Question

Roberta Radley, a forty year old professional, has accumulated savings of nearly $50,000. This money is not part of a retirement plan and is not

Roberta Radley, a forty year old professional, has accumulated savings of nearly $50,000. This money is not part of a retirement plan and is not tax-sheltered. Roberta has no near term need for the money and feels comfortable investing for the long run. Barring an unexpected development, her investment horizon is fifteen to eighteen years.

Roberta hopes to implement an investment strategy that will achieve three priority objectives:

1) Substantial diversification. Roberta knows that prudent investors diversify.

2) A favorable return/risk performance. Roberta understands that the stock market is volatile. She is willing to take on risk, but expects to be duly compensated.

3) A long-run return higher than the average return on the S&P 500. Ideally, Roberta would like her portfolio to grow to at least $300,000 in sixteen years, when her twin daughters will be entering college.

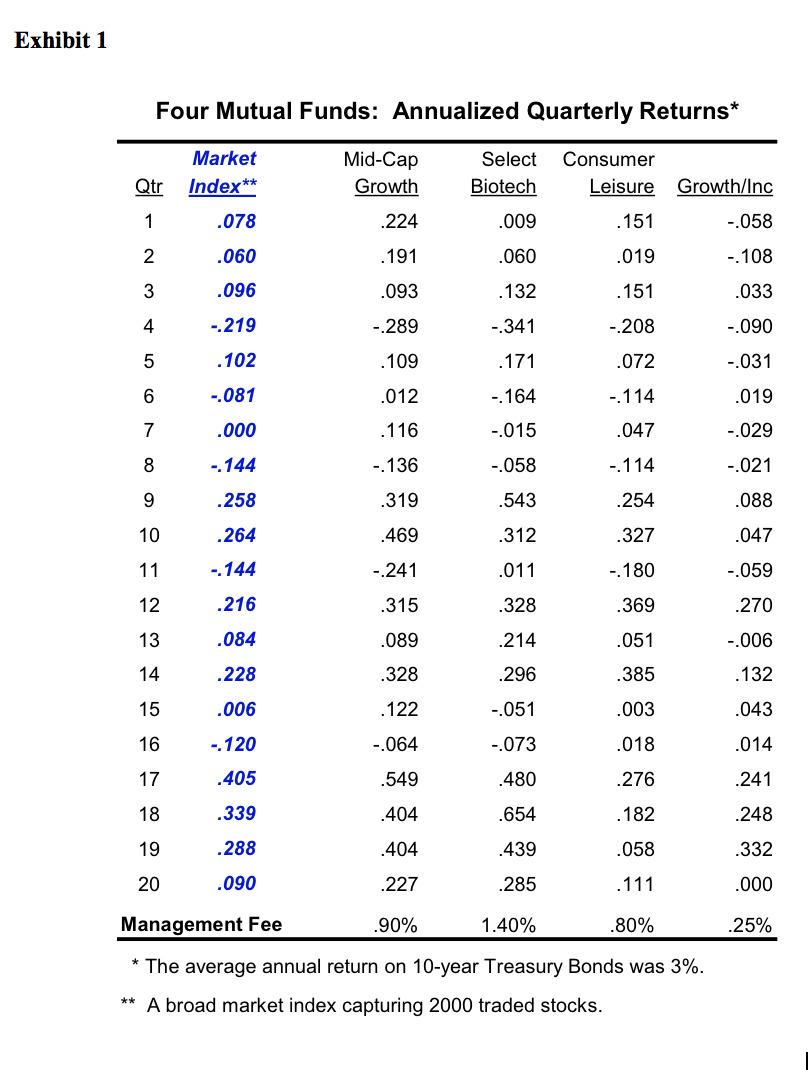

Roberta does not have the time or motivation to carefully follow the market, nor does she want to pay high fees to hire an investment advisor. Consequently, she has decided to invest initially in two carefully chosen mutual funds. After several months of research, Roberta has identified four promising funds (Exhibit 1). Each is well established and has performed reasonably well over the past several years. However, the funds differ greatly in their investment strategies. Although past performance provides no promise of future performance, Roberta hopes that the data in Exhibit 1 can help her construct a portfolio that will achieve her goals. Roberta would like to spread her money (perhaps approximately evenly) across two funds. She needs advice on how to structure her portfolio.

The Challenge 1) Using the data in Exhibit 1, describe the risk characteristics and recent performance of the four funds. Present this information in a format that could help Roberta discriminate among the funds. You might consider the following common metrics: Return average annual return Risk / Volatility standard deviation of return beta R-square Return/Risk Performance alpha Sharpe index You may choose to apply other metrics.

2) Recommend a two fund portfolio. Describe the salient characteristics of this portfolio and explain why it would serve Robertas needs.

3) What additional information should Roberta study before deciding how to structure her portfolio?

Exhibit 1 Four Mutual Funds: Annualized Quarterly Returns* Market Qtr Index** .078 .060 .096 219 102 081 Mid-Cap Growth 224 191 093 289 .109 Select Consumer Biotech 009 060 .132 341 Leisure Growth/Inc 058 -.108 033 090 2 .151 208 072 4 6 7 8 029 021 088 047 059 .270 006 132 043 014 241 248 .332 047 058 543 312 144 258 264 144 216 .084 228 .006 .120 .405 339 288 .090 -.136 319 469 241 315 089 328 .122 064 549 404 404 227 90% 254 327 .180 369 12 328 385 003 018 276 182 058 14 296 051 073 480 654 439 285 1.40% Management Fee 80% 25% The average annual return on 10-year Treasury Bonds was 3%. ** A broad market index capturing 2000 traded stocks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started