Answered step by step

Verified Expert Solution

Question

1 Approved Answer

roblem 4. (Binomial model continued, 15') Consider the same stock as Problem 3. a. In Problem 3, we constructed a recombining binomial tree. For Problem

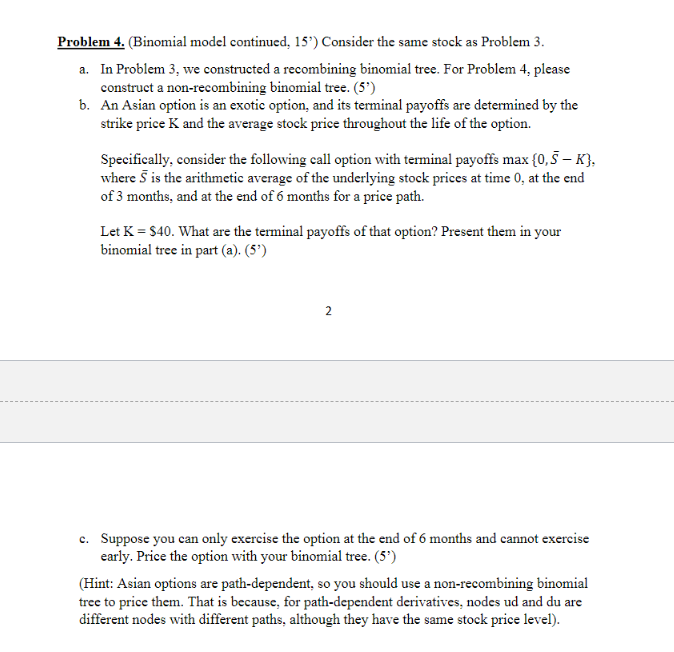

roblem 4. (Binomial model continued, 15') Consider the same stock as Problem 3. a. In Problem 3, we constructed a recombining binomial tree. For Problem 4, please construct a non-recombining binomial tree. (5') b. An Asian option is an exotic option, and its terminal payoffs are determined by the strike price K and the average stock price throughout the life of the option. Specifically, consider the following call option with terminal payoffs max{0,SK}, where S is the arithmetic average of the underlying stock prices at time 0 , at the end of 3 months, and at the end of 6 months for a price path. Let K=$40. What are the terminal payoffs of that option? Present them in your binomial tree in part (a). (5') 2 c. Suppose you can only exercise the option at the end of 6 months and cannot exercise early. Price the option with your binomial tree. (5') (Hint: Asian options are path-dependent, so you should use a non-recombining binomial tree to price them. That is because, for path-dependent derivatives, nodes ud and du are different nodes with different paths, although they have the same stock price level)

roblem 4. (Binomial model continued, 15') Consider the same stock as Problem 3. a. In Problem 3, we constructed a recombining binomial tree. For Problem 4, please construct a non-recombining binomial tree. (5') b. An Asian option is an exotic option, and its terminal payoffs are determined by the strike price K and the average stock price throughout the life of the option. Specifically, consider the following call option with terminal payoffs max{0,SK}, where S is the arithmetic average of the underlying stock prices at time 0 , at the end of 3 months, and at the end of 6 months for a price path. Let K=$40. What are the terminal payoffs of that option? Present them in your binomial tree in part (a). (5') 2 c. Suppose you can only exercise the option at the end of 6 months and cannot exercise early. Price the option with your binomial tree. (5') (Hint: Asian options are path-dependent, so you should use a non-recombining binomial tree to price them. That is because, for path-dependent derivatives, nodes ud and du are different nodes with different paths, although they have the same stock price level) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started