ROPI, WACC

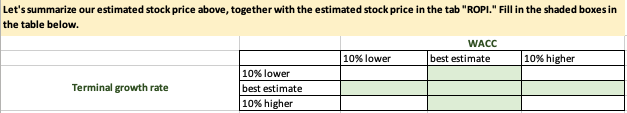

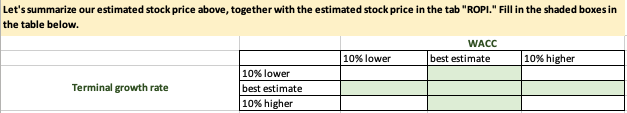

Need to fill out this chart below to find terminal growth rates for Apple using WACC.

Info on estimated stock price in information section below.

Estimated stock price in "ROPI" tab is $4.42 per share.

Below is information to help.

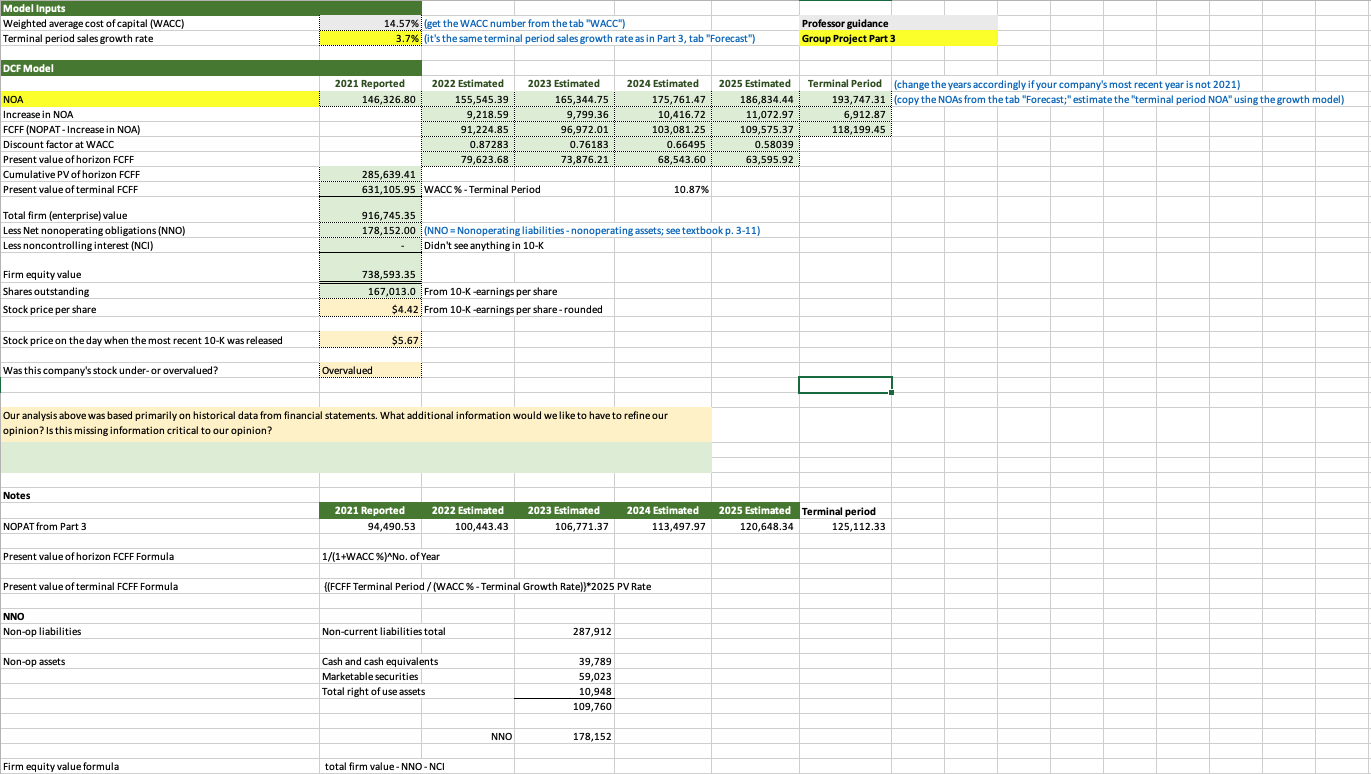

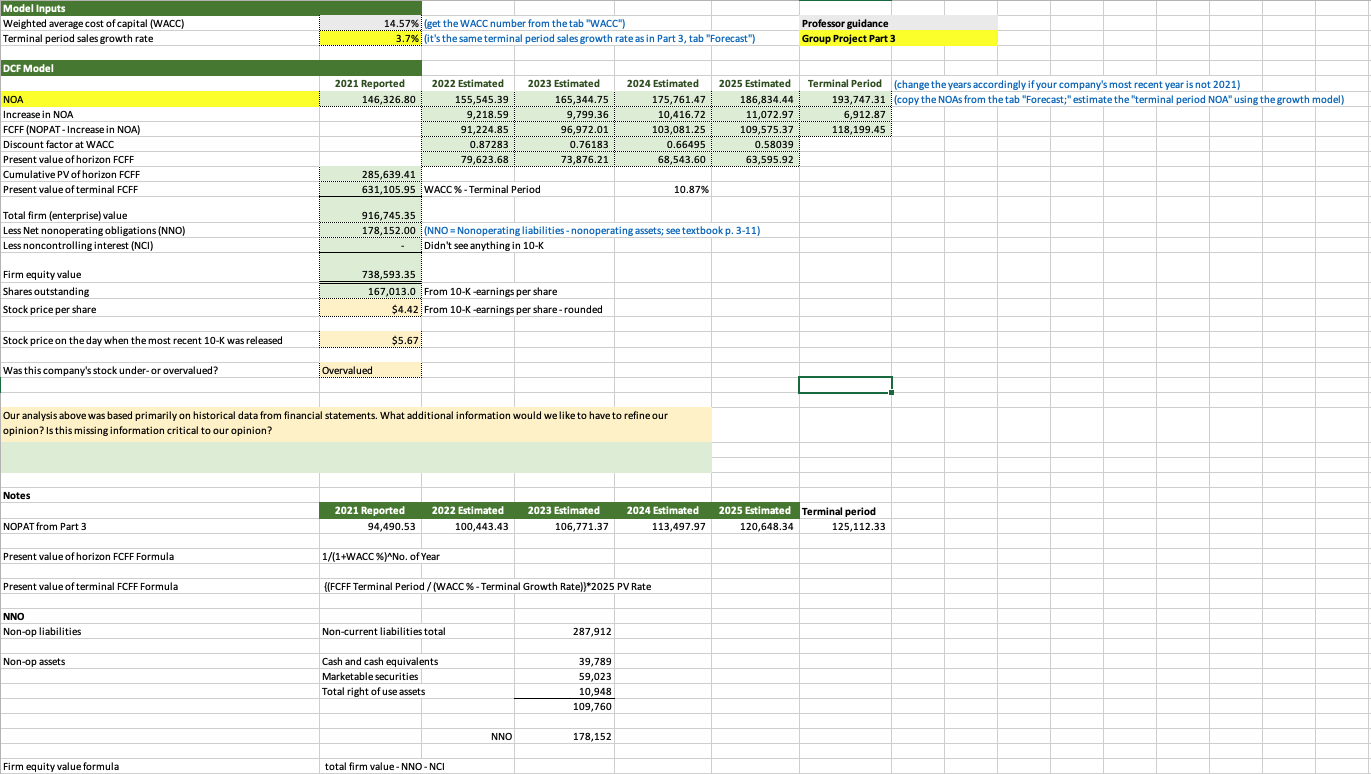

DCF

ROPI

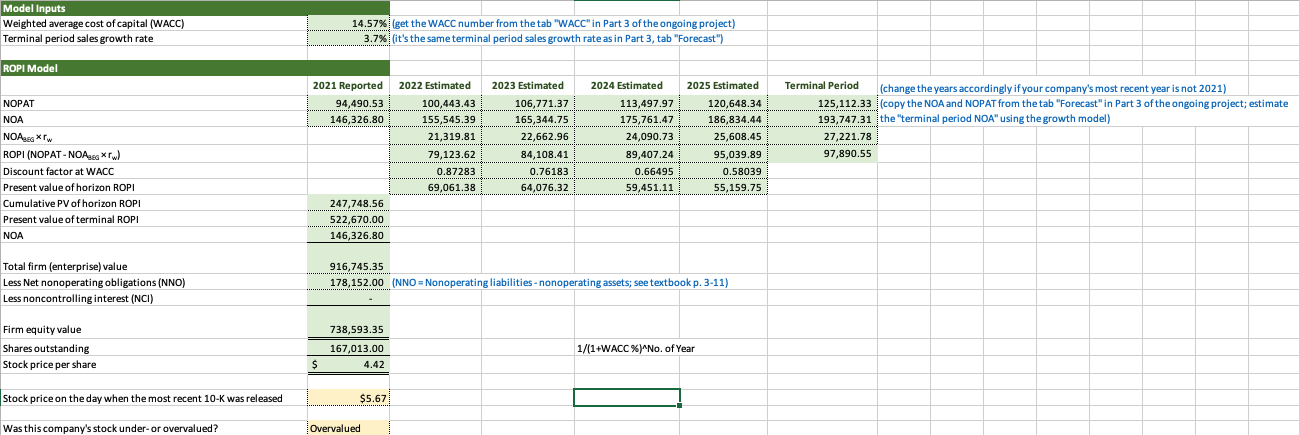

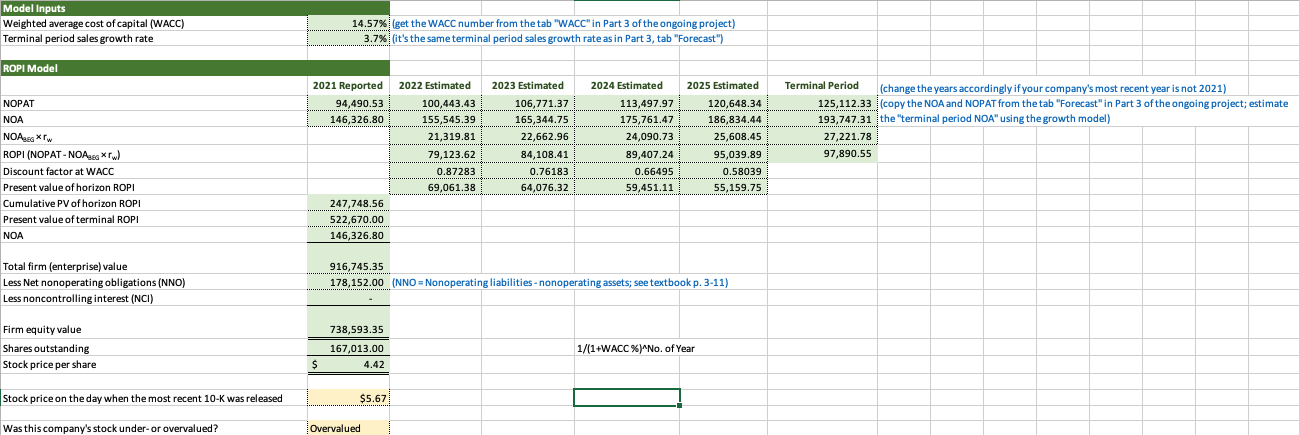

ROPI with 10% LOWER terminal growth rate, same WACC

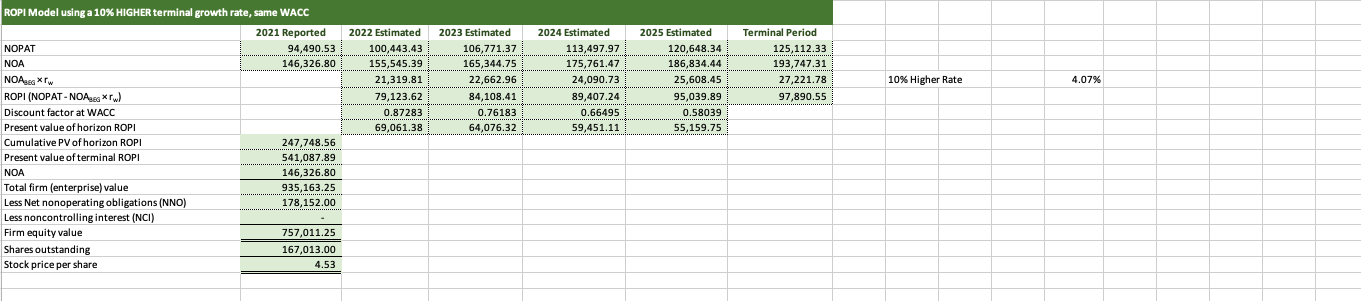

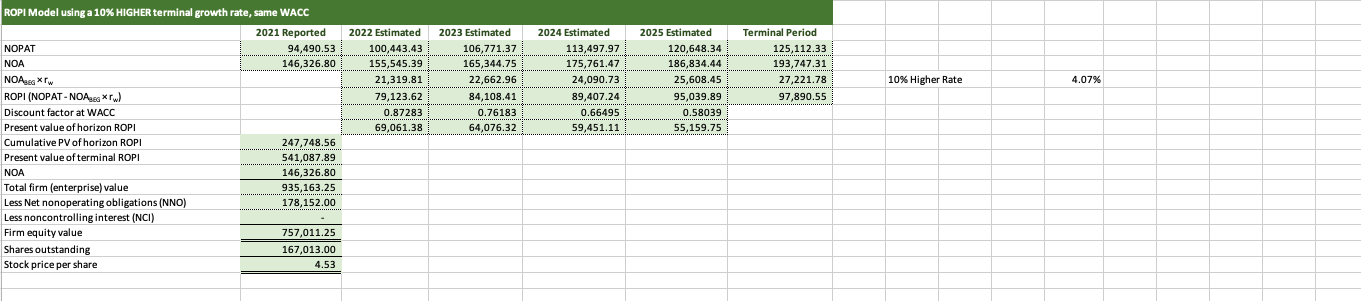

ROPI with 10% HIGHER terminal growth rate, same WACC

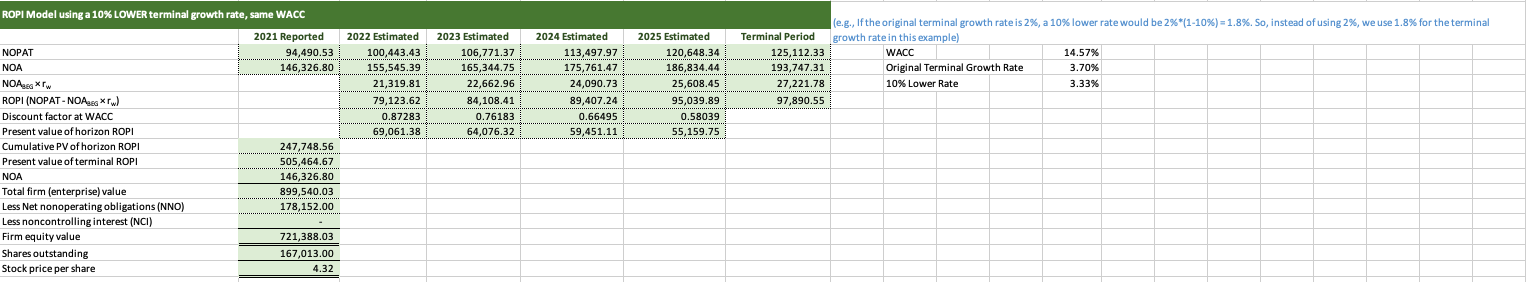

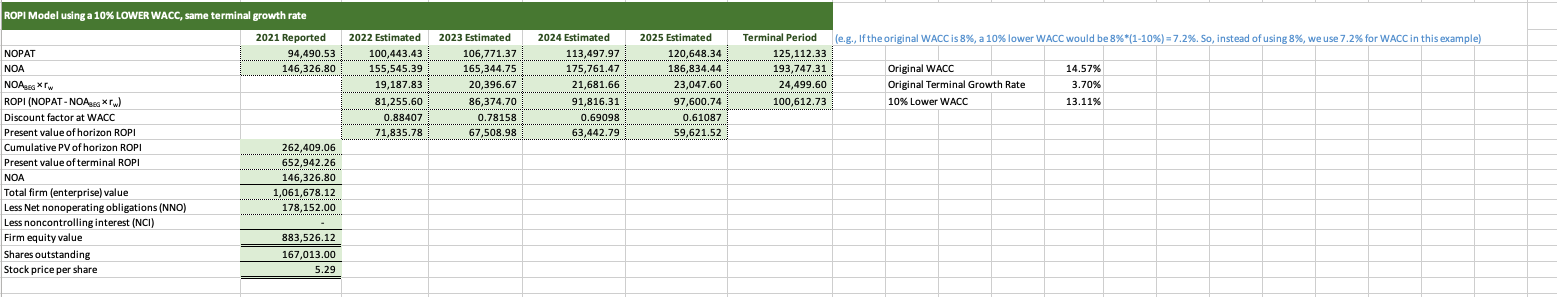

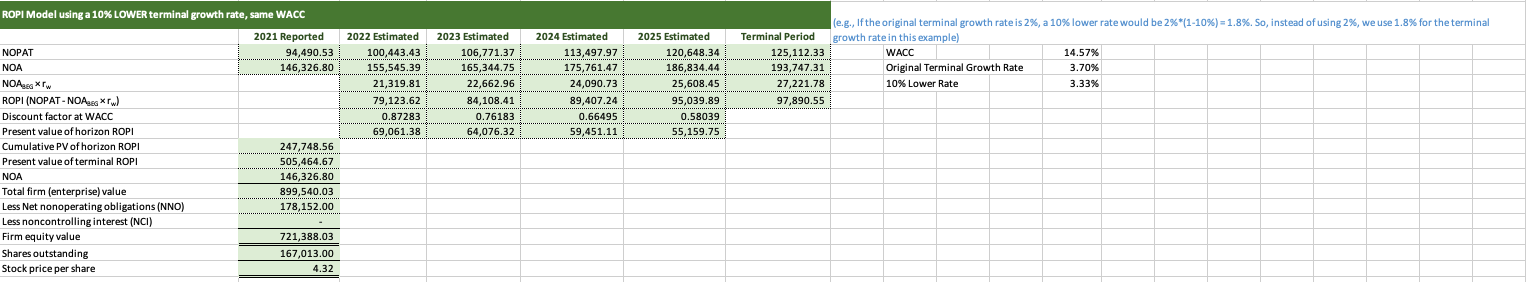

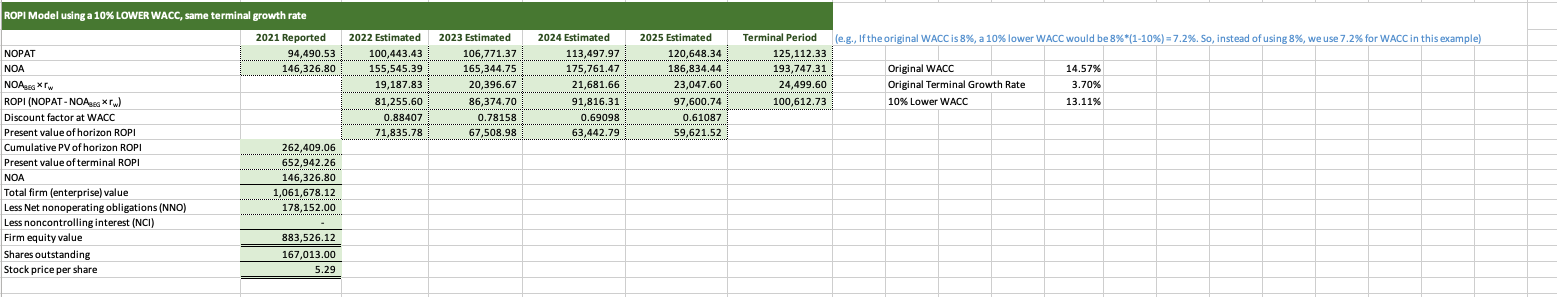

ROPI with 10% LOWER WACC, same terminal growth rate

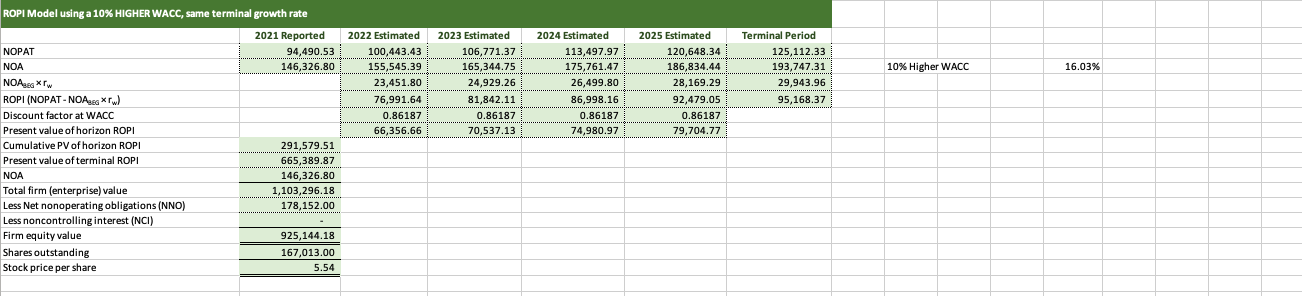

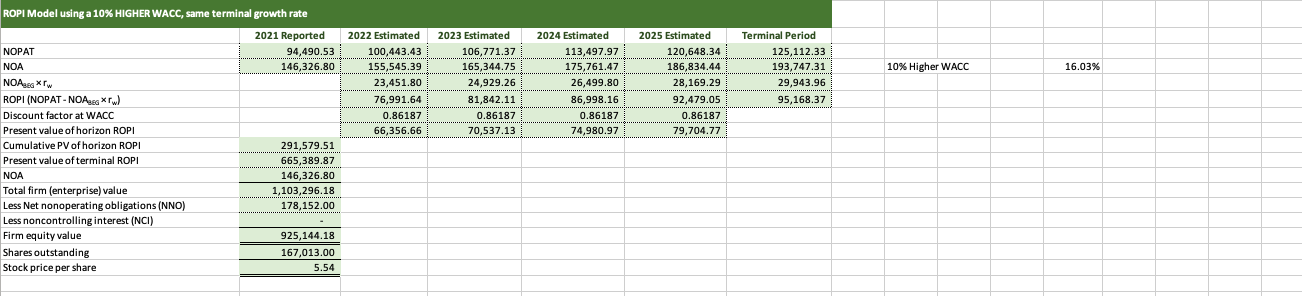

ROPI with 10% HIGHER WACC, same terminal growth rate

Let's summarize our estimated stock price above, together with the estimated stock price in the tab "ROPI." Fill in the shaded boxes in the table below. WACC 10% lower best estimate 10% higher 10% lower Terminal growth rate best estimate 10% higher Model Inputs Weighted average cost of capital (WACC) Terminal period sales growth rate 14.57% (get the WACC number from the tab "WACC") 3.7% (it's the same terminal period sales growth rate as in Part 3, tab "Forecast") Professor guidance Group Project Part 3 DCF Model NOA Increase in NOA FCFF (NOPAT - Increase in NOA) Discount factor at WACC Present value of horizon FCFF Cumulative PV of horizon FCFF Present value of terminal FCFF 2021 Reported 2022 Estimated 2023 Estimated 146,326.80 155,545.39 165,344.75 9,218.59 9,799.36 91,224.85 96,972.01 0.87283 0.76183 79,623.68 73,876.21 285,639,41 631,105.95 WACC % - Terminal Period 2024 Estimated 175,761.47 10,416.72 103,081.25 0.66495 68,543.60 Terminal Period (change the years accordingly if your company's most recent year is not 2021) 193,747.31 (copy the NOAs from the tab "Forecast;" estimate the "terminal period NOA" using the growth model) 6,912.87 118,199.45 2025 Estimated 186,834.44 11,072.97 109,575.37 0.58039 63,595.92 10.87% Total firm (enterprise) value Less Net nonoperating obligations (NNO) Less noncontrolling interest (NCI) ) 916,745.35 178,152.00 (NNO = Nonoperating liabilities - nonoperating assets; see textbook p. 3-11) Didn't see anything in 10-K Firm equity value Shares outstanding Stock price per share 738,593.35 167,013.0 From 10-K earnings per share $4.42. From 10-K earnings per share-rounded Stock price on the day when the most recent 10-K was released $5.67 Was this company's stock under-or overvalued? Overvalued Our analysis above was based primarily on historical data from financial statements. What additional information would we like to have to refine our opinion? Is this missing information critical to our opinion? Notes 2021 Reported 94,490.53 2022 Estimated 100,443.43 2023 Estimated 106,771.37 2024 Estimated 113,497.97 2025 Estimated Terminal period 120,648.34 125, 112.33 NOPAT from Part 3 Present value of horizon FCFF Formula 1/(1+WACC %)^No. of Year Present value of terminal FCFF Formula {(FCFF Terminal Period /( WACC % - Terminal Growth Rate))*2025 PV Rate NNO Non-op liabilities Non-current liabilities total 287,912 Non-op assets Cash and cash equivalents Marketable securities Total right of use assets 39,789 59,023 10,948 109,760 NNO 178,152 Firm equity value formula total firm value - NNO- NCI Model Inputs Weighted average cost of capital (WACC) Terminal period sales growth rate 14.57% (get the WACC number from the tab "WACC"in Part 3 of the ongoing project) 3.7% (it's the same terminal period sales growth rate as in Part 3, tab "Forecast") ROPI Model 2021 Reported 94,490.53 146,326.80 2022 Estimated 100,443.43 155,545.39 21,319.81 79.123.62 0.87283 69,061.38 NOPAT NOA NOAEG ROPI (NOPAT-NOA XW) Discount factor at WACC Present value of horizon ROPI Cumulative PV of horizon ROPI Present value of terminal ROPI NOA 2023 Estimated 106,771.37 165,344.75 22,662.96 84,108.41 0.76183 2024 Estimated 113,497.97 175,761.47 24,090.73 89,407.24 0.66495 59,451.11 2025 Estimated 120,648.34 186,834.44 25,608.45 95,039.89 0.58039 Terminal Period (change the years accordingly if your company's most recent year is not 2021) 125,112.33 (copy the NOA and NOPAT from the tab "Forecast" in Part 3 of the ongoing project; estimate 193,747.31 the "terminal period NOA" using the growth model) 27,221.78 97,890.55 64,076.32 55,159.75 247,748.56 522,670.00 146,326.80 Total firm (enterprise) value Less Net nonoperating obligations (NNO) Less noncontrolling interest (NCI) 916,745.35 178,152.00 (NNO=Nonoperating liabilities - nonoperating assets; see textbook p. 3-11) Firm equity value Shares outstanding Stock price per share 738,593.35 167,013.00 4.42 1/(1+WACC %)^No. of Year $ Stock price on the day when the most recent 10-K was released $5.67 Was this company's stock under-or overvalued? ? Overvalued 2022 Estimated 100,443.43 155,545.39 21,319.81 79.123.62 0.87283 69,061.38 2023 Estimated 106,771.37 165,344.75 22,662.96 84,108.41 0.76183 64,076.32 2024 Estimated 113,497.97 175,761.47 24,090.73 89,407.24 0.66495 59,451.11 2025 Estimated 120,648.34 186,834.44 25.608,45 95.039.89 0.58039 55.159.75 Terminal Period 125,112.33 193,747.31 27,221.78 97,890.55 (e.g., If the original terminal growth rate is 2%, a 10% lower rate would be 2%*(1-10%) = 1.8%. So, instead of using 2%, we use 1.8% for the terminal growth rate in this example) WACC 14.57% Original Terminal Growth Rate 3.70% 10% Lower Rate 3.33% ROPI Model using a 10% LOWER terminal growth rate, same WACC 2021 Reported NOPAT 94,490.53 NOA 146.326.80 NOAEG TW ROPI (NOPAT - NOAEG Xrul Discount factor at WACC Present value of horizon ROPI Cumulative PV of horizon ROPI 247,748.56 Present value of terminal ROPI 505,464.67 NOA 146,326.80 Total firm (enterprise) value 899,540.03 Less Net nonoperating obligations (NNO) 178,152.00 Less noncontrolling interest (NCI) Firm equity value 721,388.03 Shares outstanding 167,013.00 Stock price per share 4.32 2022 Estimated 100,443.43 155,545.39 21,319.81 79,123.62 0.87283 69,061.38 2023 Estimated 106,771.37 165,344.75 22,662.96 84,108.41 0.76183 64,076.32 2024 Estimated 113,497.97 175,761.47 24.090.73 89,407.24 0.66495 59,451.11 2025 Estimated 120,648.34 186,834,44 25,608.45 95,039.89 0.58039 55,159.75 Terminal Period 125,112.33 193,747.31 27,221.78 97,890.55 10% Higher Rate 4.07% ROPI Model using a 10% HIGHER terminal growth rate, same WACC 2021 Reported NOPAT 94,490.53 NOA 146,326.80 NOAEG * ROPI (NOPAT-NOA3 * Discount factor at WACC Present value of horizon ROPI Cumulative PV of horizon ROPI 247,748.56 Present value of terminal ROPI 541,087.89 NOA 146.326.80 Total firm (enterprise) value 935,163.25 Less Net nonoperating obligations (NNO) 178,152.00 Less noncontrolling interest (NCI) Firm equity value 757,011.25 Shares outstanding 167,013.00 Stock price per share 4.53 (e.g., If the original WACC is 8%, a 10% lower WACC would be 8%*(1-10%) = 7.2%. So, instead of using 8%, we use 7.2% for WACC in this example) 2022 Estimated 100,443.43 155,545.39 19,187.83 81,255.60 0.88407 71,835.78 2023 Estimated 106,771.37 165,344.75 20,396.67 86,374.70 0.78158 67,508.98 2024 Estimated 113,497.97 175,761.47 21,681.66 91,816.31 0.69098 63,442.79 2025 Estimated 120,648.34 186,834.44 23,047.60 97,600.74 0.61087 59,621.52 Terminal Period 125,112.33 193,747.31 24,499.60 Original WACC Original Terminal Growth Rate 10% Lower WACC 14.57% 3.70% 100,612.73 13.11% ROPI Model using a 10% LOWER WACC, same terminal growth rate 2021 Reported NOPAT 94,490.53 NOA 146,326.80 NOA, ROPI (NOPAT-NOA rul Discount factor at WACC Present value of horizon ROPI Cumulative PV of horizon ROPI 262,409.06 Present value of terminal ROPI 652,942.26 NOA 146,326.80 Total firm (enterprise) value 1,061,678.12 Less Net nonoperating obligations (NNO) 178,152.00 Less noncontrolling interest (NCI) Firm equity value 883,526.12 Shares outstanding 167,013.00 Stock price per share 5.29 I 10% Higher WACC 2022 Estimated 100,443.43 155,545.39 23,451.80 76,991.64 0.86187 66,356.66 16.03% 2023 Estimated 106,771.37 165,344.75 24,929.26 81,842.11 0.86187 70,537.13 2024 Estimated 113,497.97 175,761.47 26,499.80 86,998.16 0.86187 74,980.97 Terminal Period 125,112.33 193,747.31 29,943.96 95,168.37 2025 Estimated 120,648.34 186,834.44 28.169.29 92.479.05 0.86187 79,704.77 ROPI Model using a 10% HIGHER WACC, same terminal growth rate 2021 Reported NOPAT 94,490.53 NOA 146,326.80 NOA, ROPI (NOPAT - NOAEG * Discount factor at WACC Present value of horizon ROPI Cumulative PV of horizon ROPI 291,579.51 Present value of terminal ROPI 665,389.87 NOA 146,326.80 Total firm (enterprise) value 1,103,296.18 Less Net nonoperating obligations (NNO) 178,152.00 Less noncontrolling interest (NCI) Firm equity value 925,144.18 Shares outstanding 167,013.00 Stock price per share 5.54 Let's summarize our estimated stock price above, together with the estimated stock price in the tab "ROPI." Fill in the shaded boxes in the table below. WACC 10% lower best estimate 10% higher 10% lower Terminal growth rate best estimate 10% higher Model Inputs Weighted average cost of capital (WACC) Terminal period sales growth rate 14.57% (get the WACC number from the tab "WACC") 3.7% (it's the same terminal period sales growth rate as in Part 3, tab "Forecast") Professor guidance Group Project Part 3 DCF Model NOA Increase in NOA FCFF (NOPAT - Increase in NOA) Discount factor at WACC Present value of horizon FCFF Cumulative PV of horizon FCFF Present value of terminal FCFF 2021 Reported 2022 Estimated 2023 Estimated 146,326.80 155,545.39 165,344.75 9,218.59 9,799.36 91,224.85 96,972.01 0.87283 0.76183 79,623.68 73,876.21 285,639,41 631,105.95 WACC % - Terminal Period 2024 Estimated 175,761.47 10,416.72 103,081.25 0.66495 68,543.60 Terminal Period (change the years accordingly if your company's most recent year is not 2021) 193,747.31 (copy the NOAs from the tab "Forecast;" estimate the "terminal period NOA" using the growth model) 6,912.87 118,199.45 2025 Estimated 186,834.44 11,072.97 109,575.37 0.58039 63,595.92 10.87% Total firm (enterprise) value Less Net nonoperating obligations (NNO) Less noncontrolling interest (NCI) ) 916,745.35 178,152.00 (NNO = Nonoperating liabilities - nonoperating assets; see textbook p. 3-11) Didn't see anything in 10-K Firm equity value Shares outstanding Stock price per share 738,593.35 167,013.0 From 10-K earnings per share $4.42. From 10-K earnings per share-rounded Stock price on the day when the most recent 10-K was released $5.67 Was this company's stock under-or overvalued? Overvalued Our analysis above was based primarily on historical data from financial statements. What additional information would we like to have to refine our opinion? Is this missing information critical to our opinion? Notes 2021 Reported 94,490.53 2022 Estimated 100,443.43 2023 Estimated 106,771.37 2024 Estimated 113,497.97 2025 Estimated Terminal period 120,648.34 125, 112.33 NOPAT from Part 3 Present value of horizon FCFF Formula 1/(1+WACC %)^No. of Year Present value of terminal FCFF Formula {(FCFF Terminal Period /( WACC % - Terminal Growth Rate))*2025 PV Rate NNO Non-op liabilities Non-current liabilities total 287,912 Non-op assets Cash and cash equivalents Marketable securities Total right of use assets 39,789 59,023 10,948 109,760 NNO 178,152 Firm equity value formula total firm value - NNO- NCI Model Inputs Weighted average cost of capital (WACC) Terminal period sales growth rate 14.57% (get the WACC number from the tab "WACC"in Part 3 of the ongoing project) 3.7% (it's the same terminal period sales growth rate as in Part 3, tab "Forecast") ROPI Model 2021 Reported 94,490.53 146,326.80 2022 Estimated 100,443.43 155,545.39 21,319.81 79.123.62 0.87283 69,061.38 NOPAT NOA NOAEG ROPI (NOPAT-NOA XW) Discount factor at WACC Present value of horizon ROPI Cumulative PV of horizon ROPI Present value of terminal ROPI NOA 2023 Estimated 106,771.37 165,344.75 22,662.96 84,108.41 0.76183 2024 Estimated 113,497.97 175,761.47 24,090.73 89,407.24 0.66495 59,451.11 2025 Estimated 120,648.34 186,834.44 25,608.45 95,039.89 0.58039 Terminal Period (change the years accordingly if your company's most recent year is not 2021) 125,112.33 (copy the NOA and NOPAT from the tab "Forecast" in Part 3 of the ongoing project; estimate 193,747.31 the "terminal period NOA" using the growth model) 27,221.78 97,890.55 64,076.32 55,159.75 247,748.56 522,670.00 146,326.80 Total firm (enterprise) value Less Net nonoperating obligations (NNO) Less noncontrolling interest (NCI) 916,745.35 178,152.00 (NNO=Nonoperating liabilities - nonoperating assets; see textbook p. 3-11) Firm equity value Shares outstanding Stock price per share 738,593.35 167,013.00 4.42 1/(1+WACC %)^No. of Year $ Stock price on the day when the most recent 10-K was released $5.67 Was this company's stock under-or overvalued? ? Overvalued 2022 Estimated 100,443.43 155,545.39 21,319.81 79.123.62 0.87283 69,061.38 2023 Estimated 106,771.37 165,344.75 22,662.96 84,108.41 0.76183 64,076.32 2024 Estimated 113,497.97 175,761.47 24,090.73 89,407.24 0.66495 59,451.11 2025 Estimated 120,648.34 186,834.44 25.608,45 95.039.89 0.58039 55.159.75 Terminal Period 125,112.33 193,747.31 27,221.78 97,890.55 (e.g., If the original terminal growth rate is 2%, a 10% lower rate would be 2%*(1-10%) = 1.8%. So, instead of using 2%, we use 1.8% for the terminal growth rate in this example) WACC 14.57% Original Terminal Growth Rate 3.70% 10% Lower Rate 3.33% ROPI Model using a 10% LOWER terminal growth rate, same WACC 2021 Reported NOPAT 94,490.53 NOA 146.326.80 NOAEG TW ROPI (NOPAT - NOAEG Xrul Discount factor at WACC Present value of horizon ROPI Cumulative PV of horizon ROPI 247,748.56 Present value of terminal ROPI 505,464.67 NOA 146,326.80 Total firm (enterprise) value 899,540.03 Less Net nonoperating obligations (NNO) 178,152.00 Less noncontrolling interest (NCI) Firm equity value 721,388.03 Shares outstanding 167,013.00 Stock price per share 4.32 2022 Estimated 100,443.43 155,545.39 21,319.81 79,123.62 0.87283 69,061.38 2023 Estimated 106,771.37 165,344.75 22,662.96 84,108.41 0.76183 64,076.32 2024 Estimated 113,497.97 175,761.47 24.090.73 89,407.24 0.66495 59,451.11 2025 Estimated 120,648.34 186,834,44 25,608.45 95,039.89 0.58039 55,159.75 Terminal Period 125,112.33 193,747.31 27,221.78 97,890.55 10% Higher Rate 4.07% ROPI Model using a 10% HIGHER terminal growth rate, same WACC 2021 Reported NOPAT 94,490.53 NOA 146,326.80 NOAEG * ROPI (NOPAT-NOA3 * Discount factor at WACC Present value of horizon ROPI Cumulative PV of horizon ROPI 247,748.56 Present value of terminal ROPI 541,087.89 NOA 146.326.80 Total firm (enterprise) value 935,163.25 Less Net nonoperating obligations (NNO) 178,152.00 Less noncontrolling interest (NCI) Firm equity value 757,011.25 Shares outstanding 167,013.00 Stock price per share 4.53 (e.g., If the original WACC is 8%, a 10% lower WACC would be 8%*(1-10%) = 7.2%. So, instead of using 8%, we use 7.2% for WACC in this example) 2022 Estimated 100,443.43 155,545.39 19,187.83 81,255.60 0.88407 71,835.78 2023 Estimated 106,771.37 165,344.75 20,396.67 86,374.70 0.78158 67,508.98 2024 Estimated 113,497.97 175,761.47 21,681.66 91,816.31 0.69098 63,442.79 2025 Estimated 120,648.34 186,834.44 23,047.60 97,600.74 0.61087 59,621.52 Terminal Period 125,112.33 193,747.31 24,499.60 Original WACC Original Terminal Growth Rate 10% Lower WACC 14.57% 3.70% 100,612.73 13.11% ROPI Model using a 10% LOWER WACC, same terminal growth rate 2021 Reported NOPAT 94,490.53 NOA 146,326.80 NOA, ROPI (NOPAT-NOA rul Discount factor at WACC Present value of horizon ROPI Cumulative PV of horizon ROPI 262,409.06 Present value of terminal ROPI 652,942.26 NOA 146,326.80 Total firm (enterprise) value 1,061,678.12 Less Net nonoperating obligations (NNO) 178,152.00 Less noncontrolling interest (NCI) Firm equity value 883,526.12 Shares outstanding 167,013.00 Stock price per share 5.29 I 10% Higher WACC 2022 Estimated 100,443.43 155,545.39 23,451.80 76,991.64 0.86187 66,356.66 16.03% 2023 Estimated 106,771.37 165,344.75 24,929.26 81,842.11 0.86187 70,537.13 2024 Estimated 113,497.97 175,761.47 26,499.80 86,998.16 0.86187 74,980.97 Terminal Period 125,112.33 193,747.31 29,943.96 95,168.37 2025 Estimated 120,648.34 186,834.44 28.169.29 92.479.05 0.86187 79,704.77 ROPI Model using a 10% HIGHER WACC, same terminal growth rate 2021 Reported NOPAT 94,490.53 NOA 146,326.80 NOA, ROPI (NOPAT - NOAEG * Discount factor at WACC Present value of horizon ROPI Cumulative PV of horizon ROPI 291,579.51 Present value of terminal ROPI 665,389.87 NOA 146,326.80 Total firm (enterprise) value 1,103,296.18 Less Net nonoperating obligations (NNO) 178,152.00 Less noncontrolling interest (NCI) Firm equity value 925,144.18 Shares outstanding 167,013.00 Stock price per share 5.54