Answered step by step

Verified Expert Solution

Question

1 Approved Answer

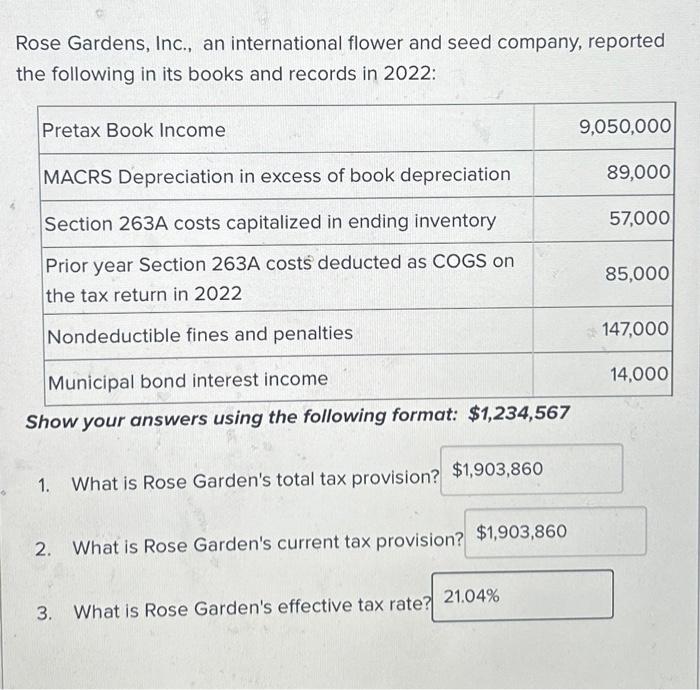

Rose Gardens, Inc., an international flower and seed company, reported the following in its books and records in 2022: Pretax Book Income MACRS Depreciation in

Rose Gardens, Inc., an international flower and seed company, reported the following in its books and records in 2022: Pretax Book Income MACRS Depreciation in excess of book depreciation Section 263A costs capitalized in ending inventory Prior year Section 263A costs deducted as COGS on the tax return in 2022 Nondeductible fines and penalties Municipal bond interest income Show your answers using the following format: $1,234,567 1. 2. 3. What is Rose Garden's total tax provision? $1,903,860 What is Rose Garden's current tax provision? $1,903,860 What is Rose Garden's effective tax rate? 21.04% 9,050,000 89,000 57,000 85,000 147,000 14,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started