Answered step by step

Verified Expert Solution

Question

1 Approved Answer

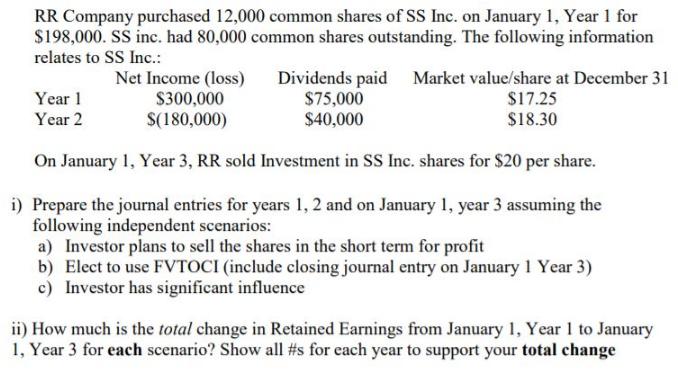

RR Company purchased 12,000 common shares of SS Inc. on January 1, Year 1 for $198,000. SS inc. had 80,000 common shares outstanding. The

RR Company purchased 12,000 common shares of SS Inc. on January 1, Year 1 for $198,000. SS inc. had 80,000 common shares outstanding. The following information relates to SS Inc.: Net Income (loss) $300,000 S(180,000) Dividends paid $75,000 $40,000 Market value/share at December 31 $17.25 $18.30 Year 1 Year 2 On January 1, Year 3, RR sold Investment in SS Inc. shares for $20 per share. i) Prepare the journal entries for years 1, 2 and on January 1, year 3 assuming the following independent scenarios: a) Investor plans to sell the shares in the short term for profit b) Elect to use FVTOCI (include closing journal entry on January 1 Year 3) c) Investor has significant influence ii) How much is the total change in Retained Earnings from January 1, Year 1 to January 1, Year 3 for each scenario? Show all #s for each year to support your total change

Step by Step Solution

★★★★★

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started