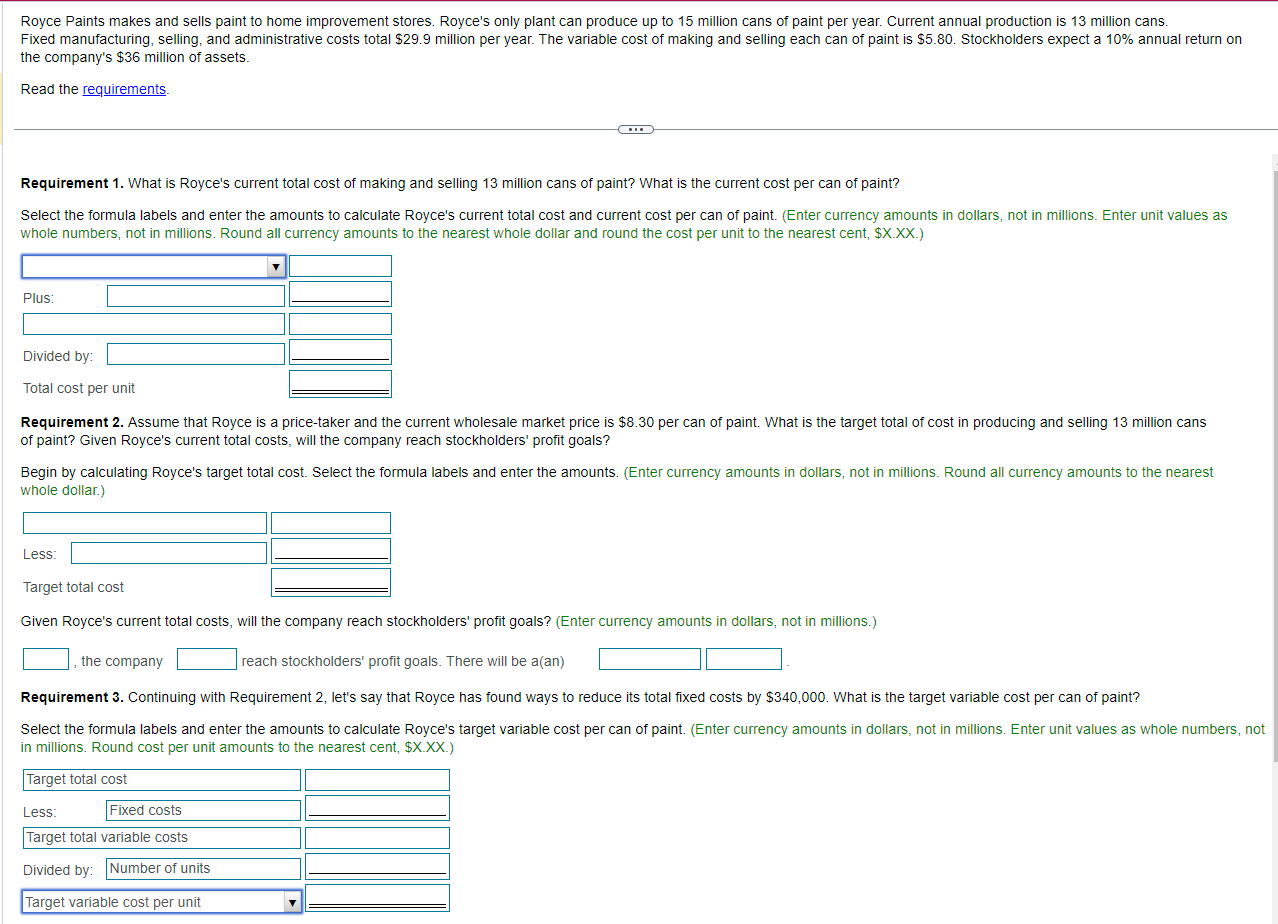

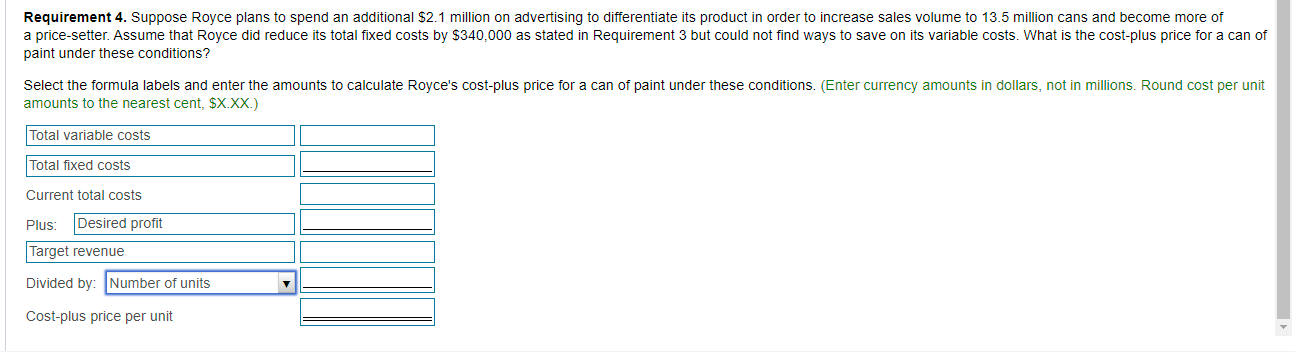

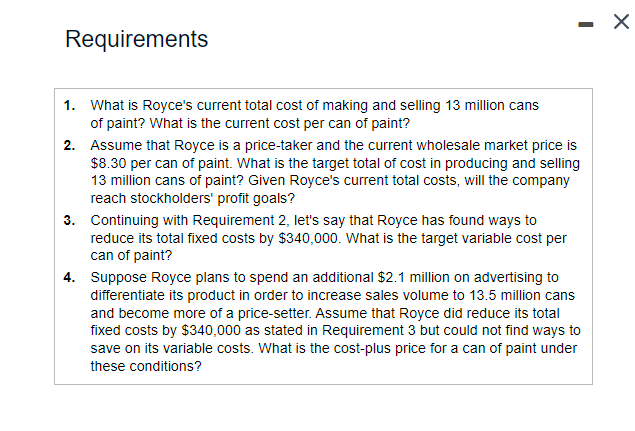

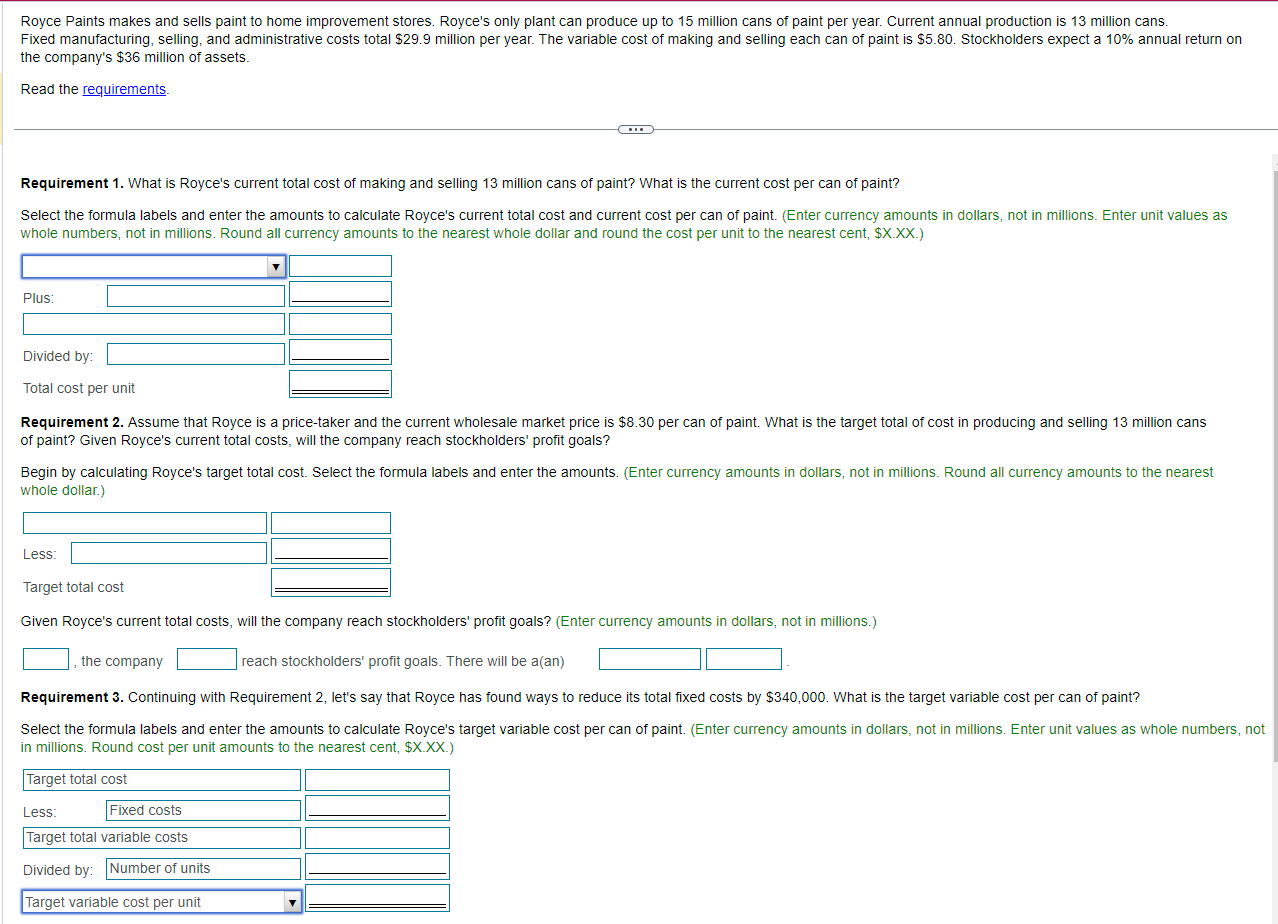

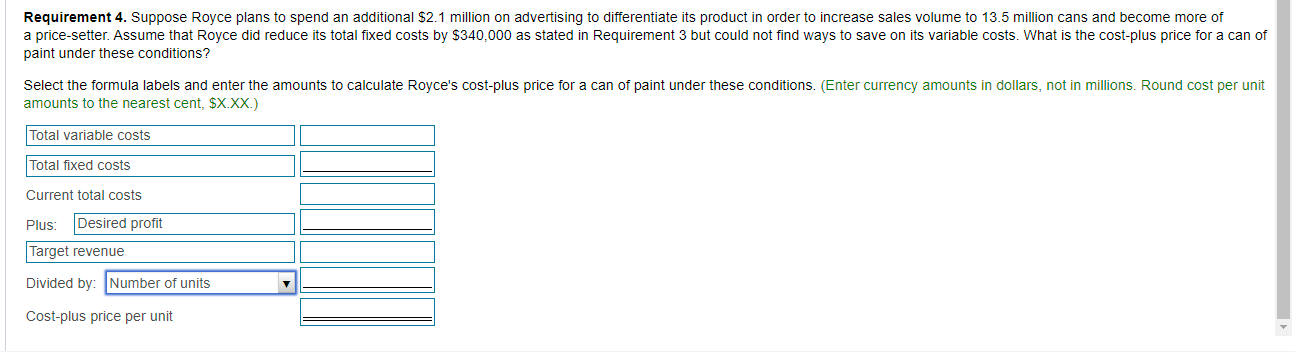

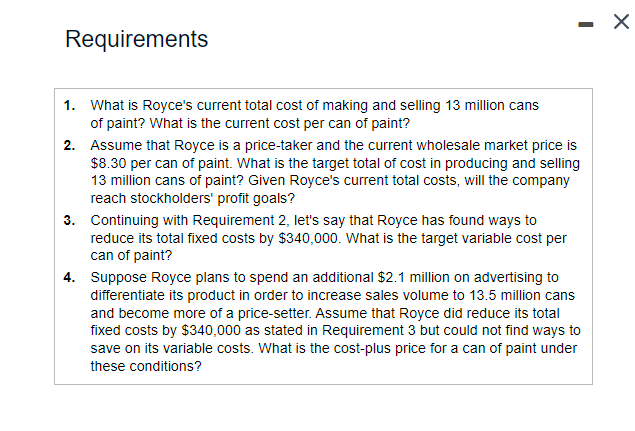

Royce Paints makes and sells paint to home improvement stores. Royce's only plant can produce up to 15 million cans of paint per year. Current annual production is 13 million cans. Fixed manufacturing, selling, and administrative costs total $29.9 million per year. The variable cost of making and selling each can of paint is $5.80. Stockholders expect a 10% annual return on the company's $36 million of assets. Read the requirements. Requirement 1. What is Royce's current total cost of making and selling 13 million cans of paint? What is the current cost per can of paint? Select the formula labels and enter the amounts to calculate Royce's current total cost and current cost per can of paint. (Enter currency amounts in dollars, not in millions. Enter unit values as whole numbers, not in millions. Round all currency amounts to the nearest whole dollar and round the cost per unit to the nearest cent, $X.XX.) Requirement 2. Assume that Royce is a price-taker and the current wholesale market price is $8.30 per can of paint. What is the target total of cost in producing and selling 13 million cans of paint? Given Royce's current total costs, will the company reach stockholders' profit goals? Begin by calculating Royce's target total cost. Select the formula labels and enter the amounts. (Enter currency amounts in dollars, not in millions. Round all currency amounts to the nearest whole dollar.) Given Royce's current total costs, will the company reach stockholders' profit goals? (Enter currency amounts in dollars, not in millions.) the company reach stockholders' profit goals. There will be a(an) Requirement 3 . Continuing with Requirement 2, let's say that Royce has found ways to reduce its total fixed costs by $340,000. What is the target variable cost per can of paint? Select the formula labels and enter the amounts to calculate Royce's target variable cost per can of paint. (Enter currency amounts in dollars, not in millions. Enter unit values as whole numbers, not in millions. Round cost per unit amounts to the nearest cent, \$X.XX.) Requirement 4. Suppose Royce plans to spend an additional $2.1 million on advertising to differentiate its product in order to increase sales volume to 13.5 million cans and become more of a price-setter. Assume that Royce did reduce its total fixed costs by $340,000 as stated in Requirement 3 but could not find ways to save on its variable costs. What is the cost-plus price for a can of paint under these conditions? Select the formula labels and enter the amounts to calculate Royce's cost-plus price for a can of paint under these conditions. (Enter currency amounts in dollars, not in millions. Round cost per unit amounts to the nearest cent, $X.XX. Requirements 1. What is Royce's current total cost of making and selling 13 million cans of paint? What is the current cost per can of paint? 2. Assume that Royce is a price-taker and the current wholesale market price is $8.30 per can of paint. What is the target total of cost in producing and selling 13 million cans of paint? Given Royce's current total costs, will the company reach stockholders' profit goals? 3. Continuing with Requirement 2, let's say that Royce has found ways to reduce its total fixed costs by $340,000. What is the target variable cost per can of paint? 4. Suppose Royce plans to spend an additional $2.1 million on advertising to differentiate its product in order to increase sales volume to 13.5 million cans and become more of a price-setter. Assume that Royce did reduce its total fixed costs by $340,000 as stated in Requirement 3 but could not find ways to save on its variable costs. What is the cost-plus price for a can of paint under these conditions