Answered step by step

Verified Expert Solution

Question

1 Approved Answer

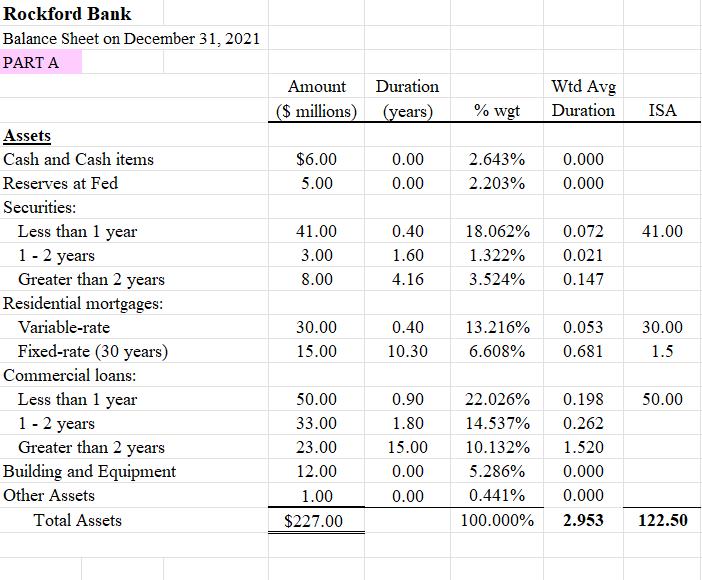

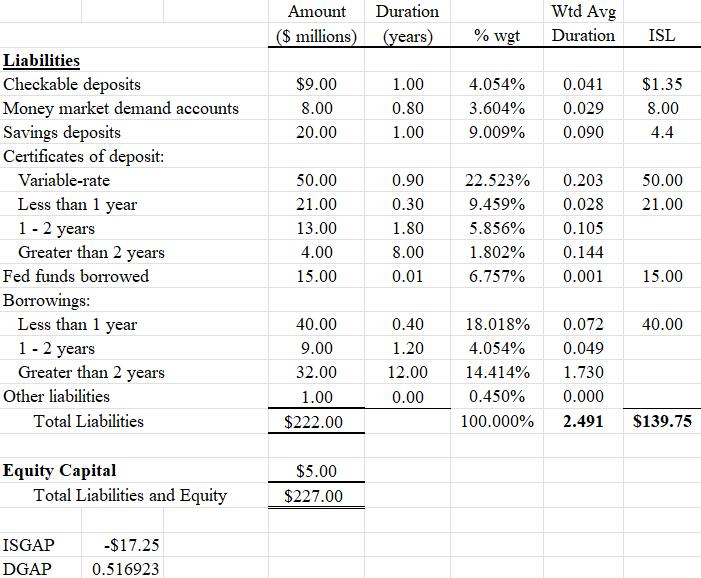

Rockford Bank Balance Sheet on December 31, 2021 PART A Assets Cash and Cash items Reserves at Fed Securities: Less than 1 year 1-2

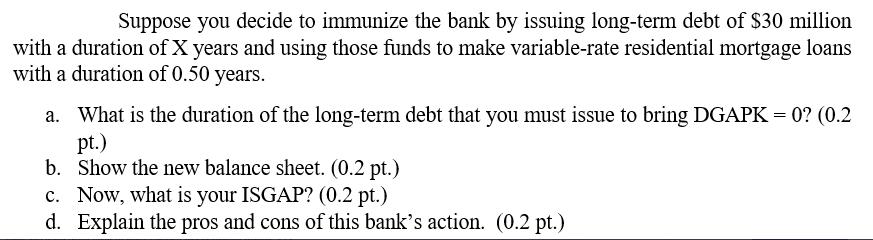

Rockford Bank Balance Sheet on December 31, 2021 PART A Assets Cash and Cash items Reserves at Fed Securities: Less than 1 year 1-2 years Greater than 2 years Residential mortgages: Variable-rate Fixed-rate (30 years) Commercial loans: Less than 1 year 1-2 years Greater than 2 years Building and Equipment Other Assets Total Assets Amount Duration ($ millions) (years) $6.00 5.00 41.00 3.00 8.00 30.00 15.00 50.00 33.00 23.00 12.00 1.00 $227.00 0.00 0.00 0.40 1.60 4.16 0.40 10.30 0.90 1.80 15.00 0.00 0.00 % wgt 2.643% 2.203% Wtd Avg Duration 0.000 0.000 18.062% 0.072 1.322% 0.021 3.524% 0.147 13.216% 0.053 6.608% 0.681 ISA 41.00 30.00 1.5 22.026% 0.198 50.00 14.537% 0.262 10.132% 1.520 5.286% 0.000 0.441% 0.000 100.000% 2.953 122.50 Liabilities Checkable deposits Money market demand accounts Savings deposits Certificates of deposit: Variable-rate Less than 1 year 1 -2 years Greater than 2 years Fed funds borrowed Borrowings: Less than 1 year 1 - 2 years Greater than 2 years Other liabilities Total Liabilities Equity Capital Total Liabilities and Equity ISGAP DGAP -$17.25 0.516923 Amount ($ millions) $9.00 8.00 20.00 50.00 21.00 13.00 4.00 15.00 40.00 9.00 32.00 1.00 $222.00 $5.00 $227.00 Duration (years) 1.00 0.80 1.00 0.90 0.30 1.80 8.00 0.01 0.40 1.20 12.00 0.00 % wgt Wtd Avg Duration ISL 4.054% 0.041 $1.35 3.604% 0.029 8.00 9.009% 0.090 4.4 22.523% 0.203 50.00 9.459% 0.028 21.00 5.856% 0.105 1.802% 0.144 6.757% 0.001 18.018% 0.072 4.054% 0.049 14.414% 1.730 0.450% 0.000 100.000% 2.491 15.00 40.00 $139.75 Suppose you decide to immunize the bank by issuing long-term debt of $30 million with a duration of X years and using those funds to make variable-rate residential mortgage loans with a duration of 0.50 years. a. What is the duration of the long-term debt that you must issue to bring DGAPK = 0? (0.2 pt.) b. Show the new balance sheet. (0.2 pt.) c. Now, what is your ISGAP? (0.2 pt.) d. Explain the pros and cons of this bank's action. (0.2 pt.)

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To determine the duration of longterm debt required to achieve DGAP 0 we need to calculate the weighted average duration of both assets and liabilitie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started