Answered step by step

Verified Expert Solution

Question

1 Approved Answer

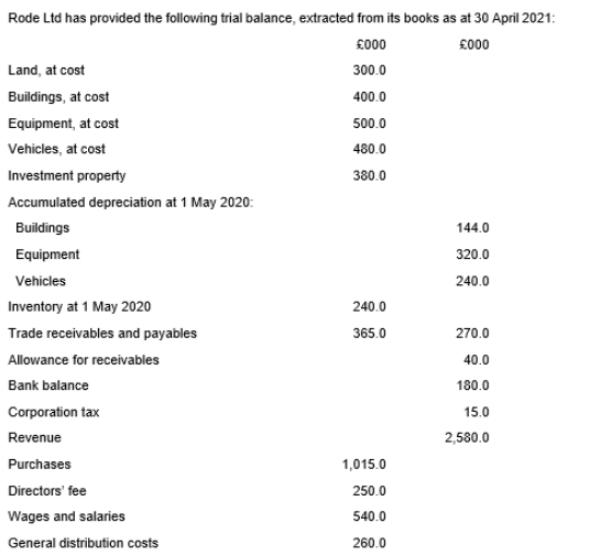

Rode Ltd has provided the following trial balance, extracted from its books as at 30 April 2021: 000 000 300.0 400.0 500.0 480.0 380.0

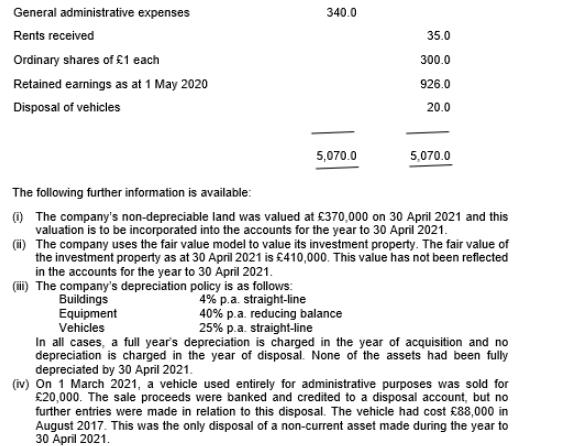

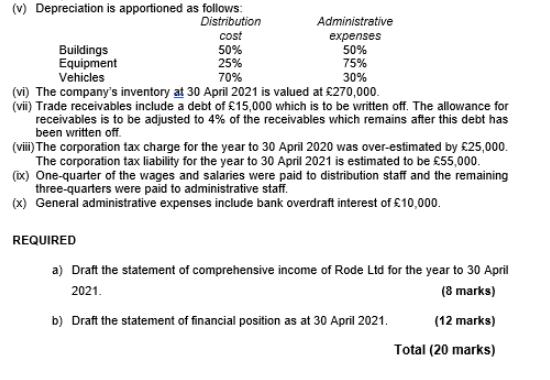

Rode Ltd has provided the following trial balance, extracted from its books as at 30 April 2021: 000 000 300.0 400.0 500.0 480.0 380.0 Land, at cost Buildings, at cost Equipment, at cost Vehicles, at cost Investment property Accumulated depreciation at 1 May 2020: Buildings Equipment Vehicles Inventory at 1 May 2020 Trade receivables and payables Allowance for receivables Bank balance Corporation tax Revenue Purchases Directors' fee Wages and salaries General distribution costs 240.0 365.0 1,015.0 250.0 540.0 260.0 144.0 320.0 240.0 270.0 40.0 180.0 15.0 2,580.0 General administrative expenses Rents received Ordinary shares of 1 each Retained earnings as at 1 May 2020 Disposal of vehicles 340.0 5,070.0 35.0 300.0 926.0 20.0 5,070.0 The following further information is available: (1) The company's non-depreciable land was valued at 370,000 on 30 April 2021 and this valuation is to be incorporated into the accounts for the year to 30 April 2021. 40% p.a. reducing balance 25% p.a. straight-line (ii) The company uses the fair value model to value its investment property. The fair value of the investment property as at 30 April 2021 is 410,000. This value has not been reflected in the accounts for the year to 30 April 2021. (iii) The company's depreciation policy is as follows: 4% p.a. straight-line Buildings Equipment Vehicles In all cases, a full year's depreciation is charged in the year of acquisition and no depreciation is charged in the year of disposal. None of the assets had been fully depreciated by 30 April 2021. (iv) On 1 March 2021, a vehicle used entirely for administrative purposes was sold for 20,000. The sale proceeds were banked and credited to a disposal account, but no further entries were made in relation to this disposal. The vehicle had cost 88,000 in August 2017. This was the only disposal of a non-current asset made during the year to 30 April 2021. (v) Depreciation is apportioned as follows: Distribution cost 50% 25% 70% Administrative expenses 50% 75% 30% (vi) The company's inventory at 30 April 2021 is valued at 270,000. (vii) Trade receivables include a debt of 15,000 which is to be written off. The allowance for receivables is to be adjusted to 4% of the receivables which remains after this debt has been written off. Buildings Equipment Vehicles (viii) The corporation tax charge for the year to 30 April 2020 was over-estimated by 25,000. The corporation tax liability for the year to 30 April 2021 is estimated to be 55,000. (ix) One-quarter of the wages and salaries were paid to distribution staff and the remaining three-quarters were paid to administrative staff. (x) General administrative expenses include bank overdraft interest of 10,000. REQUIRED a) Draft the statement of comprehensive income of Rode Ltd for the year to 30 April 2021. (8 marks) b) Draft the statement of financial position as at 30 April 2021. (12 marks) Total (20 marks)

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

According to the data Rode Itd has balance extracted ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started