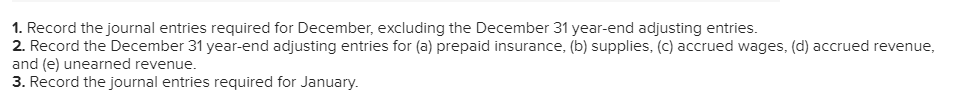

Question

Roland company began operations on December 1 and needs assistance in preparing December 31 financial statements, including its year-end adjustments. Dec. 1 prepaid a 24

Roland company began operations on December 1 and needs assistance in preparing December 31 financial statements, including its year-end adjustments.

Dec. 1 prepaid a 24 month insurance policy (coverage starting immediately) for $2,400 cash

Dec. 7 purchased supplies for $2,000 cash

Dec. 13 agreed to do $10,000 worth of work for Telo over the next 30 days. Payment is to be received when the work is completed on Jan 12

Dec 24 received $4,000 cash in advance to perform work for ABX over the next 4 weeks

Dec. 31 year end

Jan. 5 paid wages of $800 cash to workers

Jan. 12 received $10,000 cash from Telo for work performed over the last 30 days

additional info as of Dec. 31: Telo - 60% complete ABX - 25% complete

supplies remaining at year-end: $700

Wages earned by workers but not yet paid at year-end: $500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started