Answered step by step

Verified Expert Solution

Question

1 Approved Answer

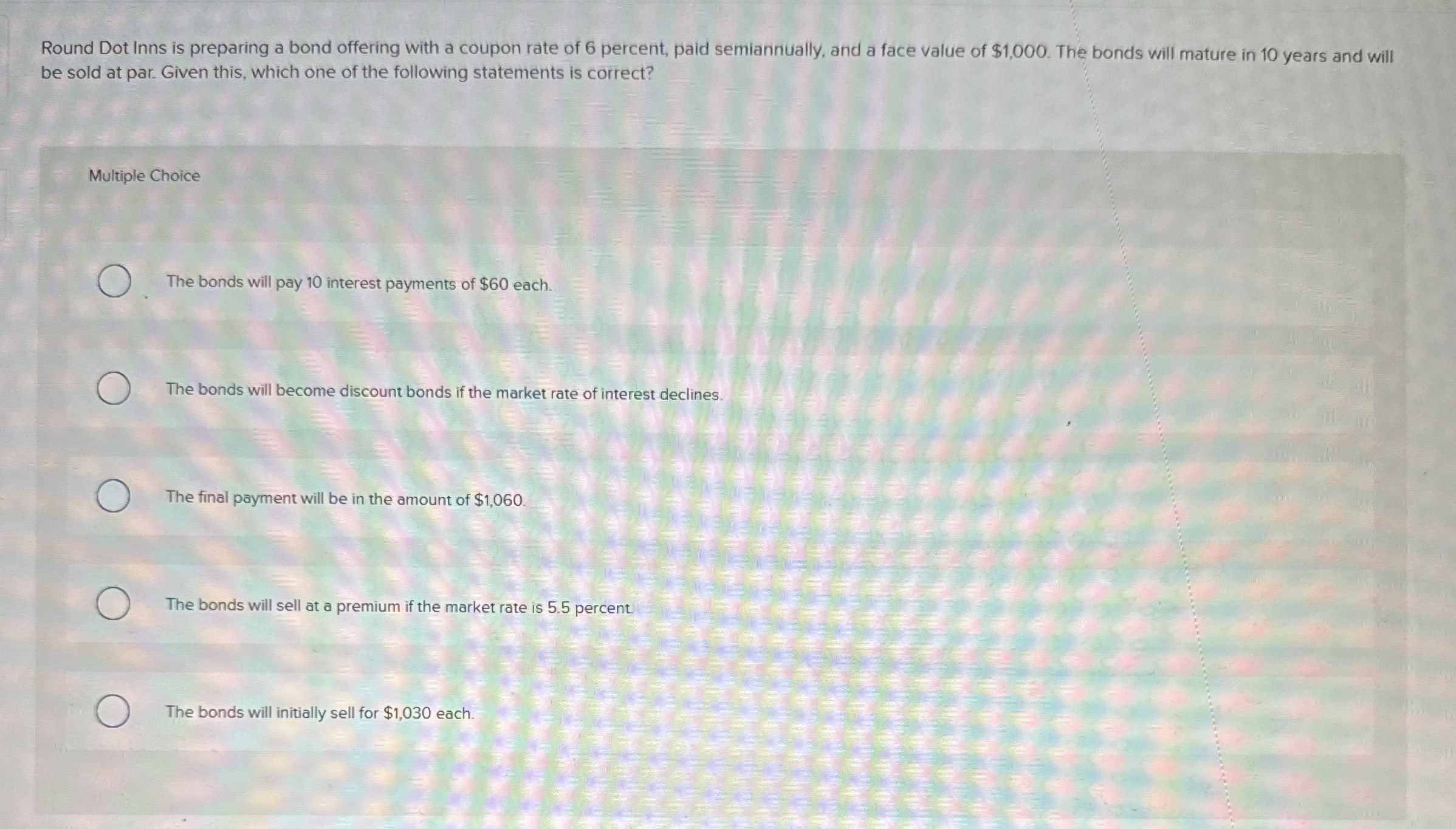

Round Dot Inns is preparing a bond offering with a coupon rate of 6 percent, paid semiannually, and a face value of $ 1 ,

Round Dot Inns is preparing a bond offering with a coupon rate of percent, paid semiannually, and a face value of $ The bonds will mature in years and will

be sold at par. Given this, which one of the following statements is correct?

Multiple Choice

The bonds will pay interest payments of $ each.

The bonds will become discount bonds if the market rate of interest declines.

The final payment will be in the amount of $

The bonds will sell at a premium if the market rate is percent.

The bonds will initially sell for $ each.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started