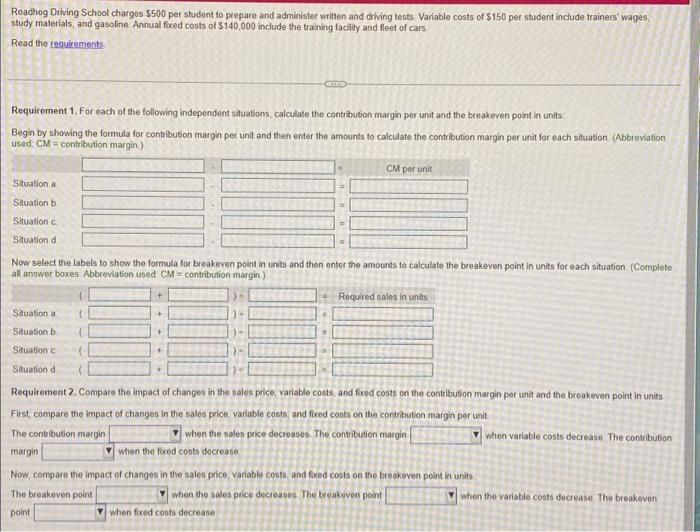

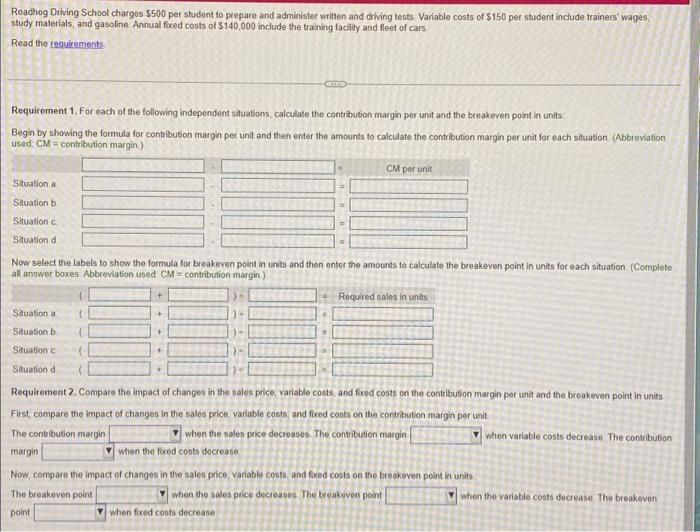

Roadhog Ditving School charges 5500 per student to prepare and administer written and driving tests. Variable costs of $150 per student include trainers' wages, study materials, and gasoline. Annual fxed costs of $140,000 include the training facily and fleet of cars Read the cequirements Requirement 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units: Begin by showing the formula for contribution margin per unit and then enter the amounts to calculate the contribution margin per unit for each situation. (Abbreviation used. CM= contribution margin) Now select the labels to show the formula for breakeven point in units and then enter the amounts to calculate the breakeven point in units for each situation. (Complete all anaver boxes. Abbreviation used CM= contribution maigin ) Requirement 2. Compare the impact of changes in the sales price, varlable costs, and ficed costs on the contribution margin per unit and the breakeven point in units First, compare the impact of changes in the sales price, variable costs and fixed costs on the contribution margin per unit The contribution margin when the sales price decreases. The contribution margin when variable costs decrease. The contribution margin When the fred costs docrease Now, compare the impact of changes in the sales price, variable costs, and fred cosis on the breokeven peint in units The breakeven point when the sales price decieases. The treakeven point point when fixed costs decrease When the variable costs decrease. The breakeven Roadhog Ditving School charges 5500 per student to prepare and administer written and driving tests. Variable costs of $150 per student include trainers' wages, study materials, and gasoline. Annual fxed costs of $140,000 include the training facily and fleet of cars Read the cequirements Requirement 1. For each of the following independent situations, calculate the contribution margin per unit and the breakeven point in units: Begin by showing the formula for contribution margin per unit and then enter the amounts to calculate the contribution margin per unit for each situation. (Abbreviation used. CM= contribution margin) Now select the labels to show the formula for breakeven point in units and then enter the amounts to calculate the breakeven point in units for each situation. (Complete all anaver boxes. Abbreviation used CM= contribution maigin ) Requirement 2. Compare the impact of changes in the sales price, varlable costs, and ficed costs on the contribution margin per unit and the breakeven point in units First, compare the impact of changes in the sales price, variable costs and fixed costs on the contribution margin per unit The contribution margin when the sales price decreases. The contribution margin when variable costs decrease. The contribution margin When the fred costs docrease Now, compare the impact of changes in the sales price, variable costs, and fred cosis on the breokeven peint in units The breakeven point when the sales price decieases. The treakeven point point when fixed costs decrease When the variable costs decrease. The breakeven