Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ROGER CPA Review Chapter 10 Problems 1,9, 10 Saved to this PC view Help Tell me what you want to do References Mailings Review V

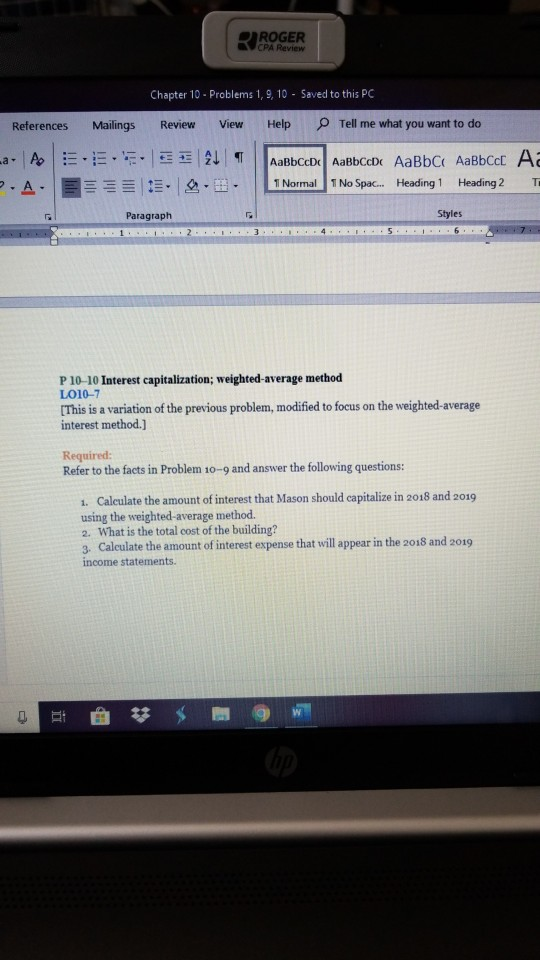

ROGER CPA Review Chapter 10 Problems 1,9, 10 Saved to this PC view Help Tell me what you want to do References Mailings Review V L Normal]TNo Spac...-Heading 1 |. Heading 2 Ti A- g-- Styles Paragraph P 10-10 Interest capitalization; weighted-average method [This is a variation of the previous problem, modified to focus on the weighted-average interest method.] Required: Refer to the facts in Problem 10-9 and answer the following questions: i. Caleulate the amount of interest that Mason should capitalize in 2018 and 2019 using the weighted-average method. 2. What is the total cost of the building? . Caleulate the amount of interest expense that will appear in the 2018 and 2019 income statements ROGER CPA Review Chapter 10 Problems 1,9, 10 Saved to this PC view Help Tell me what you want to do References Mailings Review V L Normal]TNo Spac...-Heading 1 |. Heading 2 Ti A- g-- Styles Paragraph P 10-10 Interest capitalization; weighted-average method [This is a variation of the previous problem, modified to focus on the weighted-average interest method.] Required: Refer to the facts in Problem 10-9 and answer the following questions: i. Caleulate the amount of interest that Mason should capitalize in 2018 and 2019 using the weighted-average method. 2. What is the total cost of the building? . Caleulate the amount of interest expense that will appear in the 2018 and 2019 income statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started