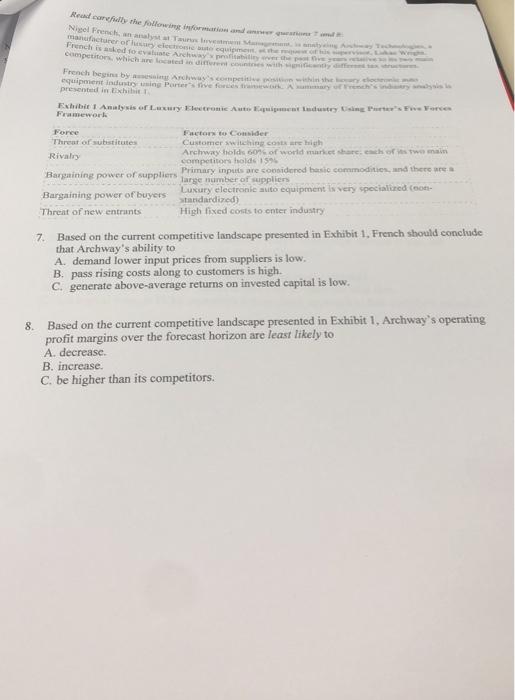

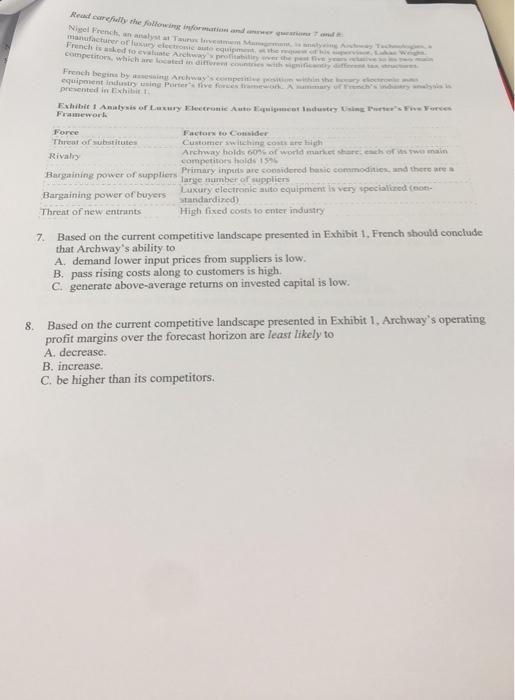

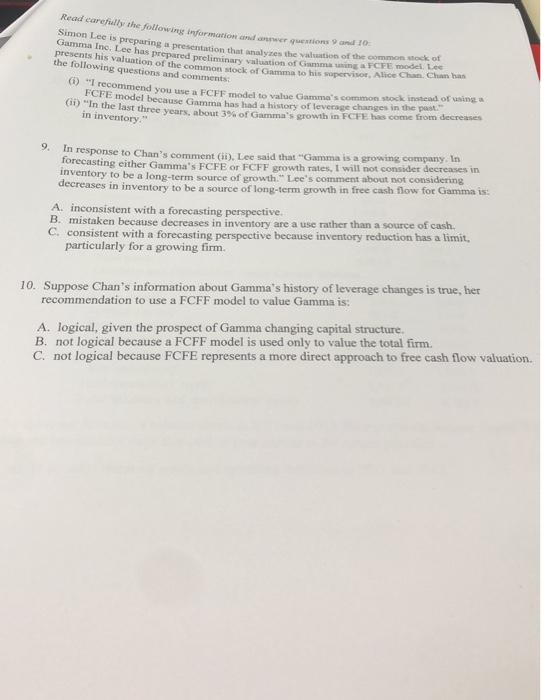

Round cardly the following information and Tamil Nigel French an analyser manufacturer of lechonete equipment French isked to evalume Archway pry competitors, which are located in any French begin by Aeg Archy's compete with the equipment industry using Parts ve for A presented in Exhibiti Exhibe Analysis of Luxury Electronic Autostry sings Forces Fewoche Force Factor to consider Threat of substitutes Customer switching control Archway holds 60% of world market share each of two main Rivalry competitors holde 15 Bargaining power of suppliers Primary inputs are considered basic commodities, and there are large number of suppliers Luxury electronie sto equipment is very specialized (con Bargaining power of buyers Standardized) Threat of new entrants High fixed costs to enter industry 7. Based on the current competitive landscape presented in Exhibit 1. French should conclude that Archway's ability to A. demand lower input prices from suppliers is low. B. pass rising costs along to customers is high C. generate above-average returns on invested capital is low. 8. Based on the current competitive landscape presented in Exhibit 1. Archway's operating profit margins over the forecast horizon are least likely to A. decrease B. increase C. be higher than its competitors. Round carefully the following information and one of Nigel French, an analysis. manufacturer of electrone equipe French is asked to everyone competitors which are located in French begin byg Archways open the equipment industry wing Porter rive foretre presented in Exhibit Exhibit Analysis of Luxury Electronic Autocol industry is worces Framework Force Factors to consider Threar of substitutes Customer switching costs are both Archway holds 60% of world market share each of two main Rivalry competitors holds 15 Bargaining power of suppliers Primary inputs are considered basic commodities, and there are large number of suppliers Bargaining power of buyers Luxury electronie auto equipment is very specialized (con Standardized) Threat of new entrants High fixed costs to enter industry 7. Based on the current competitive landscape presented in Exhibit 1. French should conclude that Archway's ability to A. demand lower input prices from suppliers is low. B. pass rising costs along to customers is high. C. generate above-average returns on invested capital is low. 8. Based on the current competitive landscape presented in Exhibit 1. Archway's operating profit margins over the forecast horizon are least likely to A. decrease B. increase C. be higher than its competitors. Read carefully the following information and answer questions com 10 Simon Lee is preparing a presentation that analyzes the valuation of the common the following questions and comments: presents his valuation of the common stock of Gamma to his supervisor, Alice Chan Chanban 0 "I recommend you use a FCFF model to value Garoma's common stock instead of using a FCFE model because Gamma has had a history of leverage changes in the past." GD "In the last three years, about 3 Or Garhinese Within Fateh come from decreases in inventory 9. In response to Chan's comment (ID). Lee said that "Gamma is a growing company. In forecasting either Gamma's FCFE or FCFF growth rates, I will not consider decreases in inventory to be a long-term source of growth. Lee's comment about not considering decreases in inventory to be a source of long-term growth in free cash flow for Gamma is: A. inconsistent with a forecasting perspective. B. mistaken because decreases in inventory are a use rather than a source of cash. C. consistent with a forecasting perspective because inventory reduction has a limit. particularly for a growing firm. 10. Suppose Chan's information about Gamma's history of leverage changes is true, her recommendation to use a FCFF model to value Gamma is: A. logical, given the prospect of Gamma changing capital structure. B. not logical because a FCFF model is used only to value the total firm. C. not logical because FCFE represents a more direct approach to free cash flow valuation