Question

Robin owns a vacation home at the beach. During the current year, Robin used the home for 20 days and rented rented it for

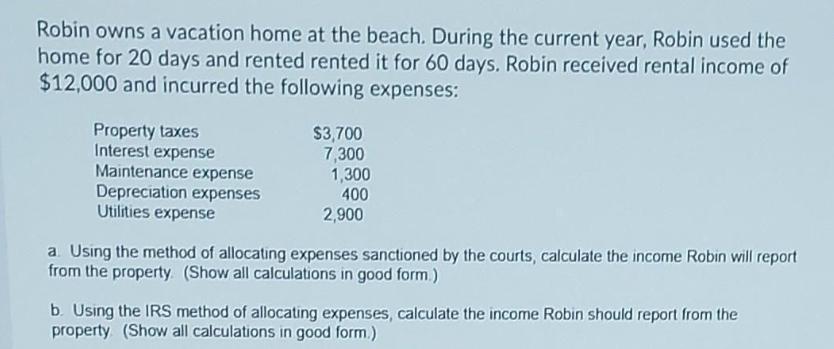

Robin owns a vacation home at the beach. During the current year, Robin used the home for 20 days and rented rented it for 60 days. Robin received rental income of $12,000 and incurred the following expenses: Property taxes Interest expense Maintenance expense Depreciation expenses Utilities expense $3,700 7,300 1,300 400 2,900 a. Using the method of allocating expenses sanctioned by the courts, calculate the income Robin will report from the property. (Show all calculations in good form.) b. Using the IRS method of allocating expenses, calculate the income Robin should report from the property (Show all calculations in good form.)

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Given that Robins used the house personal 20 Days Robin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation For Decision Makers 2017

Authors: Shirley Dennis Escoffier, Karen Fortin

7th Edition

1119330416, 978-1119330417

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App