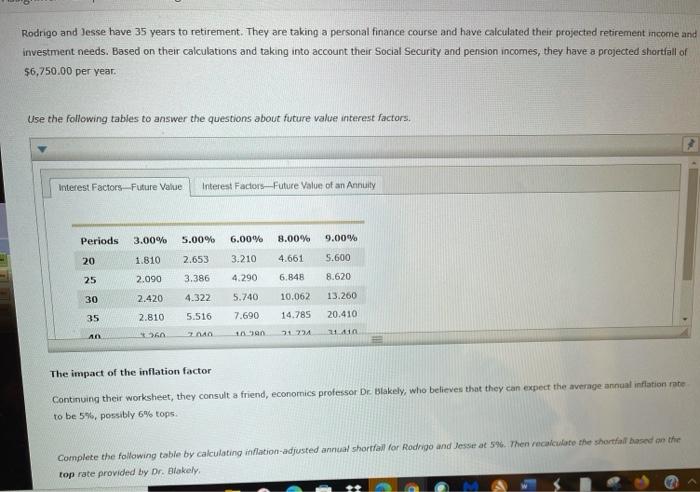

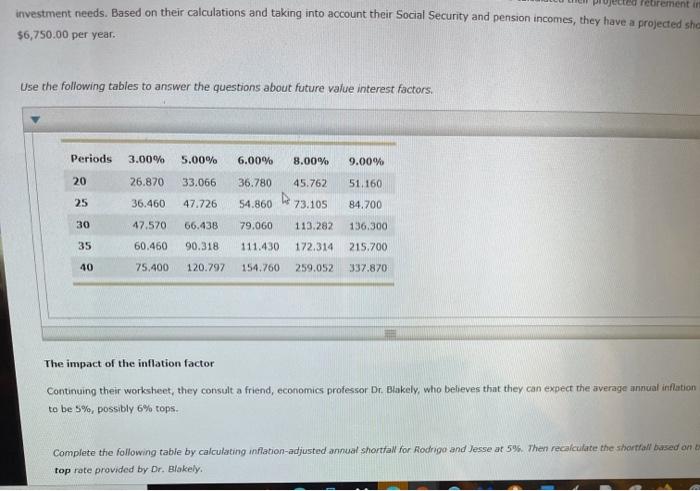

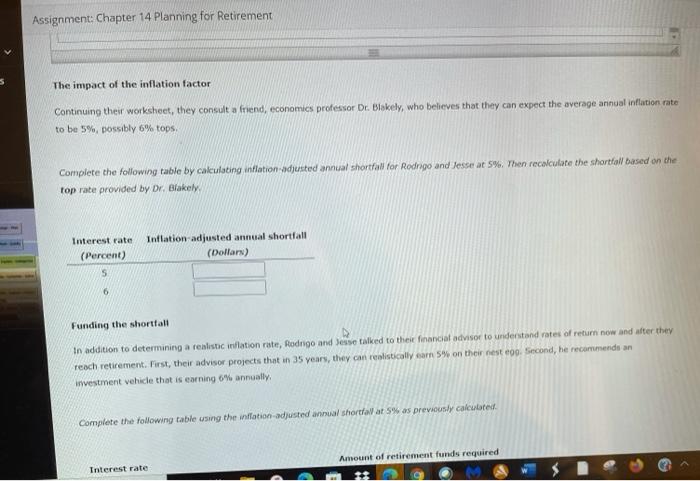

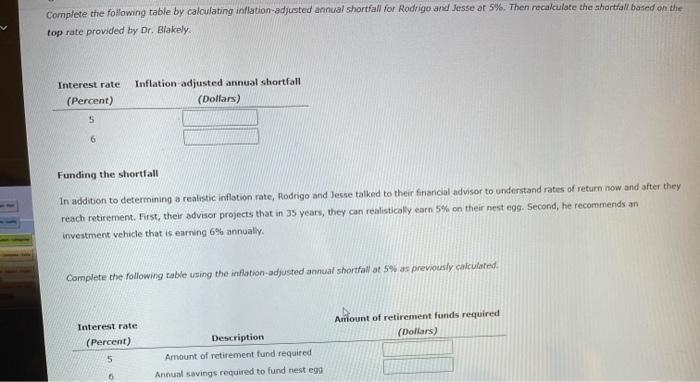

Rodrigo and Jesse have 35 years to retirement. They are taking a personal finance course and have calculated their projected retirement income and investment needs. Based on their calculations and taking into account their Social Security and pension incomes, they have a projected shortfall of $6.750.00 per year. Use the following tables to answer the questions about future value interest factors, Interest Factors Future Value Interest Factors Future Value of an Annuity Periods 3.00% 5.00% 6.00% 8.00% 9.00% 20 1.810 2.653 3.210 4.661 5.600 25 2.090 3.386 4.290 6.848 8.620 30 2.420 4.322 5.740 13.260 10.062 14.785 35 2.810 5.516 7.690 20.410 36 1090 124 An 1+ 41 The impact of the inflation factor Continuing their worksheet, they consult a friend, economies professor Dr. Blakely, who believes that they can expect the average annual inflation rate to be 5%, possibly 6% tops: Complete the following table by calculating inflation-adjusted annual shortfall for Rodrigo and Jesse at 5%. Then recalculate the shortfall based on the top rate provided by Dr. Blakely, retirement in investment needs. Based on their calculations and taking into account their Social Security and pension incomes, they have a projected she $6,750.00 per year. Use the following tables to answer the questions about future value interest factors, Periods 3.00% 5.00% 6.00% 8.00% 9.00% 20 26.870 33.066 36.780 45.762 51.160 84.700 25 36.460 47.726 54.860 73.105 30 47.570 66.438 113.282 79.060 111.430 136.300 215.700 35 60,460 90.318 172.314 40 75.400 120.797 154,760 259.052 337.870 The impact of the inflation factor Continuing their worksheet, they consult a friend, economics professor Dr. Blakely, who believes that they can expect the average annual inflation to be 5%, possibly 6% tops. Complete the following table by calculating inflation-adjusted annual shortfall for Rodrigo and Jesse at 5%. Then recalculate the shortfall based on top rate provided by Dr. Blakely. Assignment: Chapter 14 Planning for Retirement The impact of the inflation factor Continuing their worksheet, they consult a friend, economies professor Dr. Blokely, who believes that they can expect the average annual inflation rate to be 5%, possibly 6% tops, Complete the following table by calculating inflation-adjusted annual shortfall for Rodrigo and Jesse at 5%. Then recalculate the shortfall based on the top rate provided by Dr. Blakely Interest rate (Percent) Inflation-adjusted annual shortfall (Dollars) 6 Funding the shortfall In addition to determining a realistic inflation rate, Rodrigo and Jesse talked to their financial advisor to understand rates of return now and after they reach retirement. First, their advisor projects that in 35 years, they can realistically earn 5% on their nest cog. Second, he recommends an investment vehicle that is earning 6% annually, Complete the following table using the inflation-adjusted annual shortial at 5% as previously calcubredt Amount of retirement funds required Interest rate Complete the following table by calculating inflation-adjusted annual shortfall for Rodrigo and Jesse at 5%. Then recalculate the shortfall based on the top rate provided by Dr. Blakely Interest rate (Percent) Inflation adjusted annual shortfall (Dollars) 5 6 Funding the shortfall In addition to determining a realistic inflation rate, Rodrigo and Jesse talked to their financial advisor to understand rates of return now and after they reach retirement. First, their advisor projects that in 35 years, they can realistically earn 5% on their nest ego. Second, he recommends an investment vehicle that is earning 6% annual Complete the following table using the inflation-adjusted annual shortfall at 5% as previously calculated Interest rate (Percent) Aniount of retirement funds required (Dollars) Description Amount of retirement fund required Annual savings required to fund nest egg 6