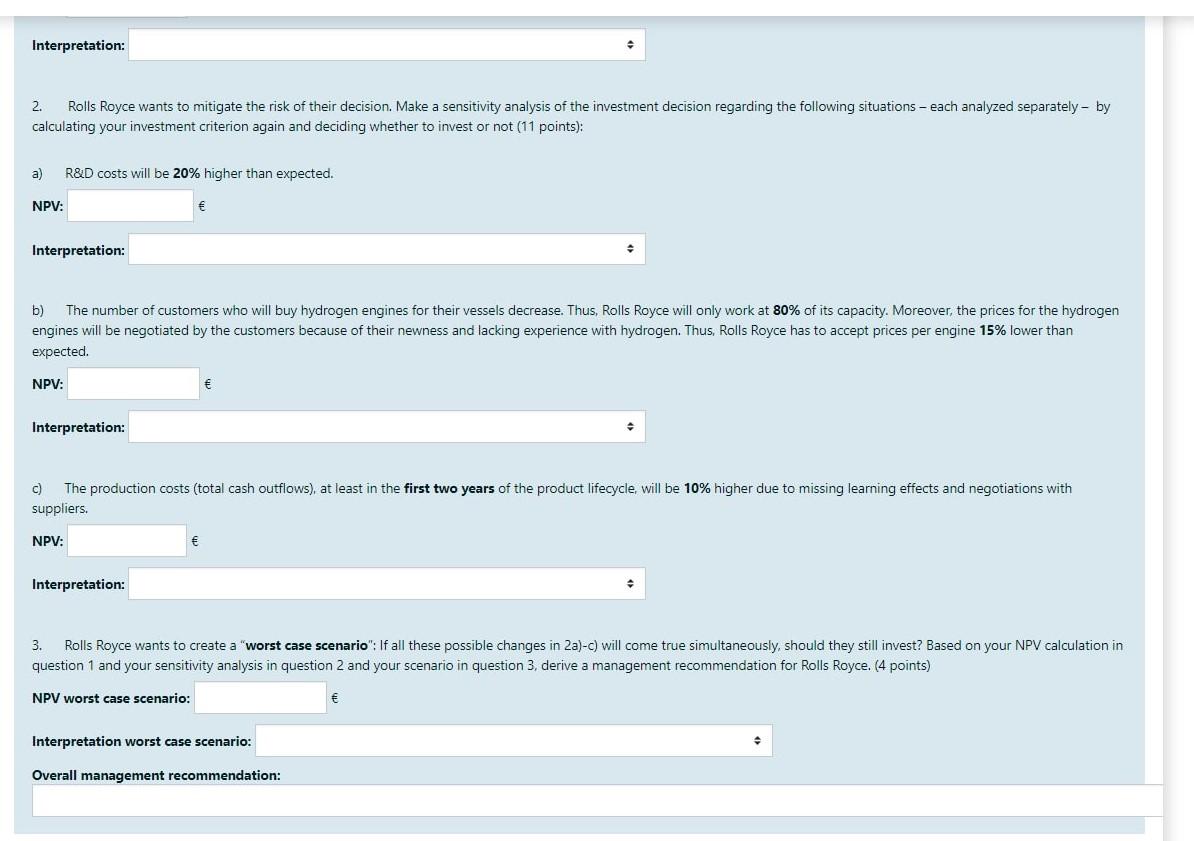

"Rolls-Royce Holdings (...) is a British multinational aerospace and defense company incorporated in February 2011 that owns Rolls-Royce, a business established in 1904 which today designs, manufactures and distributes power systems for aviation and other industries. Rolls-Royce is the world's second-largest maker of aircraft engines (after General Electric) and has major businesses in the marine propulsion and energy sectors. Rolls-Royce was the world's 16th largest defense contractor in 2018 when measured by defense revenues. Rolls-Royce Holdings plc is listed on the London Stock Exchange, where it is a constituent of the FTSE 100 Index. As of close of London trading on 28 August 2019, the company had a market capitalization of 4.656bn, the 85th-largest of any company with a primary listing on the London Stock Exchange. The company's registered office is at Kings Place, near Kings Cross in London." Source: https://en.wikipedia.org/wiki/Rolls-Royce_Holdings In their marine sector, Rolls-Royce is planning an investment regarding the research and development and production of hydrogen engines for vessels. In the excel sheet you find the information regarding the expected R&D expense the investment for the production plant and assembly line for hydrogen engines as well as expected production costs and estimated sales to the few but large business customers and governments in the marine/military sector. Download the provided excel file containing the given data and solve the tasks below. Use a separate excel sheet within the provided file for each question (1/2a/2b/2c/3). In addition, you must enter the results here in the quiz! Please enter your results with two digits after the decimal break. Depending on your location, this break is either","or"". Do not just cut off the remaining decimals, but apply commercial rounding (as excel does)! Do not use a thousands separator, 1. Analyze the investment decision: Should Roll-Royce invest into hydrogen engines? Calculate the net present value of this investment for 10 years in order to analyze the decision. (15 points) Initial investment (CF in t=0): Revenues per year (in t-1-10): Variable costs for electricity per year (in t-1-10): Variable costs for input material per year (in t-1-10): Fixed costs per year (in t-1-10): Total annual cash flow in t=1-10): NPV: Interpretation: Interpretation: 2. Rolls Royce wants to mitigate the risk of their decision. Make a sensitivity analysis of the investment decision regarding the following situations - each analyzed separately - by calculating your investment criterion again and deciding whether to invest or not (11 points): a) R&D costs will be 20% higher than expected. NPV: Interpretation: b) The number of customers who will buy hydrogen engines for their vessels decrease. Thus, Rolls Royce will only work at 80% of its capacity. Moreover, the prices for the hydrogen engines will be negotiated by the customers because of their newness and lacking experience with hydrogen. Thus, Rolls Royce has to accept prices per engine 15% lower than expected. NPV: Interpretation: c) The production costs (total cash outflows), at least in the first two years of the product lifecycle will be 10% higher due to missing learning effects and negotiations with suppliers NPV: Interpretation: 3. Rolls Royce wants to create a "worst case scenario": If all these possible changes in 2a)-c) will come true simultaneously, should they still invest? Based on your NPV calculation in question 1 and your sensitivity analysis in question 2 and your scenario in question 3. derive a management recommendation for Rolls Royce. (4 points) NPV worst case scenario: Interpretation worst case scenario: Overall management recommendation: "Rolls-Royce Holdings (...) is a British multinational aerospace and defense company incorporated in February 2011 that owns Rolls-Royce, a business established in 1904 which today designs, manufactures and distributes power systems for aviation and other industries. Rolls-Royce is the world's second-largest maker of aircraft engines (after General Electric) and has major businesses in the marine propulsion and energy sectors. Rolls-Royce was the world's 16th largest defense contractor in 2018 when measured by defense revenues. Rolls-Royce Holdings plc is listed on the London Stock Exchange, where it is a constituent of the FTSE 100 Index. As of close of London trading on 28 August 2019, the company had a market capitalization of 4.656bn, the 85th-largest of any company with a primary listing on the London Stock Exchange. The company's registered office is at Kings Place, near Kings Cross in London." Source: https://en.wikipedia.org/wiki/Rolls-Royce_Holdings In their marine sector, Rolls-Royce is planning an investment regarding the research and development and production of hydrogen engines for vessels. In the excel sheet you find the information regarding the expected R&D expense the investment for the production plant and assembly line for hydrogen engines as well as expected production costs and estimated sales to the few but large business customers and governments in the marine/military sector. Download the provided excel file containing the given data and solve the tasks below. Use a separate excel sheet within the provided file for each question (1/2a/2b/2c/3). In addition, you must enter the results here in the quiz! Please enter your results with two digits after the decimal break. Depending on your location, this break is either","or"". Do not just cut off the remaining decimals, but apply commercial rounding (as excel does)! Do not use a thousands separator, 1. Analyze the investment decision: Should Roll-Royce invest into hydrogen engines? Calculate the net present value of this investment for 10 years in order to analyze the decision. (15 points) Initial investment (CF in t=0): Revenues per year (in t-1-10): Variable costs for electricity per year (in t-1-10): Variable costs for input material per year (in t-1-10): Fixed costs per year (in t-1-10): Total annual cash flow in t=1-10): NPV: Interpretation: Interpretation: 2. Rolls Royce wants to mitigate the risk of their decision. Make a sensitivity analysis of the investment decision regarding the following situations - each analyzed separately - by calculating your investment criterion again and deciding whether to invest or not (11 points): a) R&D costs will be 20% higher than expected. NPV: Interpretation: b) The number of customers who will buy hydrogen engines for their vessels decrease. Thus, Rolls Royce will only work at 80% of its capacity. Moreover, the prices for the hydrogen engines will be negotiated by the customers because of their newness and lacking experience with hydrogen. Thus, Rolls Royce has to accept prices per engine 15% lower than expected. NPV: Interpretation: c) The production costs (total cash outflows), at least in the first two years of the product lifecycle will be 10% higher due to missing learning effects and negotiations with suppliers NPV: Interpretation: 3. Rolls Royce wants to create a "worst case scenario": If all these possible changes in 2a)-c) will come true simultaneously, should they still invest? Based on your NPV calculation in question 1 and your sensitivity analysis in question 2 and your scenario in question 3. derive a management recommendation for Rolls Royce. (4 points) NPV worst case scenario: Interpretation worst case scenario: Overall management recommendation