Answered step by step

Verified Expert Solution

Question

1 Approved Answer

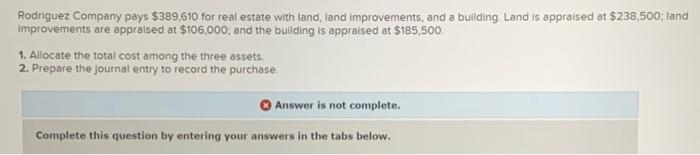

Rodriguez Company pays $389610 for real estate with land, land improvements, and a building. Land is appraised at $238500 ; land improvements are appraised at

Rodriguez Company pays $389610 for real estate with land, land improvements, and a building. Land is appraised at $238500 ; land improvements are appraised at $106,000 ; and the building is appraised at $185,000.

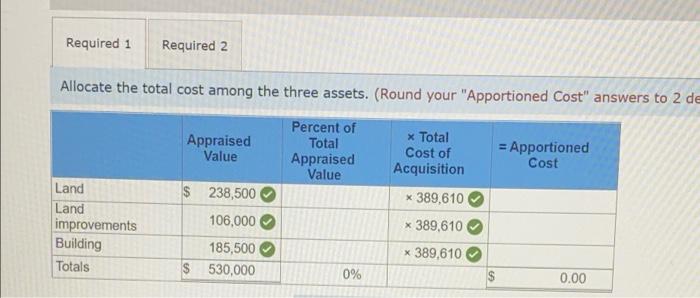

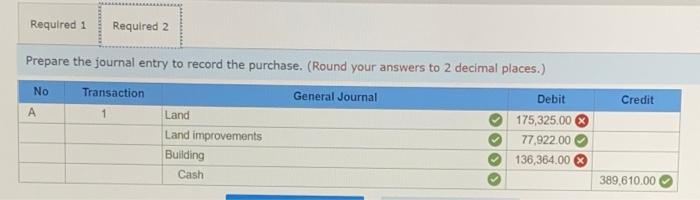

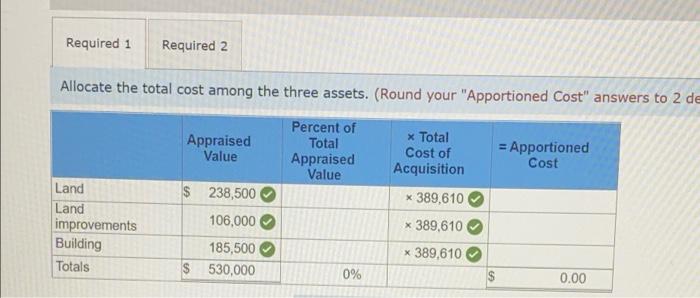

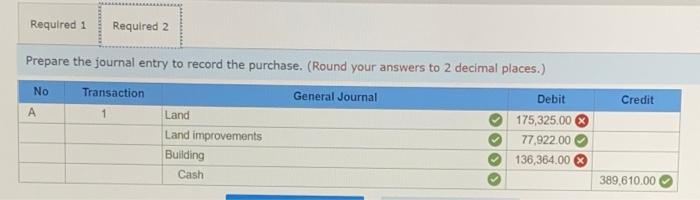

Rodriguez Company pays $389,610 for real estate with land, land improvements, and a building Land is appraised at $238,500; land Improvements are appraised at $106.000, and the building is appraised at $185,500 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Allocate the total cost among the three assets. (Round your "Apportioned Cost" answers to 2 de Appraised Value Percent of Total Appraised Value = Apportioned * Total Cost of Acquisition * 389,610 Cost Land Land improvements Building Totals $ 238,500 106,000 185,500 $530,000 x 389,610 x 389,610 0% 0.00 Required 1 Required 2 Prepare the journal entry to record the purchase. (Round your answers to 2 decimal places.) General Journal No Transaction 1 Credit Land Land improvements Building Cash Debit 175,325.00 77,922.00 136,364.00 389.610.00 1. allocate The total cost among the three assets.

2. prepare the journal entry to record the purchase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started