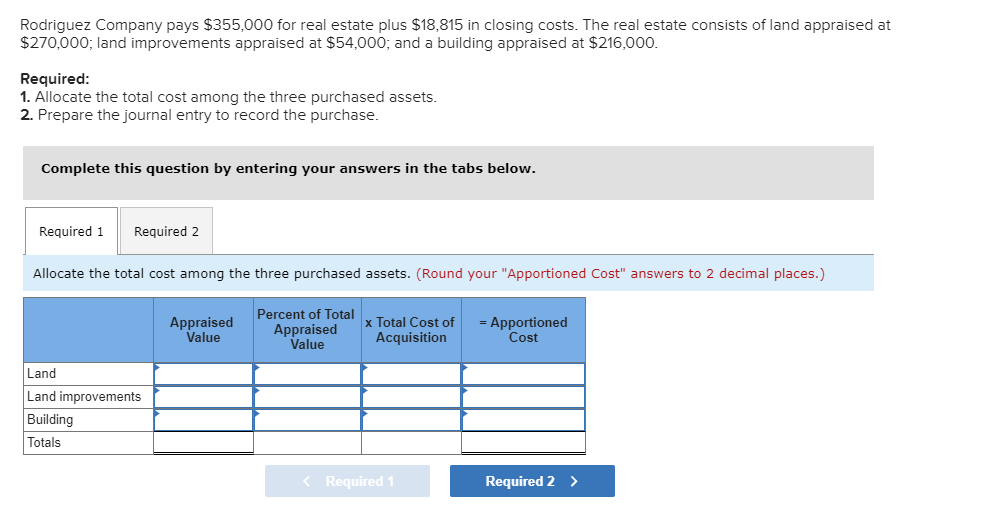

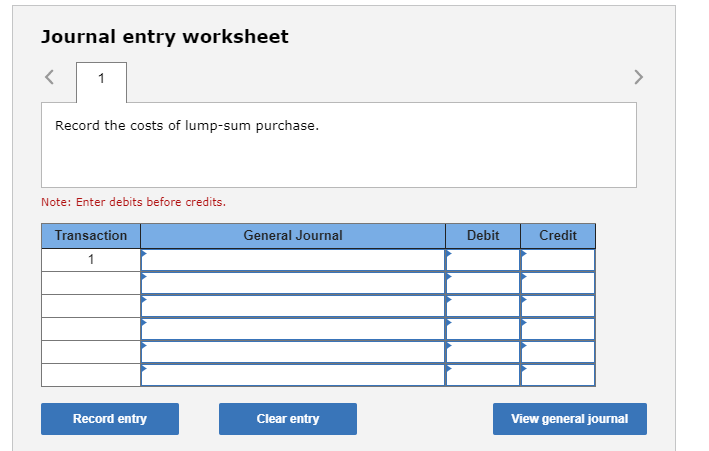

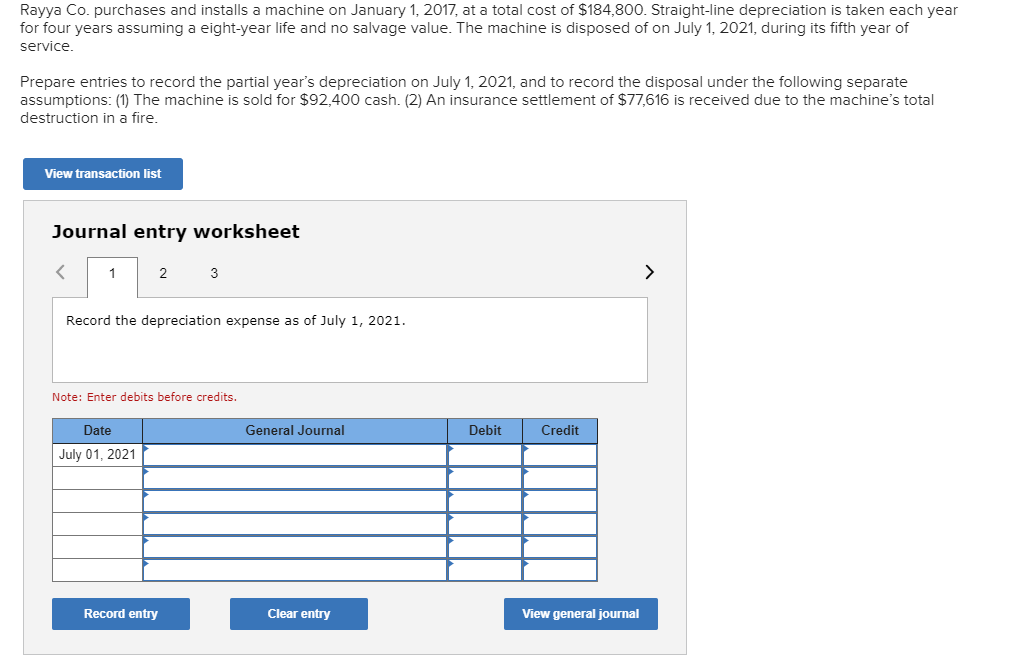

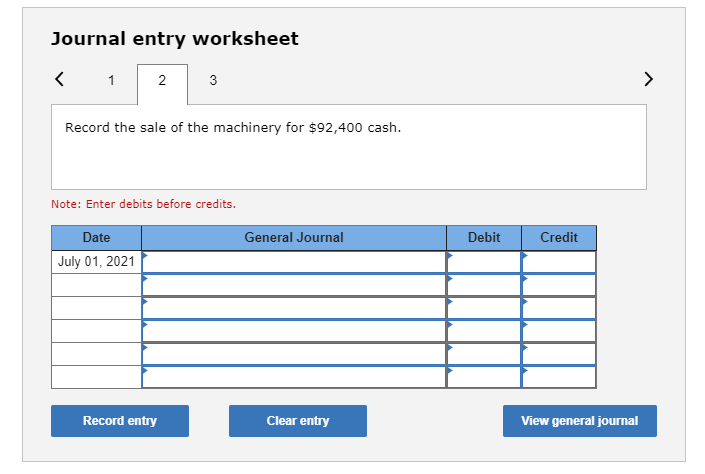

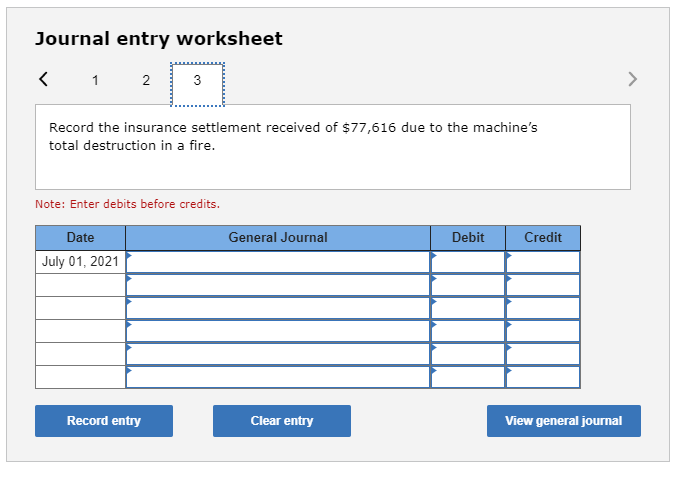

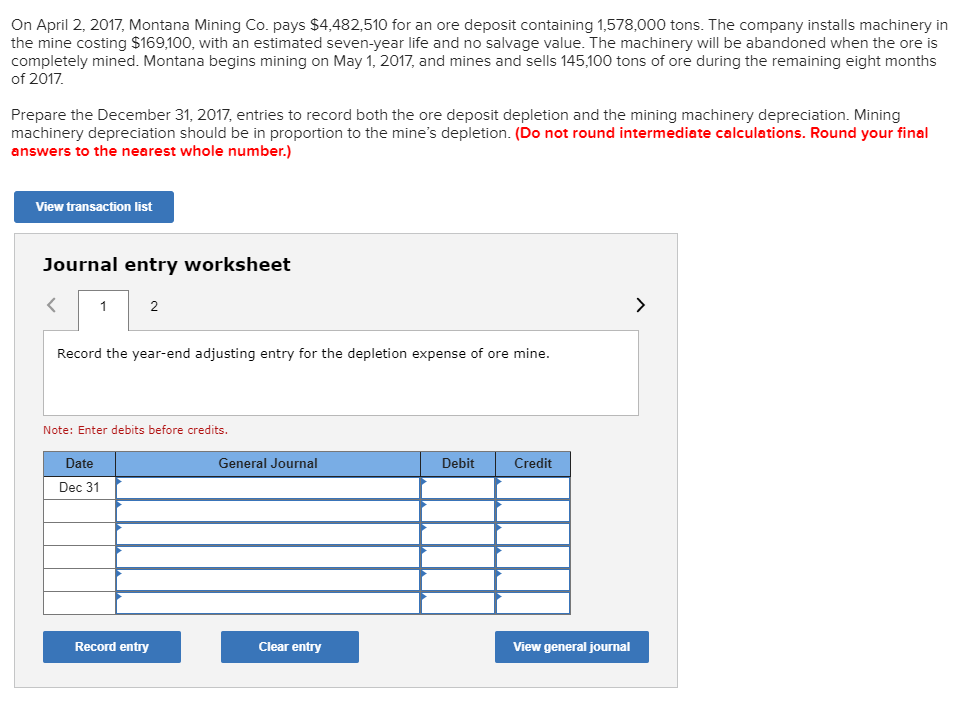

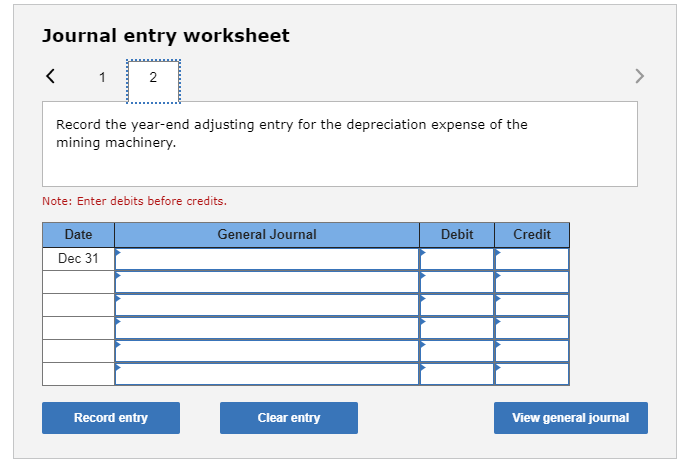

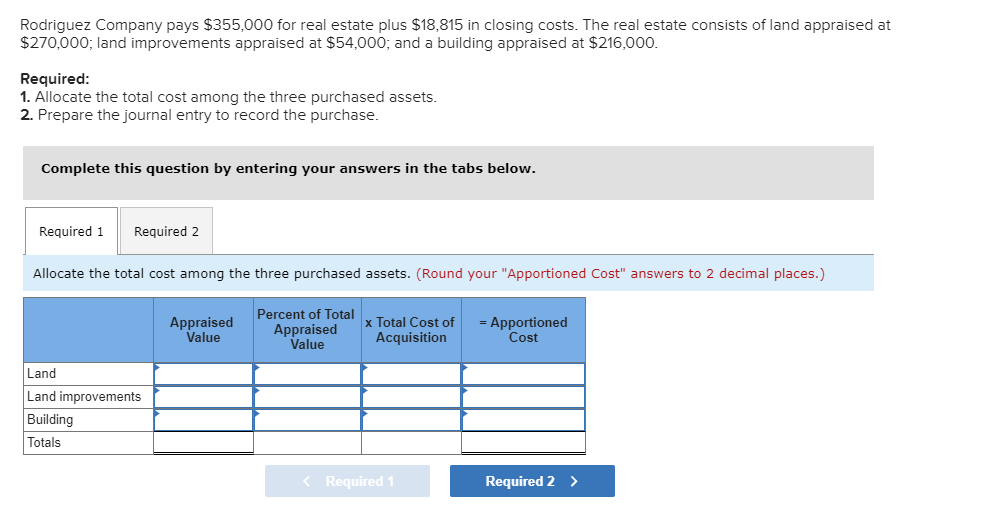

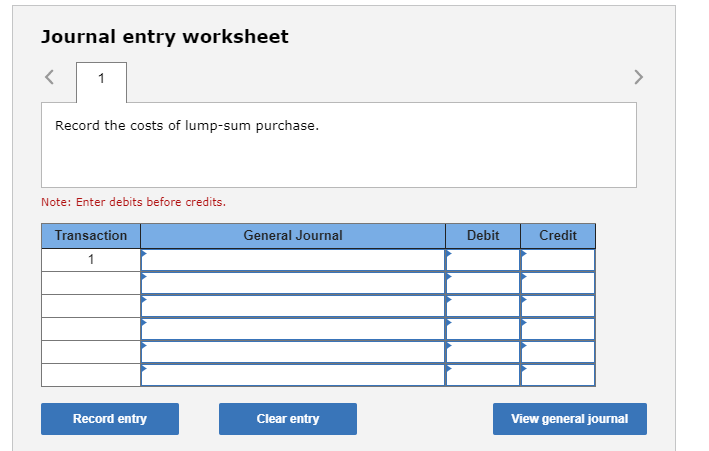

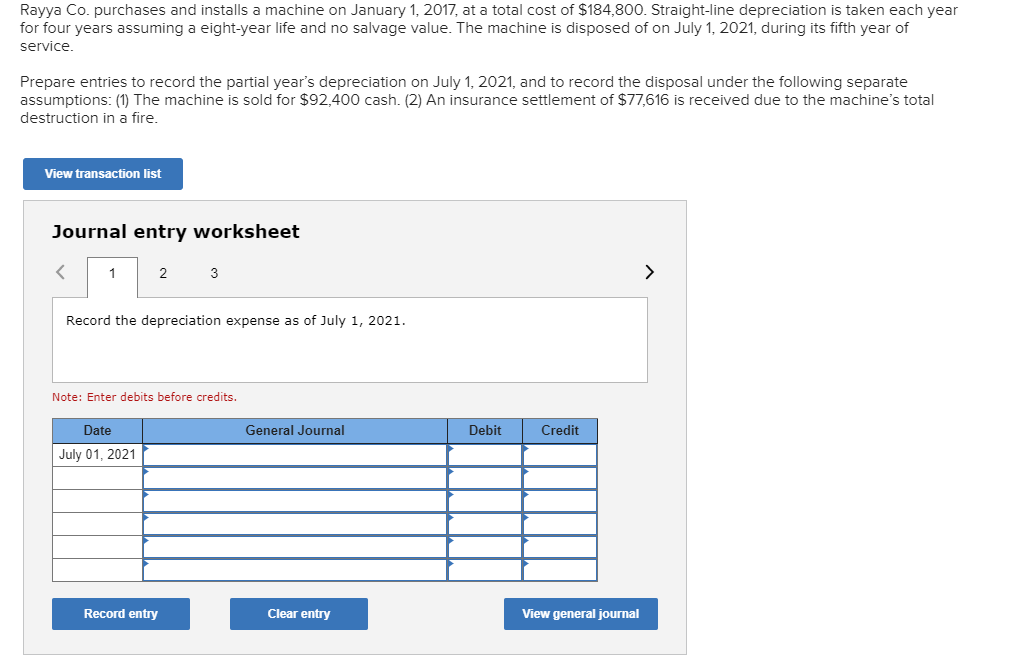

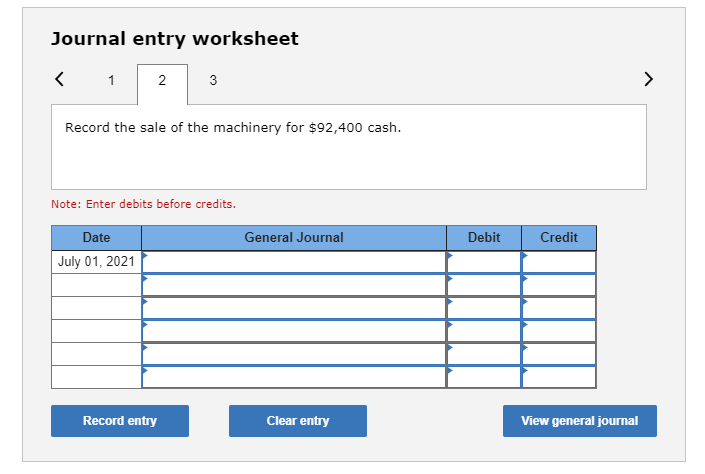

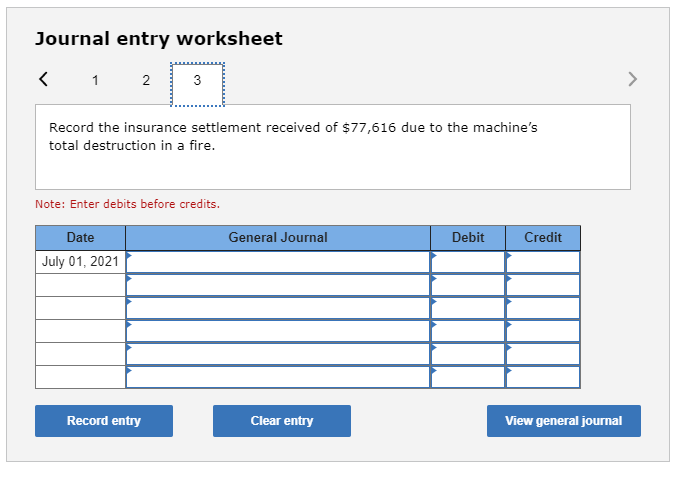

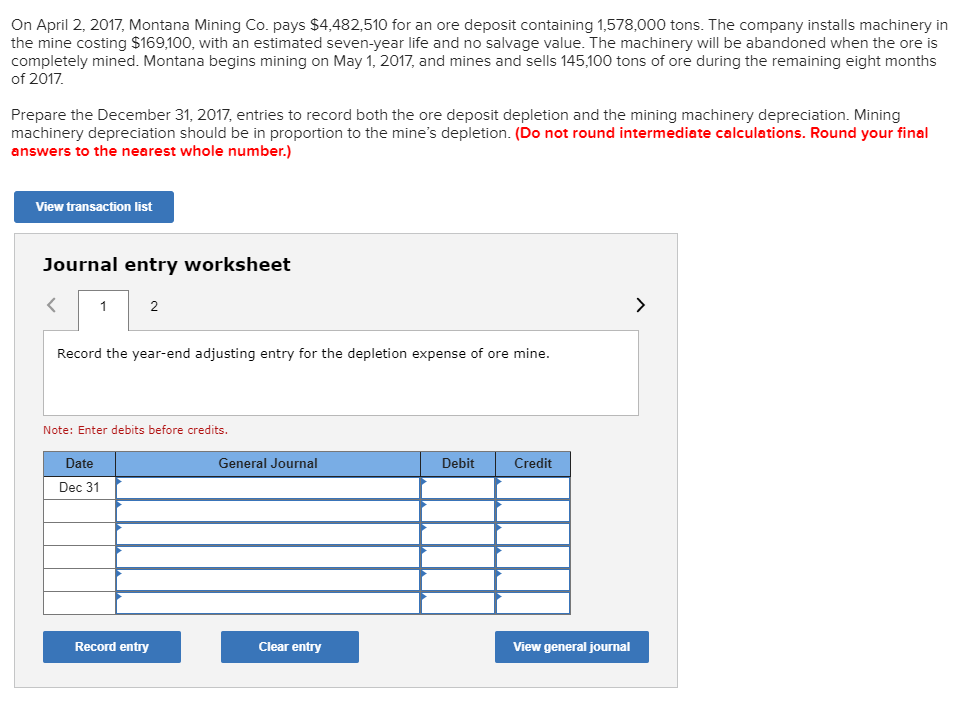

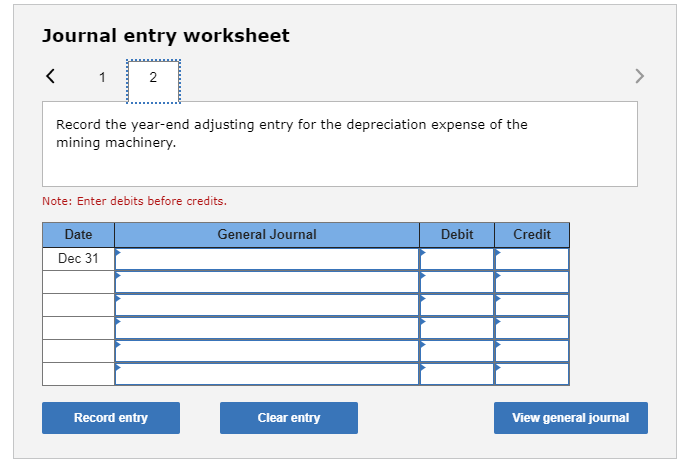

Rodriguez Company pays $355,000 for real estate plus $18,815 in closing costs. The real estate consists of land appraised at $270,000; land improvements appraised at $54,000; and a building appraised at $216,000. Required 1. Allocate the total cost among the three purchased assets 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below Required 1 Required 2 Allocate the total cost among the three purchased assets. (Round your "Apportioned Cost" answers to 2 decimal places.) Percent of Totalx Total Cost of-Apportioned Value Cost Value Land Land improvements Building Totals Journal entry worksheet Record the costs of lump-sum purchase. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Rayya Co. purchases and installs a machine on January 1,2017, at a total cost of $184,800. Straight-line depreciation is taken each year for four years assuming a eight-year life and no salvage value. The machine is disposed of on July 1, 2021, during its fifth year of service Prepare entries to record the partial year's depreciation on July 1, 2021, and to record the disposal under the following separate assumptions: (1) The machine is sold for $92,400 cash. (2) An insurance settlement of $77,616 is received due to the machine's total destruction in a fire. View transaction list Journal entry worksheet 2 Record the depreciation expense as of July 1, 2021 Note: Enter debits before credits. Date General Journal Debit Credit July 01, 2021 Record entry Clear entry View general journal Journal entry worksheet Record the sale of the machinery for $92,400 cash Note: Enter debits before credits. Date General Journal Debit Credit July 01, 2021 Clear entry Record entry View general journal Journal entry worksheet Record the insurance settlement received of $77,616 due to the machine's total destruction in a fire. Note: Enter debits before credits. Date General Journal Debit Credit July 01, 2021 Clear entry Record entry View general journal On April 2, 2017, Montana Mining Co. pays $4,482,510 for an ore deposit containing 1,578,000 tons. The company installs machinery in the mine costing $169,100, with an estimated seven-year life and no salvage value. The machinery will be abandoned when the ore is completely mined. Montana begins mining on May 1, 2017, and mines and sells 145,100 tons of ore during the remaining eight months of 2017 Prepare the December 31, 2017, entries to record both the ore deposit depletion and the mining machinery depreciation. Mining machinery depreciation should be in proportion to the mine's depletion. (Do not round intermediate calculations. Round your final answers to the nearest whole number.) View transaction list Journal entry worksheet 2 Record the year-end adjusting entry for the depletion expense of ore mine. Note: Enter debits before credits. Debit Date General Journal Credit Dec 31 Record entry Clear entry View general journal Journal entry worksheet 2 Record the year-end adjusting entry for the depreciation expense of the mining machinerv Note: Enter debits before credits. Debit Date General Journal Credit Dec 31 Clear entry Record entry View general journal