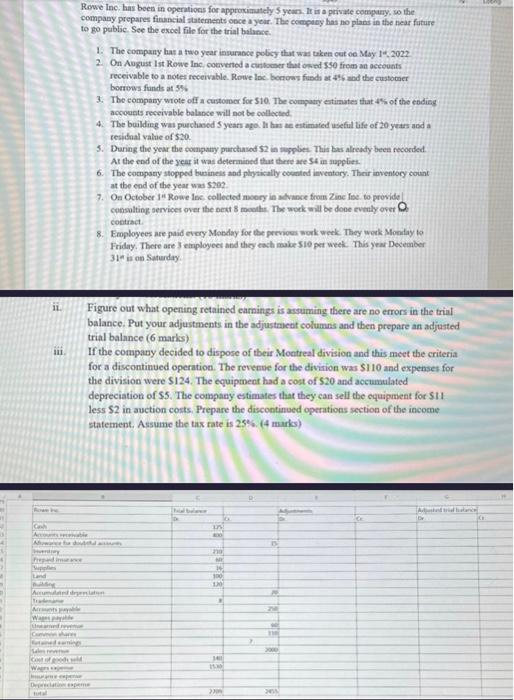

Rowe Inc, has been in operations for approximutely 5 year, It in a private compatyy, so the company prepares financial atatements once a yeur. The cenpesy has no plans in the near future to go public. See the excel file for the trial balanse. 1. The company has a two year insurance policy that wat taken cet oe May It: 2022 2. On August Ist Rowe Inc, coevented a castooner that owed 550 from an aceounts receivable to a notes receivable. Roue loc, berrows fundi at 446 and the customer borrows funds at 5% 3. The company wrote off a customer for 510 . The company etinutes that 4$ of the eading accounts receivable balance will not be collocted. 4. The building wat purchaned 5 years ago. In han ae estimuted useful life of 20 yeter and a tesidnal value of 520 5. During the year the company purchasod $2 in supples. This bes already been recorded At the end of the year it was determined that there ace 34 in mapplies. 6. The company stopped busineis and phytically coented inventory. Their inventory count at the end of the year was 5202 . 7. On October 14 Rowe Inc, collected moery in Mhance fram Zine foe. to provide consulting services over the bett 8 months The work wall be done rvenly over Q contract. 8. Exployees are paid every Monday for the previous work week. They work Montay to Friday. There are 3 employeer and they tach male 510 per week. This year December 31 ha on Saturdry. ii. Figure out what opening retained earnings is atsuming there are no errors in the trial balance. Put your adjustments in the adjustmeat columns and tben prepare an adjusted trial balance ( 6 mariss) iii. If the company decided to dispose of their Moatreal division and this meet the criteria for a discontinued operation. The revenve for the divition was $110 and expenset for the division were $124. The equipment had a cost of 520 and accumulated depreciation of 55 . The company estimates that they can sell the equipment for 511 less $2 in auction costs. Prepare the discontinued operations section of the income statement. Assume the tax rate is 25\%. (4 marks) Rowe Inc, has been in operations for approximutely 5 year, It in a private compatyy, so the company prepares financial atatements once a yeur. The cenpesy has no plans in the near future to go public. See the excel file for the trial balanse. 1. The company has a two year insurance policy that wat taken cet oe May It: 2022 2. On August Ist Rowe Inc, coevented a castooner that owed 550 from an aceounts receivable to a notes receivable. Roue loc, berrows fundi at 446 and the customer borrows funds at 5% 3. The company wrote off a customer for 510 . The company etinutes that 4$ of the eading accounts receivable balance will not be collocted. 4. The building wat purchaned 5 years ago. In han ae estimuted useful life of 20 yeter and a tesidnal value of 520 5. During the year the company purchasod $2 in supples. This bes already been recorded At the end of the year it was determined that there ace 34 in mapplies. 6. The company stopped busineis and phytically coented inventory. Their inventory count at the end of the year was 5202 . 7. On October 14 Rowe Inc, collected moery in Mhance fram Zine foe. to provide consulting services over the bett 8 months The work wall be done rvenly over Q contract. 8. Exployees are paid every Monday for the previous work week. They work Montay to Friday. There are 3 employeer and they tach male 510 per week. This year December 31 ha on Saturdry. ii. Figure out what opening retained earnings is atsuming there are no errors in the trial balance. Put your adjustments in the adjustmeat columns and tben prepare an adjusted trial balance ( 6 mariss) iii. If the company decided to dispose of their Moatreal division and this meet the criteria for a discontinued operation. The revenve for the divition was $110 and expenset for the division were $124. The equipment had a cost of 520 and accumulated depreciation of 55 . The company estimates that they can sell the equipment for 511 less $2 in auction costs. Prepare the discontinued operations section of the income statement. Assume the tax rate is 25\%. (4 marks)