Answered step by step

Verified Expert Solution

Question

1 Approved Answer

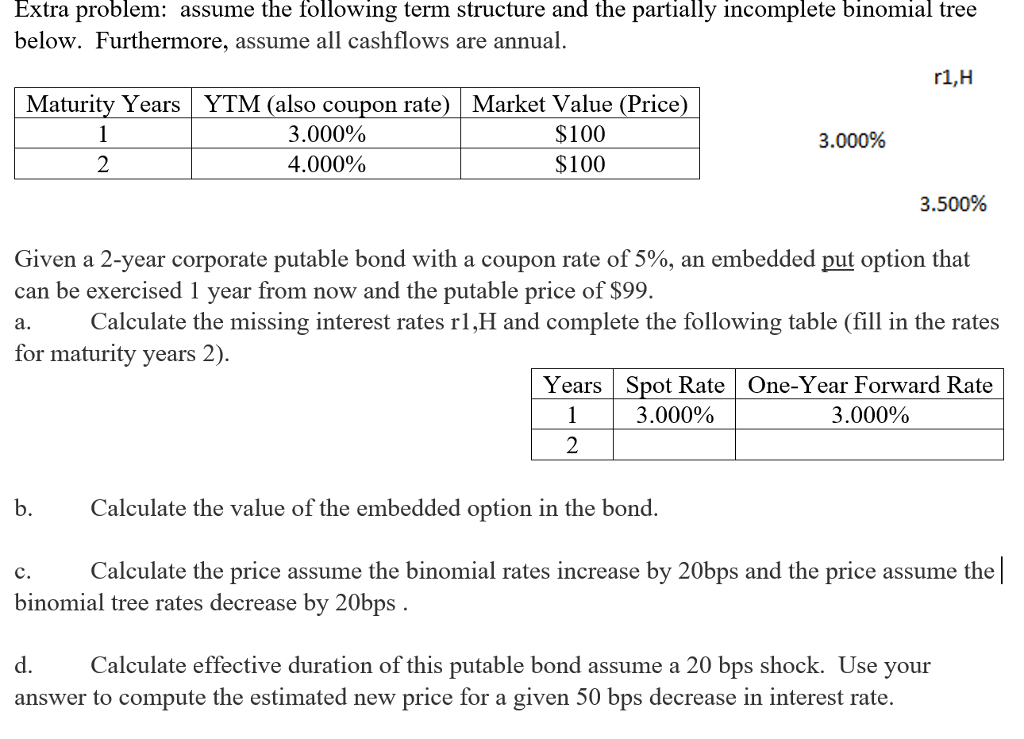

ro is 3% and r1,L is 3.5% Extra problem: assume the following term structure and the partially incomplete binomial tree below. Furthermore, assume all cashflows

ro is 3% and r1,L is 3.5%

Extra problem: assume the following term structure and the partially incomplete binomial tree below. Furthermore, assume all cashflows are annual. Given a 2-year corporate putable bond with a coupon rate of 5%, an embedded put option that can be exercised 1 year from now and the putable price of exist99. a. Calculate the missing interest rates r 1, H and complete the following table (fill in the rates for maturity years 2). b. Calculate the value of the embedded option in the bond. c. Calculate the price assume the binomial rates increase by 20bps and the price assume the | binomial tree rates decrease by 20bps. d. Calculate effective duration of this putable bond assume a 20 bps shock. Use your answer to compute the estimated new price for a given 50 bps decrease in interest rate. Extra problem: assume the following term structure and the partially incomplete binomial tree below. Furthermore, assume all cashflows are annual. Given a 2-year corporate putable bond with a coupon rate of 5%, an embedded put option that can be exercised 1 year from now and the putable price of exist99. a. Calculate the missing interest rates r 1, H and complete the following table (fill in the rates for maturity years 2). b. Calculate the value of the embedded option in the bond. c. Calculate the price assume the binomial rates increase by 20bps and the price assume the | binomial tree rates decrease by 20bps. d. Calculate effective duration of this putable bond assume a 20 bps shock. Use your answer to compute the estimated new price for a given 50 bps decrease in interest rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started