Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Robert and Jessica Rodriquez wish to obtain a mortgage loan to buy their first home. The couple must have a debt-to- income ratio of 36

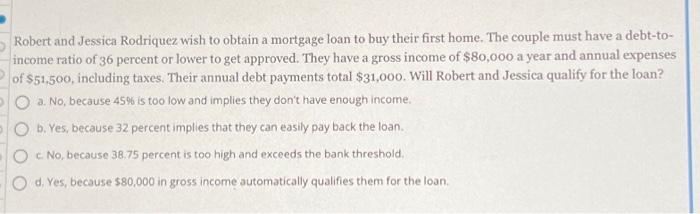

Robert and Jessica Rodriquez wish to obtain a mortgage loan to buy their first home. The couple must have a debt-to- income ratio of 36 percent or lower to get approved. They have a gross income of $80,000 a year and annual expenses of $51,500, including taxes. Their annual debt payments total $31,000. Will Robert and Jessica qualify for the loan? O a. No, because 45% is too low and implies they don't have enough income. b. Yes, because 32 percent implies that they can easily pay back the loan. c. No, because 38.75 percent is too high and exceeds the bank threshold. d. Yes, because $80,000 in gross income automatically qualifies them for the loan.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started