Question

Rocktown Corporation bought 780 shares of General Eccentric stock on March 20 for its trading securities portfolio at $26 per share. Rocktown sold the stock

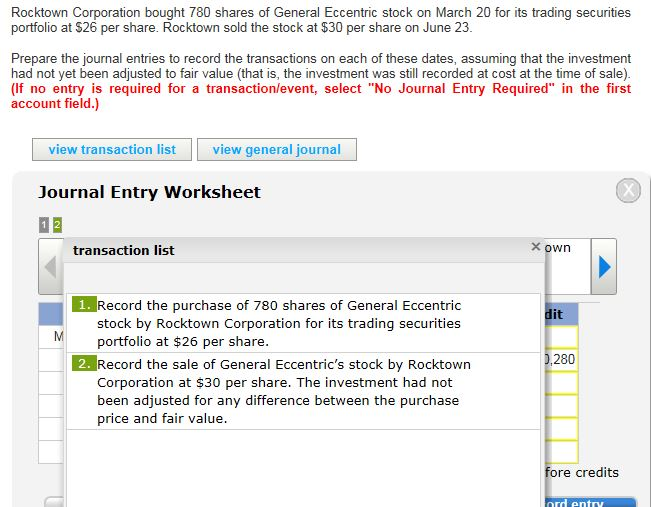

Rocktown Corporation bought 780 shares of General Eccentric stock on March 20 for its trading securities portfolio at $26 per share. Rocktown sold the stock at $30 per share on June 23.

Prepare the journal entries to record the transactions on each of these dates, assuming that the investment had not yet been adjusted to fair value (that is, the investment was still recorded at cost at the time of sale).

Transaction List:

1) Record the purchase of 780 shares of General Eccentric stock by Rocktown Corporation for its trading securities portfolio at $26 per share

2) Record the sale of General Eccentrics stock by Rocktown Corporation at $30 per share. The investment had not been adjusted for any difference between the purchase price and fair value.

Rocktown Corporation bought 780 shares of General Eccentric stock on March 20 for its trading securities portfolio at S26 per share. Rocktown sold the stock at $30 per share on June 23. Prepare the journal entries to record the transactions on each of these dates, assuming that the investment had not yet been adjusted to fair value (that is, the investment was still recorded at cost at the time of sale) (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) view transaction list view general journal Journal Entry Worksheet transaction list own 1. Record the purchase of 780 shares of General Eccentric it stock by Rocktown Corporation for its trading securities portfolio at $26 per share. 280 2. Record the sale of General Eccentric's stock by Rocktown Corporation at $30 per share. The investment had not been adjusted for any difference between the purchase price and fair value fore credits rd entryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started