. Instead, the purchase/sale price will be based on a multiple of the income earned from "continuing operations" at the end of the current fiscal year. To ensure RHAS's reported net income is appropriate, Benny's family engaged your firm to provide assurance that the year-end financial statements are reliable and representative of on-going operations. In the past, RHAS's financial statements always have been prepared by the GFO without audit or review. Like wildite satari parks in Atrica, visitors drive through RHAS's 3,200-acre park that is home to over 100 species of native animals, birds, and fish. Although hunting is not allowed in the park, fishing is permitted from "person-made" lakes that RHAS constructed and began stocking with fish two years aga The Park is a popular year-round tourist attraction, with the number of vehicle admissions increasing from 40,000 in Sept 2010 when the park opened to over 55,000 by the end of the previous fiscal year (FY 2020). Most of RHAS's revenues are earned through park admission and hotel accommodation tees. Each vehicle admitted to the park is charged a $20 entrance fee, and approximately one-third of all park visitors stay in RHAS's 85 -room, "Osprey" themed hotel. With an average nightly rate of $210, hotel occupancy rates typically average 60% each year. Most purchases and payments relate to animal and fish acquisition, feeding, and medical care, as well as to hotel administration and operations. Your partner provides you with unaudited financial statements prepared by the CFO (separately attached to Canvas), excerpts from the company's significant accounting policies (Exhibit 1), and other relevant client information (Exhibit 2). Significant Accounting Policies Animal and fish stock - In accordance with industry practice, the stock of fish and animals is reported at the lower of cost or market value. Market values are estimated using current replacement costs. Capital assets - Capital assets include land, human-made lakes, hotel buildings, and equipment. Hotel buildings and equipment are amortized on a straight-line basis over their estimated useful lives. In 2021 fiscal year, the remaining estimated useful life of hotel buildings was reduced from 25 to 18 years. Land and human-made lakes are not amortized. Contingent Liabilities - RHAS does not routinely collect the scientific data needed to evaluate the ecological health of its park. However, significant growth in visitors over the past 5 years is thought to be damaging park ecology. In 2021, RHAS accrued a liability in the amount of $150 (thousand) for possible future environmental restoration costs that may be incurred as a result of deteriorating park ecology. The amount is included in accrued liabilities. EXHIBIT 2 OTHER CLIENT INFORMATION From the day RHAS was founded, Benjamin "Benny" Kurtz carefully controlled every aspect of RHAS's operations, using his extensive knowledge of veterinary care, marketing, and federal laws and regulations. As CEO, Benny was respected by everyone-not only RHAS's employees and customers but also concerned environmental and animal-rights activists. On the financial side, Benny worked closely with the CFO to design and implement a strong accounting system. All purchases of fish and animals for the park were approved by Stevie. Additionally, hotel profitability was reviewed by Benny and the CFO on a monthly basis. Park admission revenues and cash receipts were compared daily to vehicle counts obtained from monitors installed at the admission gates. A perpetual inventory system was introduced to monitor quantities of fish and animals. The perpetual inventory system was implemented in the 2021 fiscal year to track quantities of fish and animal stock present on the RHAS park grounds. RHAS personnel easily can track the number of fish released into the man-made lakes, as well as the number of fish caught and removed. Unfortunately, the number of fish births and mortalities are more difficult to track. RHAS estimates these numbers based on its prior experience, allowing for possible changes in environmental conditions. The CFO described 2021 as an unusually harsh winter month and, accordingly, has had to "override" the perpetual system by writing-off significant quantities of fish stock. The write-off resulted in 20% of the 2021 fish stock balance being charged as an expense on the income statement. In contrast to fish stock, animal stock apparently survived the harsh weather with much greater success. In fact, the CFO mentioned that 30 newborn animals survived the winter, as compared to only 20 in each of the prior three years. Many of these newborn animals were sold to private zoos and other animal parks in 2021; consequently, animal sales revenues increased in the current year. The growth in successful animal births also led the CFO to reconsider the accounting policy used to record and update animal stock costs. The animal In contrast to fish stock, animal stock apparently survived the harsh weather with much greater success. In fact, the CFO mentioned that 30 newborn animals survived the winter, as compared to only 20 in each of the prior three years. Many of these newborn animals were sold to private zoos and other animal parks in 2021; consequently, animal sales revenues increased in the current year. The growth in successful animal births also led the CFO to reconsider the accounting policy used to record and update animal stock costs. The animal stock account primarily includes costs for adult animal purchases, although some birth-related medical care costs also are included. In the past, these animal costs were assigned to each individual animal using the specific identification inventory method. The CFO apparently found that method overly cumbersome and decided to change to an average cost method for all animals in July 2021. Consequently, when newborn animals now are sold, the average cost of animal stock at the time of sale is used to determine the cost of animal sales to be expensed on the income statement. River Hawk Animal Sanctuary River Hawk Animal Sanctuary Unaudited Balance Sheet (thousands of dollars)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started