Ross Electronics has one product in its ending inventory. Per unit data consist of the following: cost, $35; replacement cost, $33; selling price, $45;

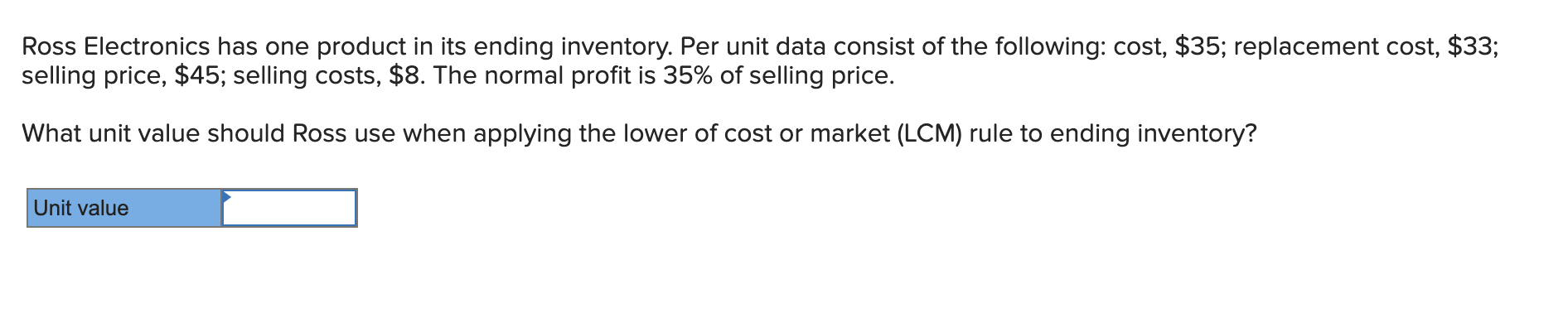

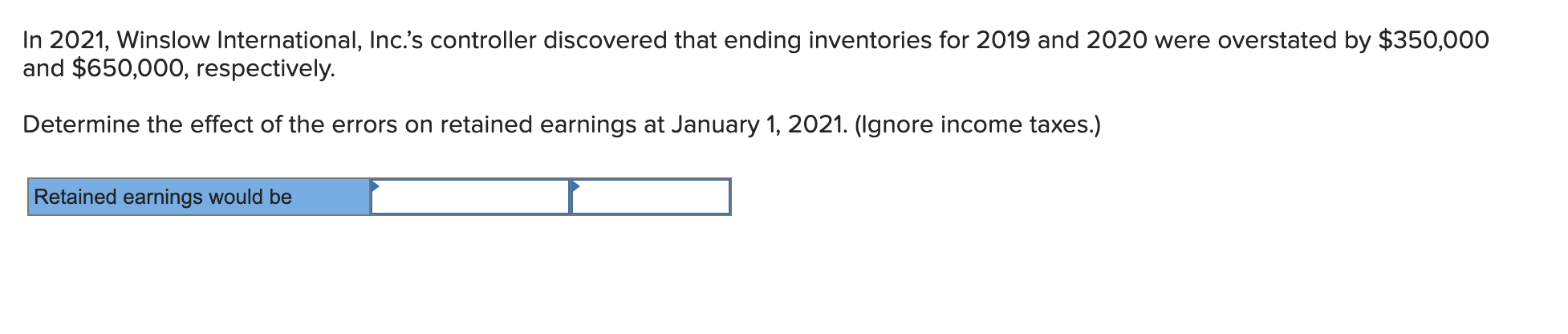

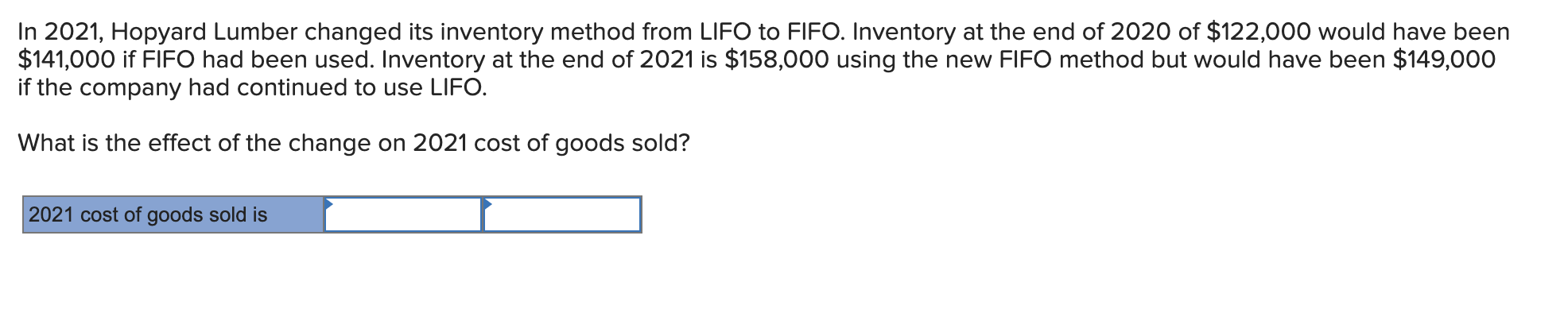

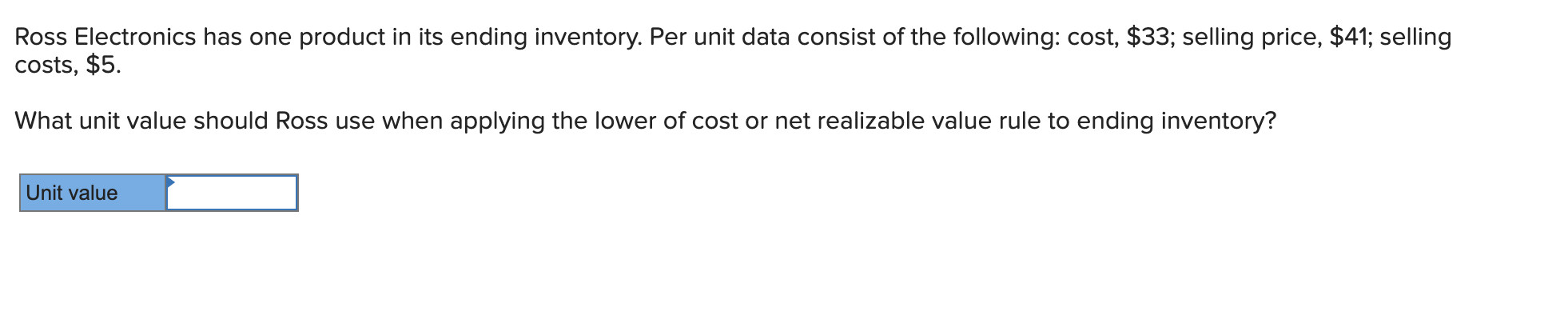

Ross Electronics has one product in its ending inventory. Per unit data consist of the following: cost, $35; replacement cost, $33; selling price, $45; selling costs, $8. The normal profit is 35% of selling price. What unit value should Ross use when applying the lower of cost or market (LCM) rule to ending inventory? Unit value In 2021, Winslow International, Inc.'s controller discovered that ending inventories for 2019 and 2020 were overstated by $350,000 and $650,000, respectively. Determine the effect of the errors on retained earnings at January 1, 2021. (Ignore income taxes.) Retained earnings would be In 2021, Hopyard Lumber changed its inventory method from LIFO to FIFO. Inventory at the end of 2020 of $122,000 would have been $141,000 if FIFO had been used. Inventory at the end of 2021 is $158,000 using the new FIFO method but would have been $149,000 if the company had continued to use LIFO. What is the effect of the change on 2021 cost of goods sold? 2021 cost of goods sold is Ross Electronics has one product in its ending inventory. Per unit data consist of the following: cost, $33; selling price, $41; selling costs, $5. What unit value should Ross use when applying the lower of cost or net realizable value rule to ending inventory? Unit value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The unit value that Ross should use when applying the lower of cost or net reali...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started