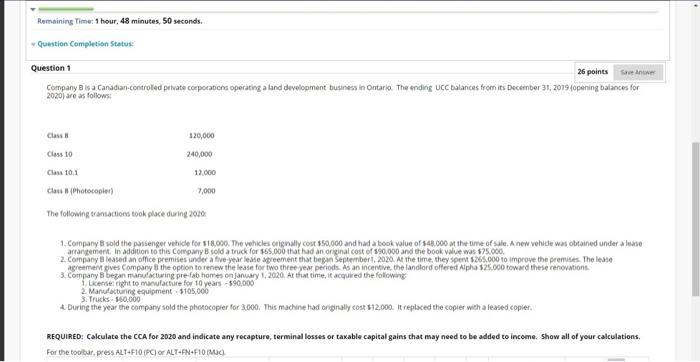

Romaining Time: 1 hour. 48 minutes, 50 seconds. Question Completion Status Question 1 26 points See Company B is a Canadian-controlled private corporation operating a land development business in Ontario. The ending uc balances from its December 31, 2019 opening balances for 2020) are as follows: Class 120,000 Class 10 240,000 Clan 101 12.000 Claus Photocooler 7,000 The following transactions took place during 2020 1. Company B sold the passenger vehicle for 518,000. The vehicles originally cost $50,000 and had a book value of 548,000 at the time of sale. A new vehide was obtained under a lase 3.COM WWW.the landlord offered Alpha 125.000 toward these 2. Company B leased an office premises under a five year late spreement that began September 1, 2020. At the time, they spent $265.000 to improve the premises. The lease 2. Manufacturing equipment 5105,000 3.Trucks 10,000 4. During the year the company sold the photocopier for 3.000. This machine had originally cost $12.000. It replaced the copier with a leased copier REQUIRED: Calculate the CCA for 2020 and indicate any recapture, terminal losses or taxable capital gains that may need to be added to income. Show all of your calculations, For the toolbar, press ALT+F10/PC) O ALT-EN-F10/MO Romaining Time: 1 hour. 48 minutes, 50 seconds. Question Completion Status Question 1 26 points See Company B is a Canadian-controlled private corporation operating a land development business in Ontario. The ending uc balances from its December 31, 2019 opening balances for 2020) are as follows: Class 120,000 Class 10 240,000 Clan 101 12.000 Claus Photocooler 7,000 The following transactions took place during 2020 1. Company B sold the passenger vehicle for 518,000. The vehicles originally cost $50,000 and had a book value of 548,000 at the time of sale. A new vehide was obtained under a lase 3.COM WWW.the landlord offered Alpha 125.000 toward these 2. Company B leased an office premises under a five year late spreement that began September 1, 2020. At the time, they spent $265.000 to improve the premises. The lease 2. Manufacturing equipment 5105,000 3.Trucks 10,000 4. During the year the company sold the photocopier for 3.000. This machine had originally cost $12.000. It replaced the copier with a leased copier REQUIRED: Calculate the CCA for 2020 and indicate any recapture, terminal losses or taxable capital gains that may need to be added to income. Show all of your calculations, For the toolbar, press ALT+F10/PC) O ALT-EN-F10/MO