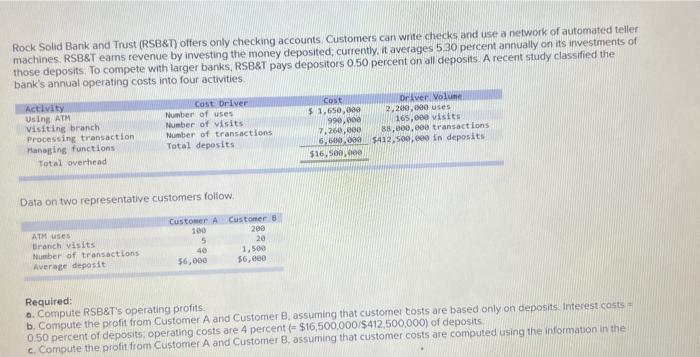

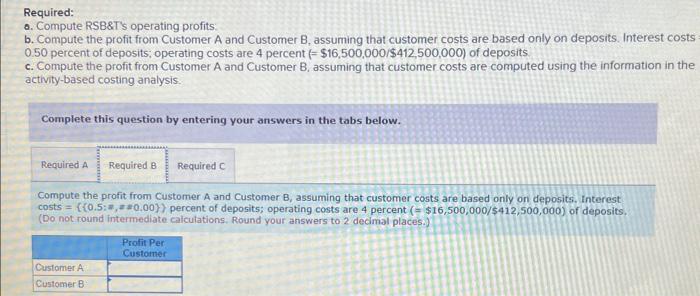

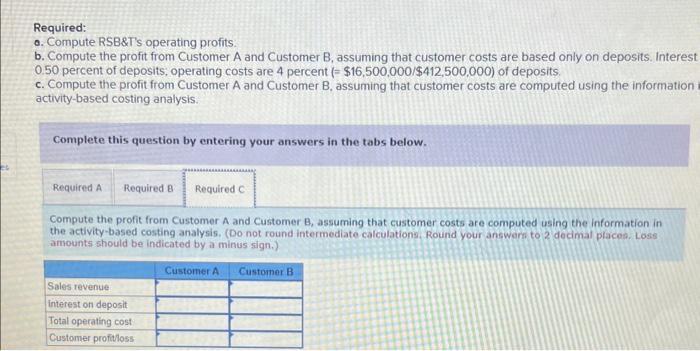

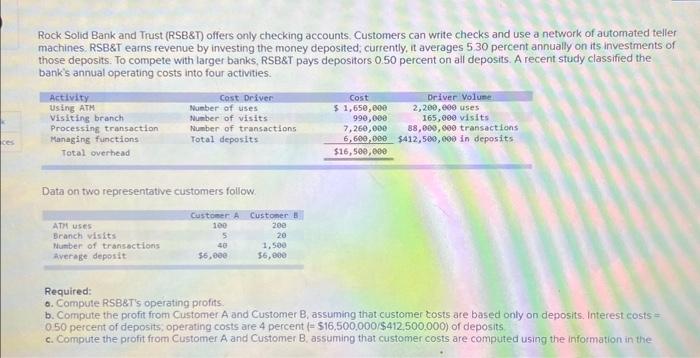

Rock Solid Bank and Trust (RSB\&T) offers only checking accounts Customers can write checks and use a network of automated teller machines. RSB\&T eams revenue by investing the money deposited, currently, it averages 5.30 percent annually on its investments of those deposits, To compete with larger banks, RSB\&T pays depositors 0.50 percent on all deposits. A recent study classified the bank's annual operating costs into four actwities Data on two representative customers follow Required: b. Compute the profit from Customer A and Customer B, assuming that customer tosts are based only on deposits. Interest costs = 0. Compute RSB\&T's operating profits. 0.50 percent of depositsi operating costs are 4 percent (=$16,500,000/$412,500,000) of deposits. c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the intormation in the Required: o. Compute RSB\&T's operating profits: b. Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest costs = 0.50 percent of deposits, operating costs are 4 percent (=$16,500,000/$412,500,000) of deposits. c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the activity-based costing analysis Complete this question by entering your answers in the tabs below. Compute RSBET's operating profits. Required: a. Compute RSB\&T's operating profits: b. Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest costs 0.50 percent of deposits; operating costs are 4 percent (=$16,500,000/$412,500,000) of deposits c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the activity-based costing analysis. Complete this question by entering your answers in the tabs below. Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits, Interest costs ={(0.5:=,2=0.00}} percent of deposits; operating costs are 4 percent (=$16,500,000/$412,500,000) of deposits. (Do not round intermediate caiculations. Round your answers to 2 decimal places.) Required: o. Compute RSB\&TS operating profits. b. Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest 0.50 percent of deposits, operating costs are 4 percent (=$16,500,000/$412,500,000) of deposits. c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information activity-based costing analysis. Complete this question by entering your answers in the tabs below. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the activity-based costing analysis. (Do not round intermediate calculationg. Round your answeri to 2 decimal places. Loss amounts should be indicated by a minus sign.) Rock Solid Bank and Trust (RSB\&T) offers only checking accounts, Customers can write checks and use a network of automated teller machines. RSB\&T earns revenue by investing the money deposited; currently, it averages 530 percent annually on its investments of those deposits. To compete with larger banks, RSB\&T pays depositors 0.50 percent on all deposits. A recent study classified the bank's annual operating costs into four activities. Data on two representative customers follow Required: o. Compule RSBET's operating profits b. Compute the profit from Customer. A and Customer B, assuming that-customer tosts are based only on deposits. Interest costs = 0.50 percent of deposits, operating costs are 4 percent (=$16,500,000/$412,500,000) of deposits c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the intormation in the