Answered step by step

Verified Expert Solution

Question

1 Approved Answer

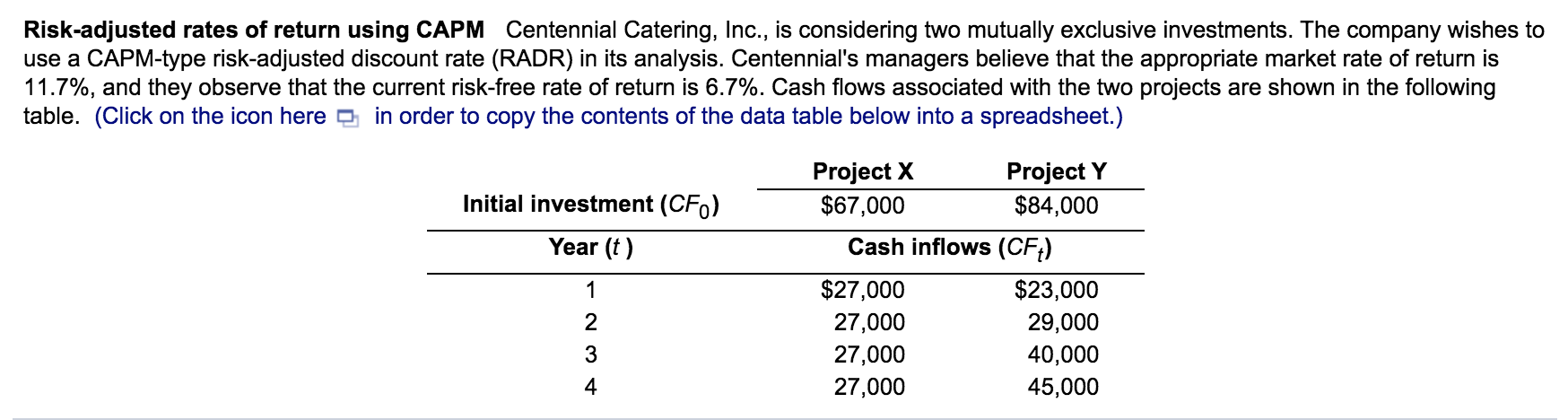

(*Round to two decimals*) Risk-adjusted rates of return using CAPM Centennial Catering, Inc., is considering two mutually exclusive investments. The company wishes to use a

(*Round to two decimals*)

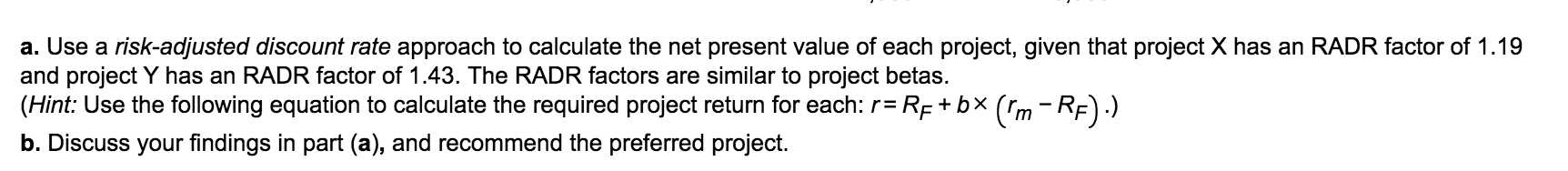

Risk-adjusted rates of return using CAPM Centennial Catering, Inc., is considering two mutually exclusive investments. The company wishes to use a CAPM-type risk-adjusted discount rate (RADR) in its analysis. Centennial's managers believe that the appropriate market rate of return is 11.7%, and they observe that the current risk-free rate of return is 6.7%. Cash flows associated with the two projects are shown in the following table. (Click on the icon here e in order to copy the contents of the data table below into a spreadsheet.) Initial investment (CFO) Year (t) Project X Project Y $67,000 $84,000 Cash inflows (CF) AWN $27,000 27,000 27,000 27,000 $23,000 29,000 40,000 45,000 a. Use a risk-adjusted discount rate approach to calculate the net present value of each project, given that project X has an RADR factor of 1.19 and project Y has an RADR factor of 1.43. The RADR factors are similar to project betas. (Hint: Use the following equation to calculate the required project return for each: r=RE + bx (rm -RE).) b. Discuss your findings in part (a), and recommend the preferred projectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started