Answered step by step

Verified Expert Solution

Question

1 Approved Answer

rp=5.5% rf=7% tax=40% Q6: You are analyzing a line of cosmetics that Gap is proposing to introduce, and you are trying to arrive at reasonable

rp=5.5%

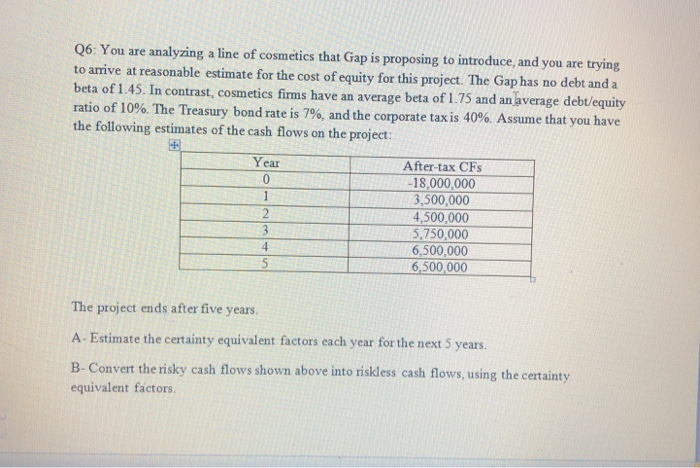

Q6: You are analyzing a line of cosmetics that Gap is proposing to introduce, and you are trying to arrive at reasonable estimate for the cost of equity for this project. The Gap has no debt and a beta of 1.45. In contrast, cosmetics firms have an average beta of 1.75 and an average debt/equity ratio of 10%. The Treasury bond rate is 7%, and the corporate tax is 40%. Assume that you have the following estimates of the cash flows on the project: Year After-tax CFS -18,000,000 3,500,000 4,500,000 5,750,000 6,500,000 6,500,000 The project ends after five years. A Estimate the certainty equivalent factors each year for the next 5 years. B-Convert the risky cash flows shown above into riskless cash flows, using the certainty equivalent factors rf=7%

tax=40%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started