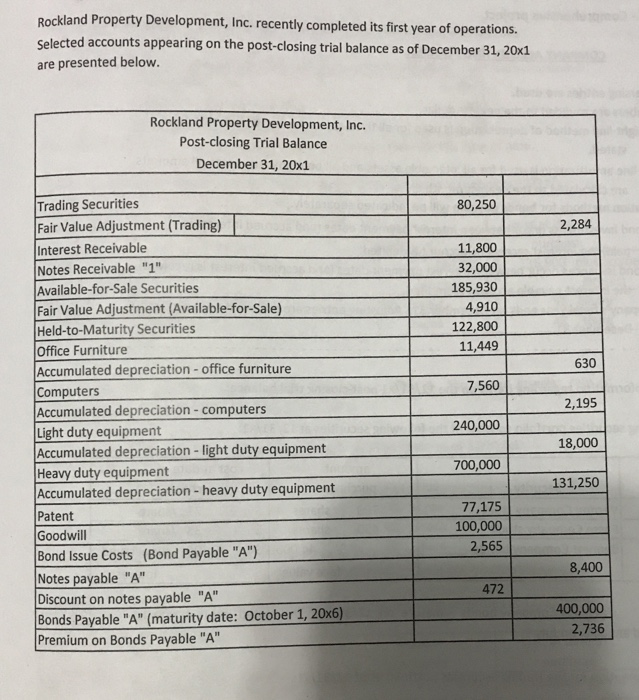

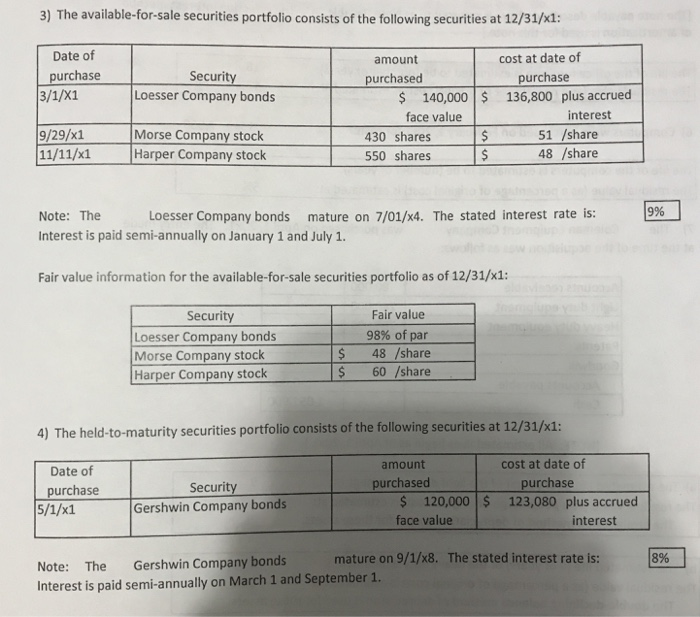

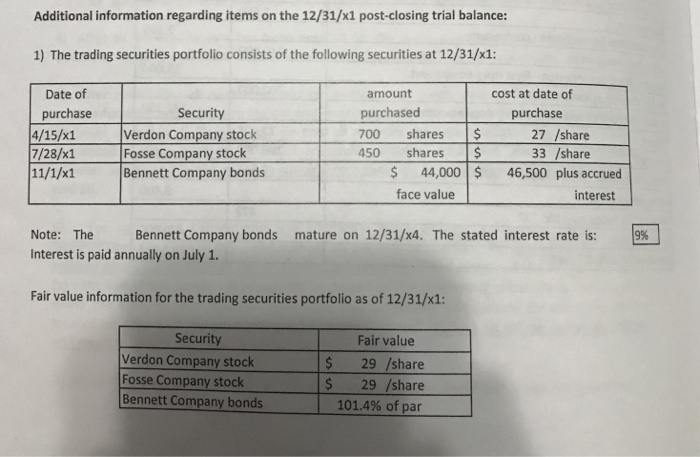

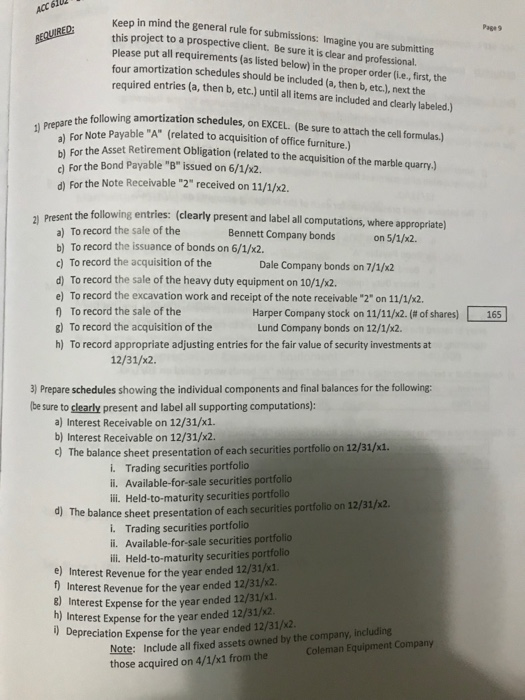

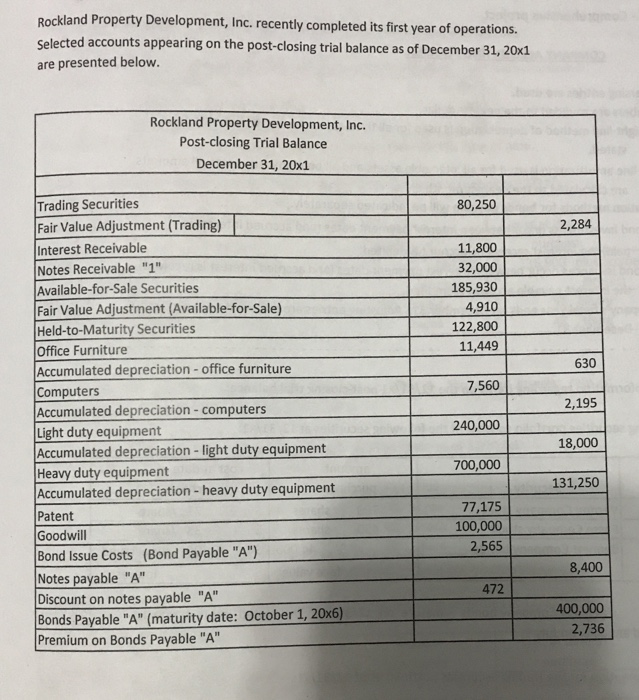

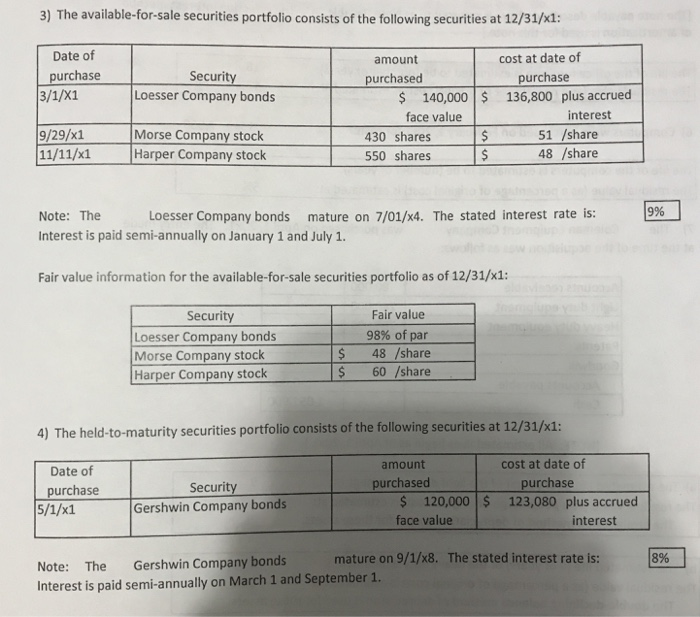

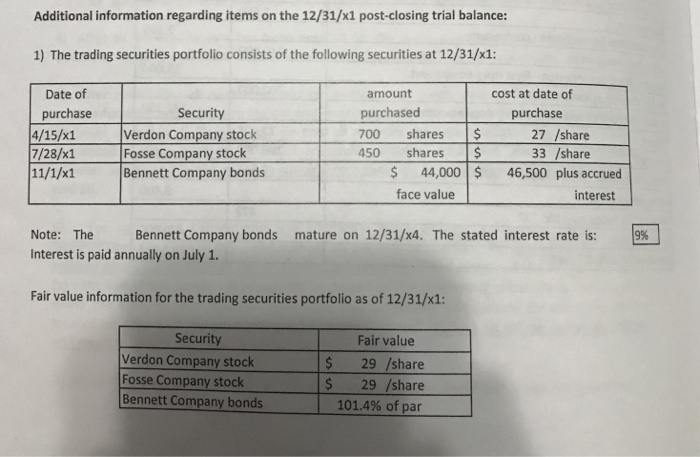

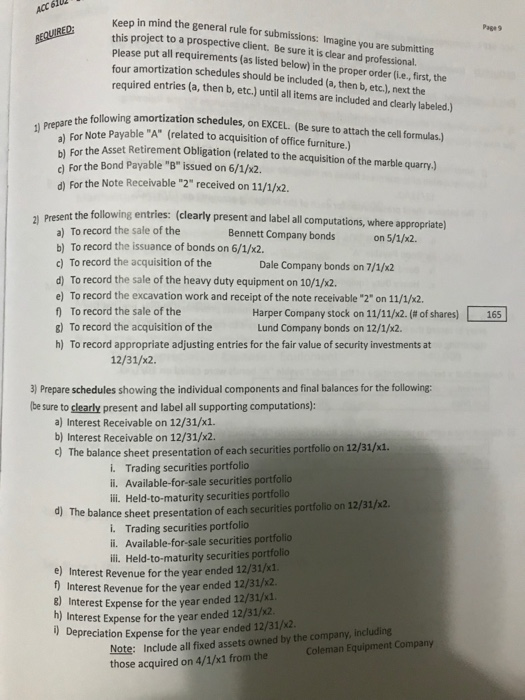

Rockland Property Development, Inc. recently completed its first year of operations. Selected accounts appearing on the post-closing trial balance as of December 31, 20x1 are presented below. Rockland Property Development, Inc. Post-closing Trial Balance December 31, 20x1 80,250 2,284 11,800 32,000 185,930 4,910 122,800 11,449 630 7,560 2,195 Trading Securities Fair Value Adjustment (Trading) Interest Receivable Notes Receivable "1" Available-for-Sale Securities Fair Value Adjustment (Available-for-Sale) Held-to-Maturity Securities Office Furniture Accumulated depreciation - office furniture Computers Accumulated depreciation - computers Light duty equipment Accumulated depreciation - light duty equipment Heavy duty equipment Accumulated depreciation - heavy duty equipment Patent Goodwill Bond Issue Costs (Bond Payable "A") Notes payable "A" Discount on notes payable "A" Bonds Payable "A" (maturity date: October 1, 20x6) Premium on Bonds Payable "A" 240,000 18,000 700,000 131,250 77,175 100,000 2,565 8,400 472 400,000 2,736 3) The available-for-sale securities portfolio consists of the following securities at 12/31/x1: Date of purchase 3/1/X1 Security Loesser Company bonds amount cost at date of purchased purchase $ 140,000 $ 136,800 plus accrued face value interest 430 shares $ 51 /share 550 shares $ 48 /share 9/29/x1 11/11/1 Morse Company stock Harper Company stock 996 Note: The Loesser Company bonds mature on 7/01/x4. The stated interest rate is: Interest is paid semi-annually on January 1 and July 1. Fair value information for the available-for-sale securities portfolio as of 12/31/x1: Security Loesser Company bonds Morse Company stock Harper Company stock Fair value 98% of par 48 /share 60 /share $ $ 4) The held-to-maturity securities portfolio consists of the following securities at 12/31/1: Date of purchase 5/1/X1 Security Gershwin Company bonds amount cost at date of purchased purchase $ 120,000 $ 123,080 plus accrued face value interest 8% Note: The Gershwin Company bonds mature on 9/1/x8. The stated interest rate is: Interest is paid semi-annually on March 1 and September 1. Additional information regarding items on the 12/31/x1 post-closing trial balance: 1) The trading securities portfolio consists of the following securities at 12/31/x1: Date of purchase 4/15/x1 7/28/x1 (11/1/x1 Security Verdon Company stock Fosse Company stock Bennett Company bonds amount purchased 700 shares $ 450 shares $ $ 44,000$ face value cost at date of purchase 27 /share 33 /share 46,500 plus accrued interest mature on 12/31/x4. The stated interest rate is: 9% Note: The Bennett Company bonds Interest is paid annually on July 1. Fair value information for the trading securities portfolio as of 12/31/x1: Security Verdon Company stock Fosse Company stock Bennett Company bonds Fair value $ 29 /share $ 29 /share 101.4% of par ACC 62 Pus REQUIRED Keep in mind the general rule for submissions: Imagine you are submitting this project to a prospective client. Be sure it is clear and professional Please put all requirements (as listed below) in the proper order (ie., first, the four amortization schedules should be included (a, then b, etc.), next the required entries (a, then b, etc.) until all items are included and clearly labeled.) 1) Prepare the following amortization schedules, on EXCEL. (Be sure to attach the cell formulas.) a) For Note Payable "A" (related to acquisition of office furniture.) b) for the Asset Retirement Obligation (related to the acquisition of the marble quarry.) c) For the Bond Payable "B" issued on 6/1/x2. d) For the Note Receivable "2" received on 11/1/X2. 2) Present the following entries: (clearly present and label all computations, where appropriate) a) To record the sale of the Bennett Company bonds on 5/1/x2. b) To record the issuance of bonds on 6/1/x2. c) To record the acquisition of the Dale Company bonds on 7/1/X2 d) To record the sale of the heavy duty equipment on 10/1/X2. e) To record the excavation work and receipt of the note receivable "2" on 11/1/x2. To record the sale of the Harper Company stock on 11/11/ 2. (# of shares) 8) To record the acquisition of the Lund Company bonds on 12/1/X2. h) To record appropriate adjusting entries for the fair value of security investments at 12/31/x2. 165 3) Prepare schedules showing the individual components and final balances for the following: (be sure to clearly present and label all supporting computations): a) Interest Receivable on 12/31/x1. b) Interest Receivable on 12/31/x2. c) The balance sheet presentation of each securities portfolio on 12/31/xi. 1. Trading securities portfolio ii. Available-for-sale securities portfolio ili. Held-to-maturity securities portfolio d) The balance sheet presentation of each securities portfolio on 12/31/42 i. Trading securities portfolio ii. Available-for-sale securities portfolio ill. Held-to-maturity securities portfolio e) Interest Revenue for the year ended 12/31/X1. ) Interest Revenue for the year ended 12/31/x2. 8) Interest Expense for the year ended 12/31/44. h) Interest Expense for the year ended 12/31/42 Depreciation Expense for the year ended 12/31/x2. Note: Include all fixed assets owned by the company, including Coleman Equipment Company those acquired on 4/1/x1 from the Rockland Property Development, Inc. recently completed its first year of operations. Selected accounts appearing on the post-closing trial balance as of December 31, 20x1 are presented below. Rockland Property Development, Inc. Post-closing Trial Balance December 31, 20x1 80,250 2,284 11,800 32,000 185,930 4,910 122,800 11,449 630 7,560 2,195 Trading Securities Fair Value Adjustment (Trading) Interest Receivable Notes Receivable "1" Available-for-Sale Securities Fair Value Adjustment (Available-for-Sale) Held-to-Maturity Securities Office Furniture Accumulated depreciation - office furniture Computers Accumulated depreciation - computers Light duty equipment Accumulated depreciation - light duty equipment Heavy duty equipment Accumulated depreciation - heavy duty equipment Patent Goodwill Bond Issue Costs (Bond Payable "A") Notes payable "A" Discount on notes payable "A" Bonds Payable "A" (maturity date: October 1, 20x6) Premium on Bonds Payable "A" 240,000 18,000 700,000 131,250 77,175 100,000 2,565 8,400 472 400,000 2,736 3) The available-for-sale securities portfolio consists of the following securities at 12/31/x1: Date of purchase 3/1/X1 Security Loesser Company bonds amount cost at date of purchased purchase $ 140,000 $ 136,800 plus accrued face value interest 430 shares $ 51 /share 550 shares $ 48 /share 9/29/x1 11/11/1 Morse Company stock Harper Company stock 996 Note: The Loesser Company bonds mature on 7/01/x4. The stated interest rate is: Interest is paid semi-annually on January 1 and July 1. Fair value information for the available-for-sale securities portfolio as of 12/31/x1: Security Loesser Company bonds Morse Company stock Harper Company stock Fair value 98% of par 48 /share 60 /share $ $ 4) The held-to-maturity securities portfolio consists of the following securities at 12/31/1: Date of purchase 5/1/X1 Security Gershwin Company bonds amount cost at date of purchased purchase $ 120,000 $ 123,080 plus accrued face value interest 8% Note: The Gershwin Company bonds mature on 9/1/x8. The stated interest rate is: Interest is paid semi-annually on March 1 and September 1. Additional information regarding items on the 12/31/x1 post-closing trial balance: 1) The trading securities portfolio consists of the following securities at 12/31/x1: Date of purchase 4/15/x1 7/28/x1 (11/1/x1 Security Verdon Company stock Fosse Company stock Bennett Company bonds amount purchased 700 shares $ 450 shares $ $ 44,000$ face value cost at date of purchase 27 /share 33 /share 46,500 plus accrued interest mature on 12/31/x4. The stated interest rate is: 9% Note: The Bennett Company bonds Interest is paid annually on July 1. Fair value information for the trading securities portfolio as of 12/31/x1: Security Verdon Company stock Fosse Company stock Bennett Company bonds Fair value $ 29 /share $ 29 /share 101.4% of par ACC 62 Pus REQUIRED Keep in mind the general rule for submissions: Imagine you are submitting this project to a prospective client. Be sure it is clear and professional Please put all requirements (as listed below) in the proper order (ie., first, the four amortization schedules should be included (a, then b, etc.), next the required entries (a, then b, etc.) until all items are included and clearly labeled.) 1) Prepare the following amortization schedules, on EXCEL. (Be sure to attach the cell formulas.) a) For Note Payable "A" (related to acquisition of office furniture.) b) for the Asset Retirement Obligation (related to the acquisition of the marble quarry.) c) For the Bond Payable "B" issued on 6/1/x2. d) For the Note Receivable "2" received on 11/1/X2. 2) Present the following entries: (clearly present and label all computations, where appropriate) a) To record the sale of the Bennett Company bonds on 5/1/x2. b) To record the issuance of bonds on 6/1/x2. c) To record the acquisition of the Dale Company bonds on 7/1/X2 d) To record the sale of the heavy duty equipment on 10/1/X2. e) To record the excavation work and receipt of the note receivable "2" on 11/1/x2. To record the sale of the Harper Company stock on 11/11/ 2. (# of shares) 8) To record the acquisition of the Lund Company bonds on 12/1/X2. h) To record appropriate adjusting entries for the fair value of security investments at 12/31/x2. 165 3) Prepare schedules showing the individual components and final balances for the following: (be sure to clearly present and label all supporting computations): a) Interest Receivable on 12/31/x1. b) Interest Receivable on 12/31/x2. c) The balance sheet presentation of each securities portfolio on 12/31/xi. 1. Trading securities portfolio ii. Available-for-sale securities portfolio ili. Held-to-maturity securities portfolio d) The balance sheet presentation of each securities portfolio on 12/31/42 i. Trading securities portfolio ii. Available-for-sale securities portfolio ill. Held-to-maturity securities portfolio e) Interest Revenue for the year ended 12/31/X1. ) Interest Revenue for the year ended 12/31/x2. 8) Interest Expense for the year ended 12/31/44. h) Interest Expense for the year ended 12/31/42 Depreciation Expense for the year ended 12/31/x2. Note: Include all fixed assets owned by the company, including Coleman Equipment Company those acquired on 4/1/x1 from the