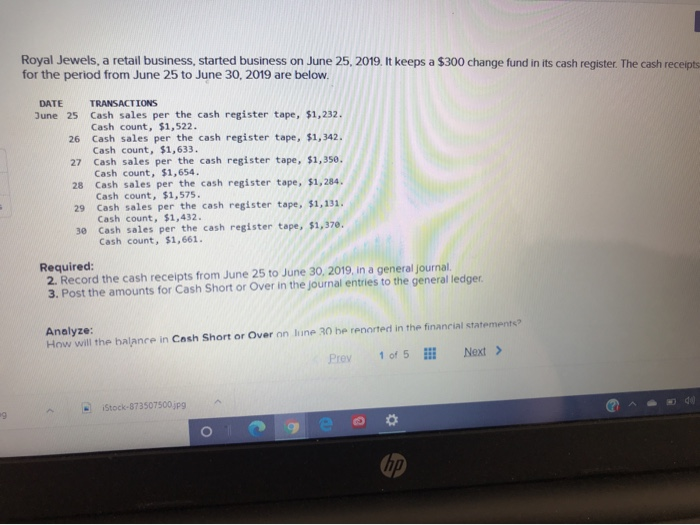

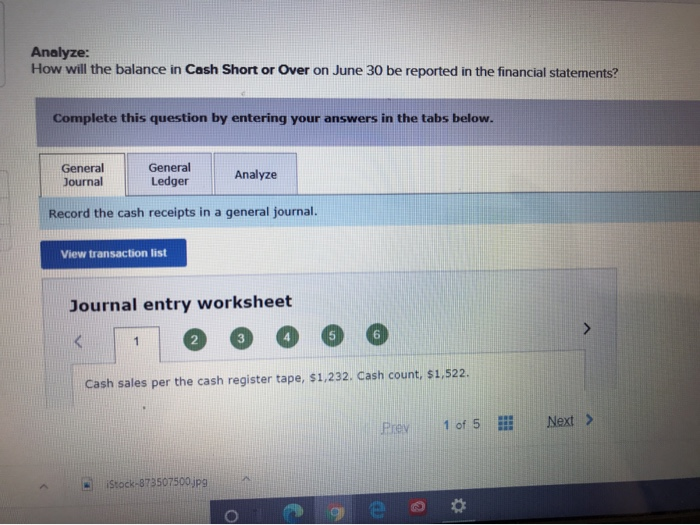

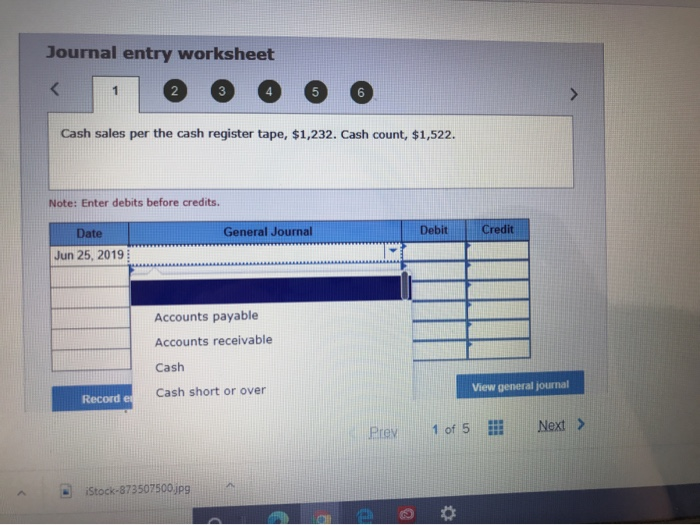

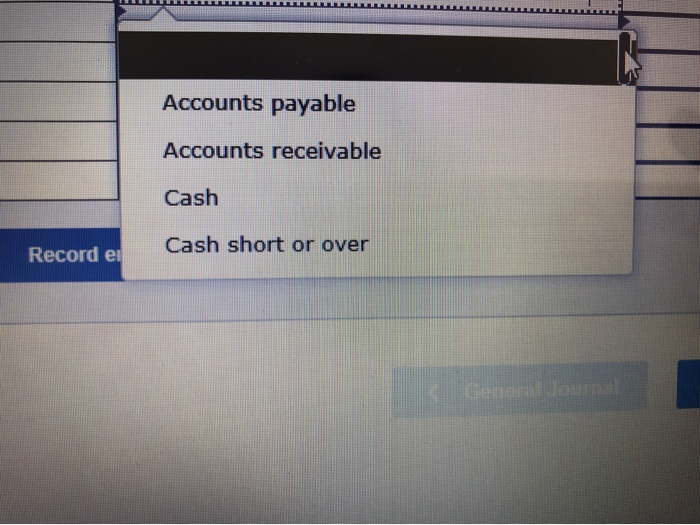

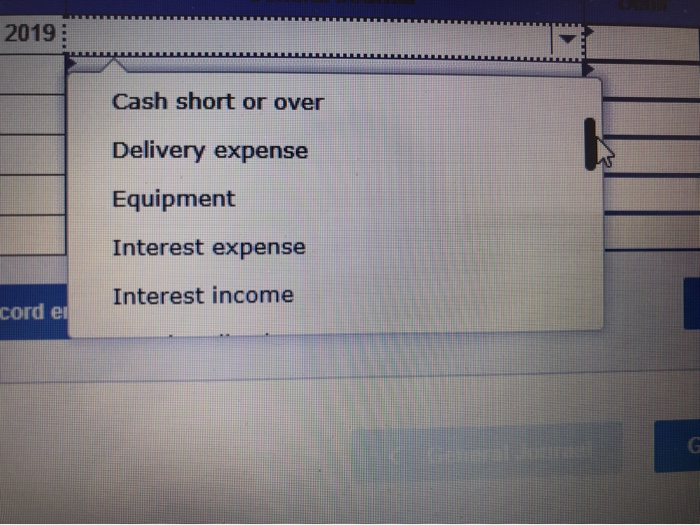

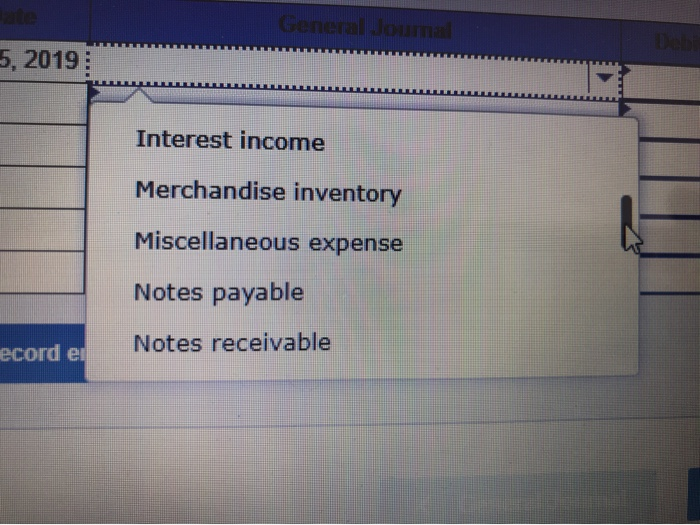

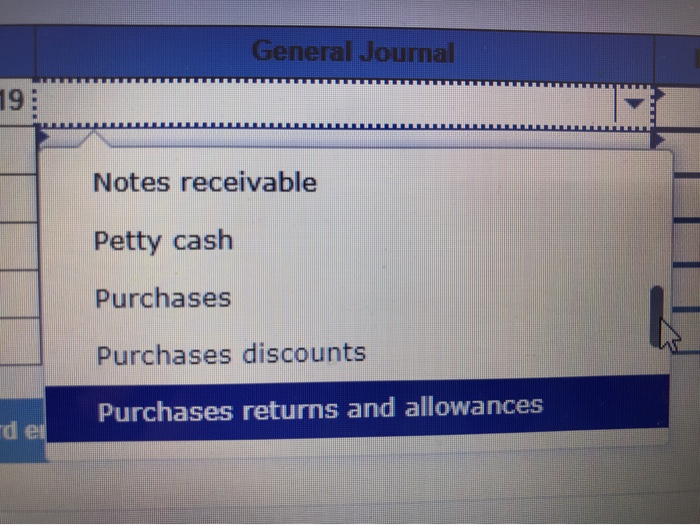

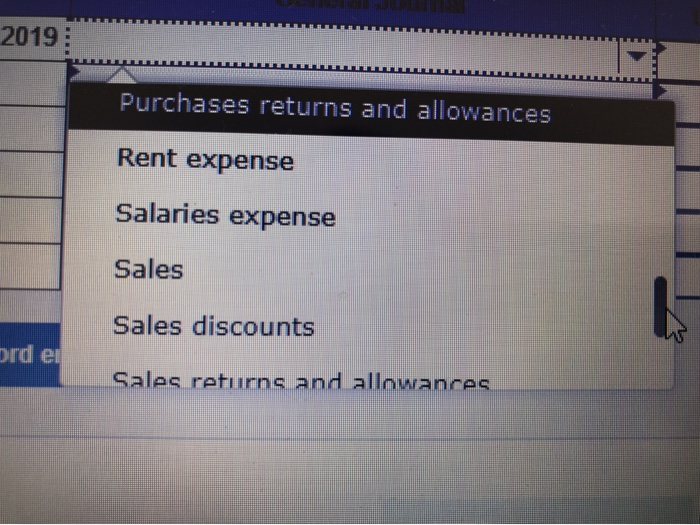

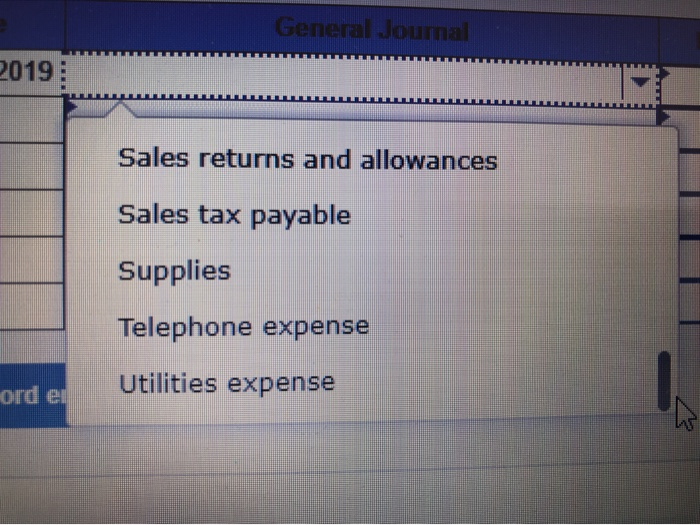

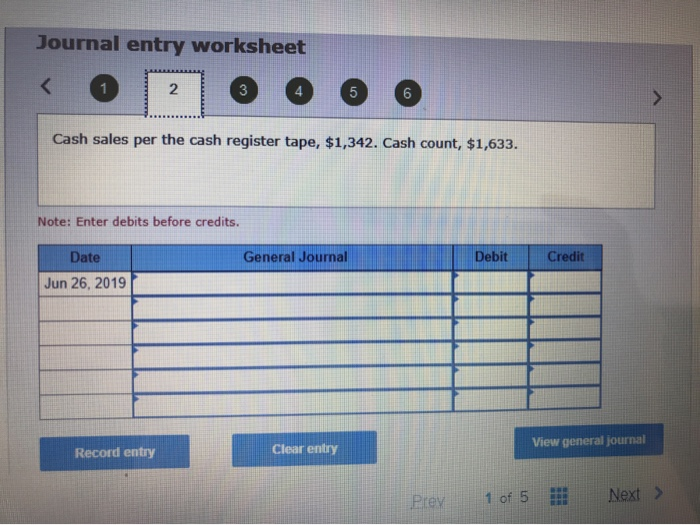

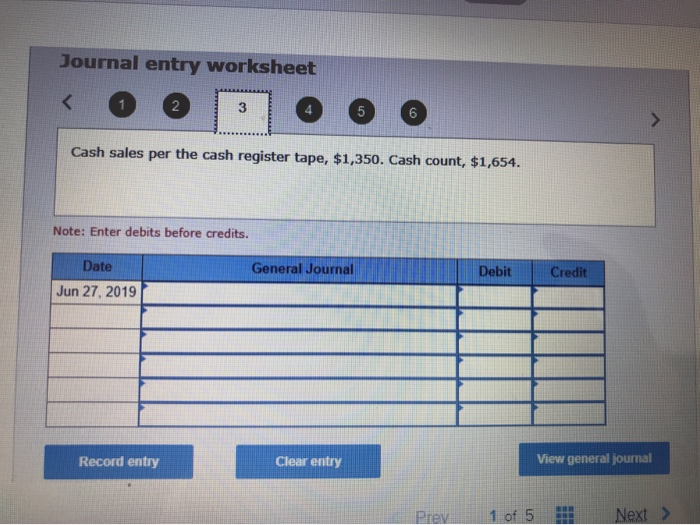

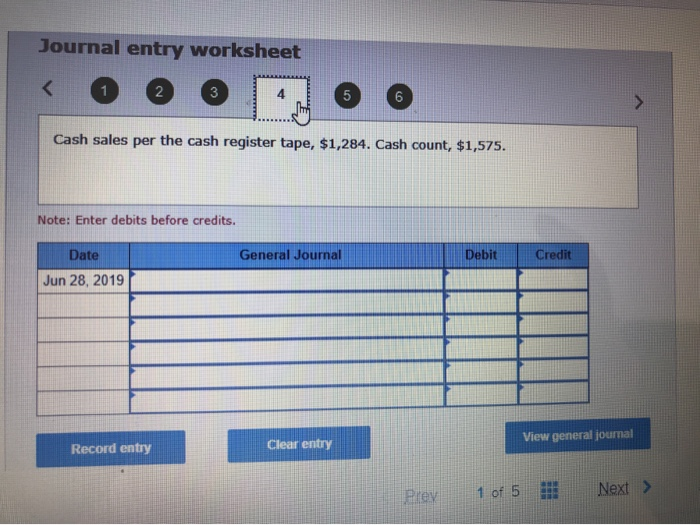

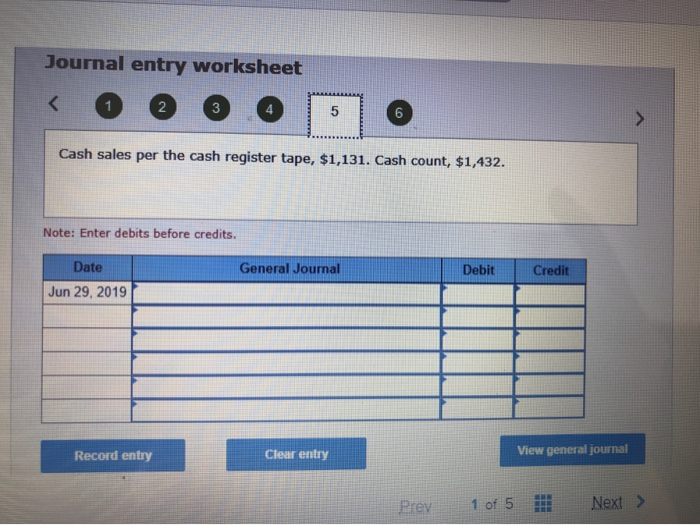

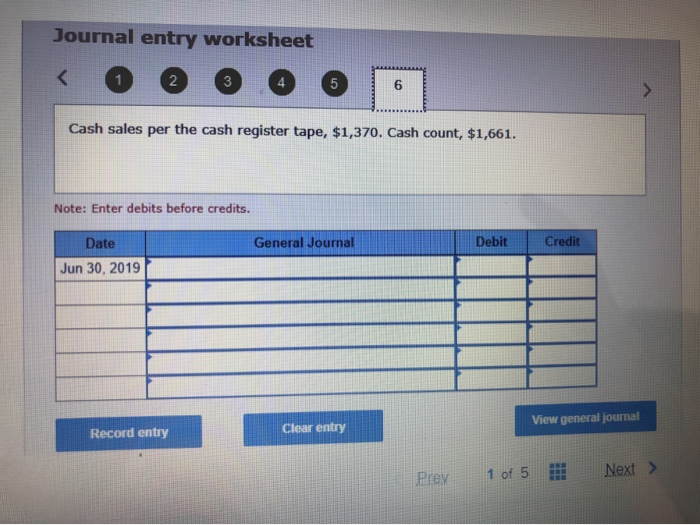

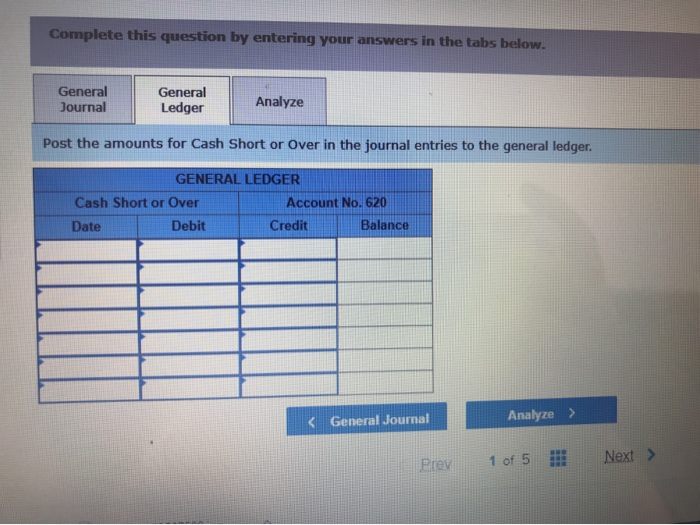

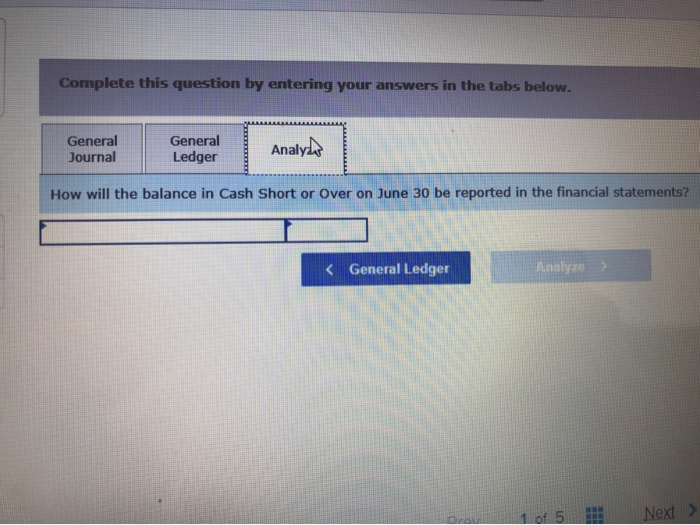

Royal Jewels, a retail business, started business on June 25, 2019. It keeps a $300 change fund in its cash register. The cash receipts for the period from June 25 to June 30, 2019 are below. DATE TRANSACTIONS June 25 Cash sales per the cash register tape, $1,232. Cash count, $1,522. 26 Cash sales per the cash register tape, $1,342. Cash count, $1,633. 27 Cash sales per the cash register tape, $1,350. Cash count, $1,654. 28 Cash sales per the cash register tape, $1,284. Cash count, $1,575. 29 Cash sales per the cash register tape, $1,131. Cash count, $1,432. 30 Cash sales per the cash register tape, $1,370. Cash count, $1,661. Required: 2. Record the cash receipts from June 25 to June 30, 2019, in a general Journal 3. Post the amounts for Cash Short or Over in the journal entries to the general ledger Analyze: How will the balance in Cosh Short or Over on line 20 be reported in the financial statements? Prev 1 of 5 !!! Next > Stock-873507500jpg o hip Analyze: How will the balance in Cash Short or Over on June 30 be reported in the financial statements? Complete this question by entering your answers in the tabs below. General Journal General Ledger Analyze Record the cash receipts in a general journal. View transaction list Journal entry worksheet 1 Cash sales per the cash register tape, $1,232. Cash count, $1,522. Prev 1 of 5 Next > iStock-873507500.jpg Journal entry worksheet 1 3 Cash sales per the cash register tape, $1,232. Cash count, $1,522. Note: Enter debits before credits. General Journal Debit Credit Date Jun 25, 2019 Accounts payable Accounts receivable Cash Cash short or over View general journal Recorded Prev 1 of 5 Next > iStock-873507500.jpg Accounts payable Accounts receivable Cash Record ei Cash short or over 2019: Cash short or over Delivery expense Equipment Interest expense Interest income cord ei G 5, 2019 Interest income Merchandise inventory Miscellaneous expense Notes payable ecord ei Notes receivable General Joumal 19: Notes receivable Petty cash Purchases Purchases discounts Purchases returns and allowances 2019: Purchases returns and allowances Rent expense Salaries expense Sales Sales discounts ord en Sales returns and allowances General Jouma 2019: Sales returns and allowances Sales tax payable Supplies Telephone expense Utilities expense ord er Journal entry worksheet Journal entry worksheet Journal entry worksheet 2 3 4 5 6 Cash sales per the cash register tape, $1,284. Cash count, $1,575. Note: Enter debits before credits. Date General Journal Debit Credit Jun 28, 2019 Record entry Clear entry View general joumal Pey 1 of 5 !!! Next > Journal entry worksheet Journal entry worksheet Complete this question by entering your answers in the tabs below. General Journal General Ledger Analyze Post the amounts for Cash Short or Over in the journal entries to the general ledger. GENERAL LEDGER Cash Short or Over Account No. 620 Date Debit Credit Balance Prev 1 of 5 !!! Next > Complete this question by entering your answers in the tabs below. General Journal General Ledger Analys How will the balance in Cash Short or Over on June 30 be reported in the financial statements?