Answered step by step

Verified Expert Solution

Question

1 Approved Answer

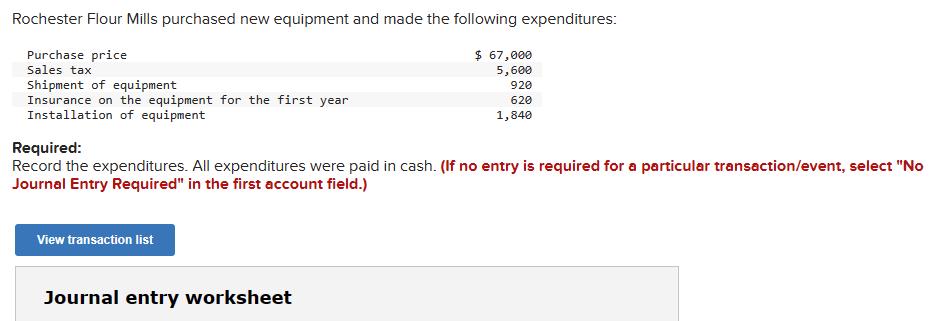

Rochester Flour Mills purchased new equipment and made the following expenditures: Purchase price $ 67,000 Sales tax 5,600 Shipment of equipment 920 620 Insurance

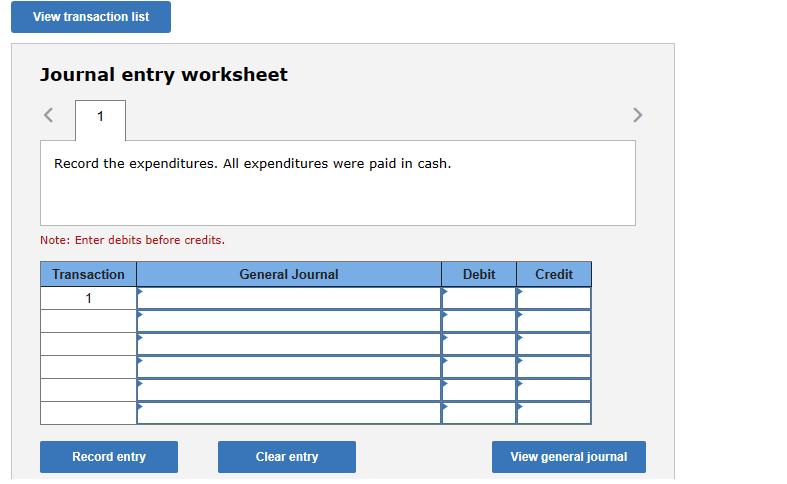

Rochester Flour Mills purchased new equipment and made the following expenditures: Purchase price $ 67,000 Sales tax 5,600 Shipment of equipment 920 620 Insurance on the equipment for the first year Installation of equipment 1,840 Required: Record the expenditures. All expenditures were paid in cash. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet View transaction list Journal entry worksheet 1 Record the expenditures. All expenditures were paid in cash. Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit View general journal

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Heres the breakdown of the expenditures and the corresponding journal entries ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started