Question

Rogers Company signs a five-year capital lease with Packer Company for office equipment. The annual year-end lease payment is $12,000, and the interest rate is

Rogers Company signs a five-year capital lease with Packer Company for office equipment. The annual year-end lease payment is $12,000, and the interest rate is 5%

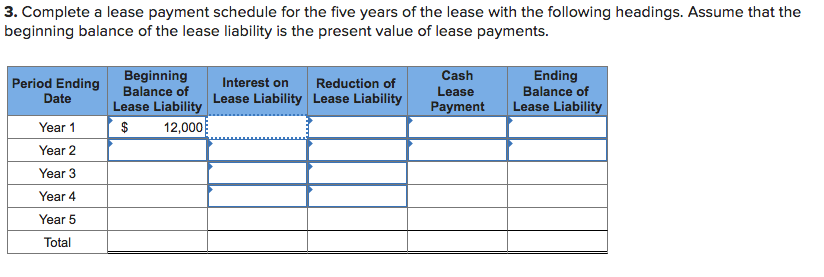

Complete a lease payment schedule for the five years of the lease with the following headings. Assume that the beginning balance of the lease liability is the present value of lease payments.

Use straight-line depreciation and prepare the journal entry to depreciate the leased asset at the end of year 1. Assume zero salvage value and a five-year life for the office equipment.

Record the annual depreciation expense on the office equipment at the end of year 1.

3. Complete a lease payment schedule for the five years of the lease with the following headings. Assume that the beginning balance of the lease liability is the present value of lease payments. Beginning Balance of Lease Liability Lease Liability Lease Liability 12,000 Cash Ending Balance of Lease Liability Period Ending Date Interest on Reduction of Lease Payment Year 1 Year 2 Year 3 Year 4 Year 5 TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started