Answered step by step

Verified Expert Solution

Question

1 Approved Answer

rre Greetings experts! This is a multi-part exercise and I have a lot of doubts and been stuck on it for a while, I downloaded

rre

Greetings experts! This is a multi-part exercise and I have a lot of doubts and been stuck on it for a while, I downloaded a fresh new document because I keep getting stuck, if it would be possible to add an explanation I would appreciate it because I want to learn, thanks in advanced

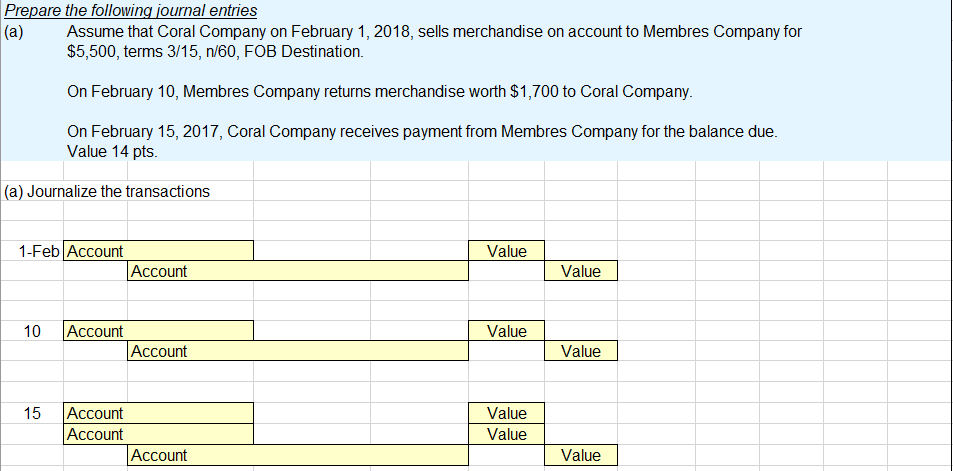

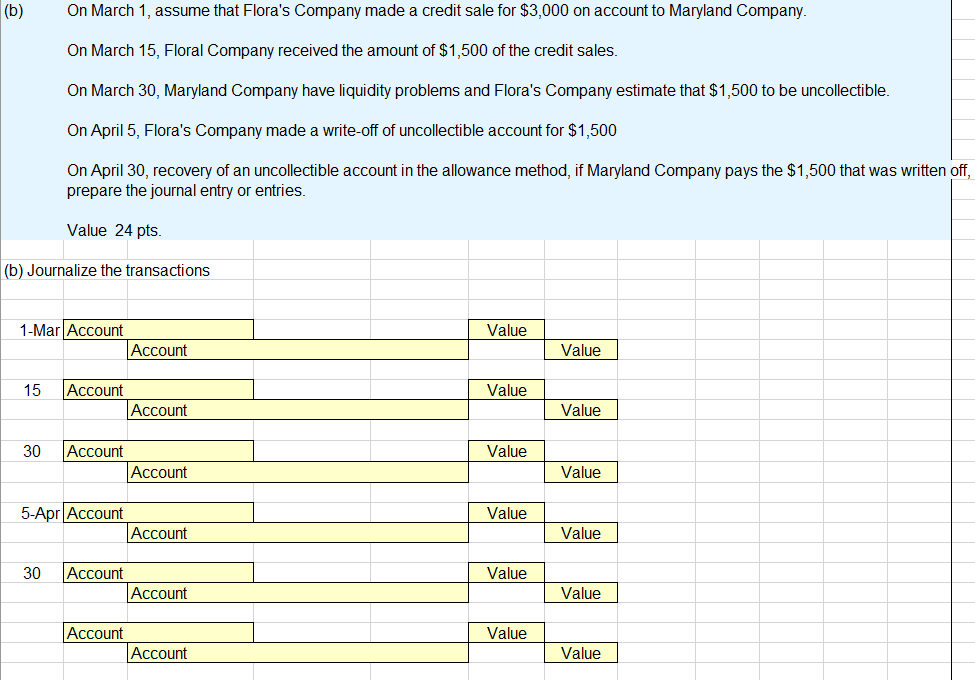

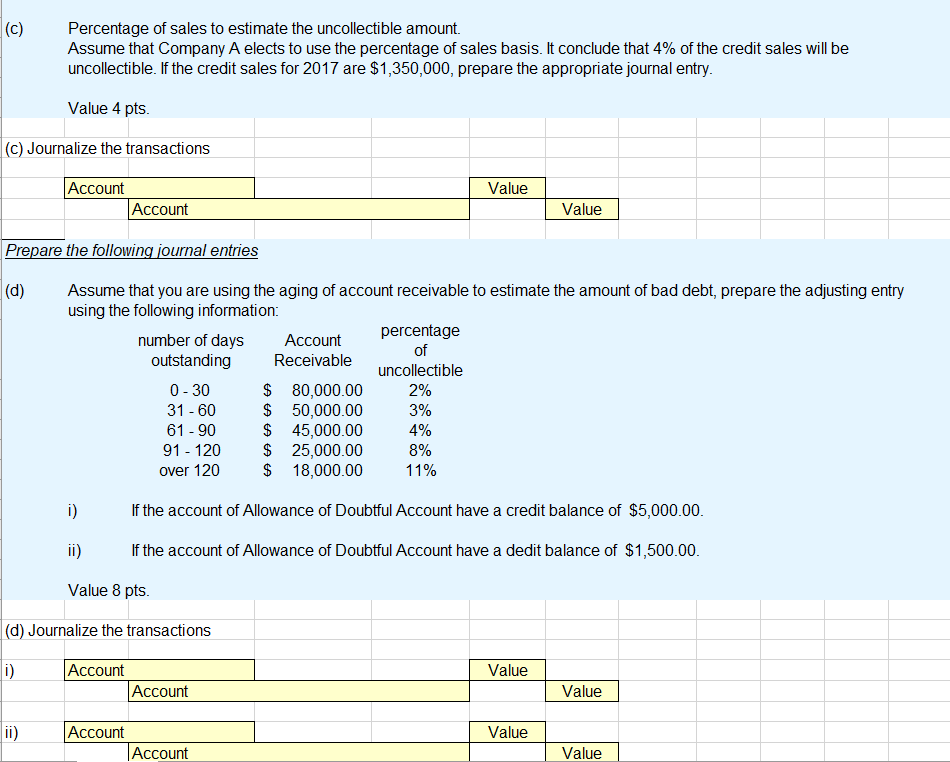

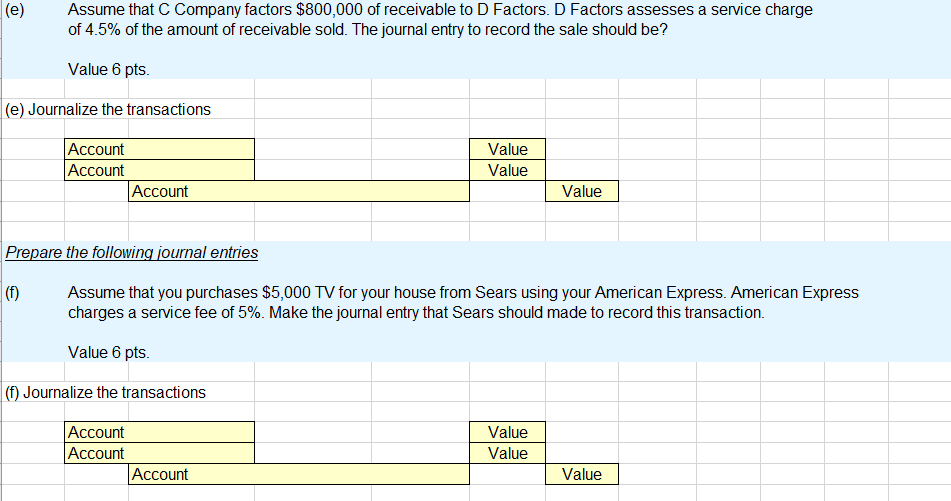

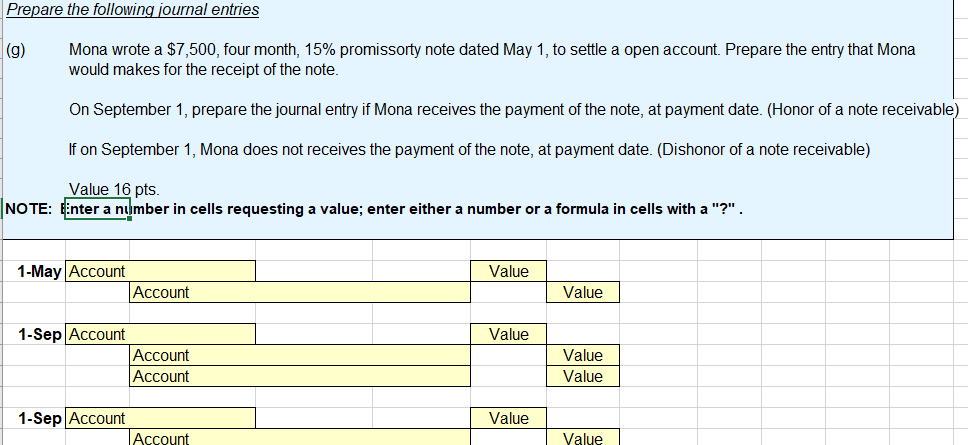

Prepare the following journal entries (a) Assume that Coral Company on February 1, 2018, sells merchandise on account to Membres Company for $5,500, terms 3/15, 1/60, FOB Destination. On February 10, Membres Company returns merchandise worth $1,700 to Coral Company. On February 15, 2017, Coral Company receives payment from Membres Company for the balance due. Value 14 pts. (a) Journalize the transactions Value 1-Feb Account Account Value 10 Value Account Account Value 15 Account Account Account Value Value Value (b) On March 1, assume that Flora's Company made a credit sale for $3,000 on account to Maryland Company. On March 15, Floral Company received the amount of $1,500 of the credit sales. On March 30, Maryland Company have liquidity problems and Flora's Company estimate that $1,500 to be uncollectible. On April 5, Flora's Company made a write-off of uncollectible account for $1,500 On April 30, recovery of an uncollectible account in the allowance method, if Maryland Company pays the $1,500 that was written off, prepare the journal entry or entries. Value 24 pts. (b) Journalize the transactions Value 1-Mar Account Account Value 15 Value Account Account Value 30 Value Account Account Value Value 5-Apr Account Account Value 30 Value Account Account Value Value Account Account Value (c) Percentage of sales to estimate the uncollectible amount. Assume that Company A elects to use the percentage of sales basis. It conclude that 4% of the credit sales will be uncollectible. If the credit sales for 2017 are $1,350,000, prepare the appropriate journal entry. Value 4 pts. (c) Journalize the transactions Value Account Account Value Prepare the following journal entries (d) Assume that you are using the aging of account receivable to estimate the amount of bad debt, prepare the adjusting entry using the following information: number of days Account percentage of outstanding Receivable uncollectible 0-30 $ 80,000.00 2% 31 - 60 $ 50,000.00 3% 61 - 90 $ 45,000.00 4% 91 - 120 $ 25,000.00 8% over 120 $ 18,000.00 11% i) If the account of Allowance of Doubtful Account have a credit balance of $5,000.00. ii) If the account of Allowance of Doubtful Account have a dedit balance of $1,500.00. Value 8 pts. (d) Journalize the transactions i) Value Account Account Value ii) Value Account Account Value (e) Assume that c Company factors $800,000 of receivable to D Factors. D Factors assesses a service charge of 4.5% of the amount of receivable sold. The journal entry to record the sale should be? Value 6 pts. (e) Journalize the transactions Account Account Account Value Value Value Prepare the following journal entries (f) Assume that you purchases $5,000 TV for your house from Sears using your American Express. American Express charges a service fee of 5%. Make the journal entry that Sears should made to record this transaction. Value 6 pts. (f) Journalize the transactions Account Account Account Value Value Value Prepare the following journal entries (g) Mona wrote a $7,500, four month, 15% promissorty note dated May 1, to settle a open account. Prepare the entry that Mona would makes for the receipt of the note. On September 1, prepare the journal entry if Mona receives the payment of the note, at payment date. (Honor of a note receivable) If on September 1, Mona does not receives the payment of the note, at payment date. (Dishonor of a note receivable) Value 16 pts. NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". Value 1-May Account Account Value Value 1-Sep Account Account Account Value Value Value 1-Sep Account Account Value Prepare the following journal entries (a) Assume that Coral Company on February 1, 2018, sells merchandise on account to Membres Company for $5,500, terms 3/15, 1/60, FOB Destination. On February 10, Membres Company returns merchandise worth $1,700 to Coral Company. On February 15, 2017, Coral Company receives payment from Membres Company for the balance due. Value 14 pts. (a) Journalize the transactions Value 1-Feb Account Account Value 10 Value Account Account Value 15 Account Account Account Value Value Value (b) On March 1, assume that Flora's Company made a credit sale for $3,000 on account to Maryland Company. On March 15, Floral Company received the amount of $1,500 of the credit sales. On March 30, Maryland Company have liquidity problems and Flora's Company estimate that $1,500 to be uncollectible. On April 5, Flora's Company made a write-off of uncollectible account for $1,500 On April 30, recovery of an uncollectible account in the allowance method, if Maryland Company pays the $1,500 that was written off, prepare the journal entry or entries. Value 24 pts. (b) Journalize the transactions Value 1-Mar Account Account Value 15 Value Account Account Value 30 Value Account Account Value Value 5-Apr Account Account Value 30 Value Account Account Value Value Account Account Value (c) Percentage of sales to estimate the uncollectible amount. Assume that Company A elects to use the percentage of sales basis. It conclude that 4% of the credit sales will be uncollectible. If the credit sales for 2017 are $1,350,000, prepare the appropriate journal entry. Value 4 pts. (c) Journalize the transactions Value Account Account Value Prepare the following journal entries (d) Assume that you are using the aging of account receivable to estimate the amount of bad debt, prepare the adjusting entry using the following information: number of days Account percentage of outstanding Receivable uncollectible 0-30 $ 80,000.00 2% 31 - 60 $ 50,000.00 3% 61 - 90 $ 45,000.00 4% 91 - 120 $ 25,000.00 8% over 120 $ 18,000.00 11% i) If the account of Allowance of Doubtful Account have a credit balance of $5,000.00. ii) If the account of Allowance of Doubtful Account have a dedit balance of $1,500.00. Value 8 pts. (d) Journalize the transactions i) Value Account Account Value ii) Value Account Account Value (e) Assume that c Company factors $800,000 of receivable to D Factors. D Factors assesses a service charge of 4.5% of the amount of receivable sold. The journal entry to record the sale should be? Value 6 pts. (e) Journalize the transactions Account Account Account Value Value Value Prepare the following journal entries (f) Assume that you purchases $5,000 TV for your house from Sears using your American Express. American Express charges a service fee of 5%. Make the journal entry that Sears should made to record this transaction. Value 6 pts. (f) Journalize the transactions Account Account Account Value Value Value Prepare the following journal entries (g) Mona wrote a $7,500, four month, 15% promissorty note dated May 1, to settle a open account. Prepare the entry that Mona would makes for the receipt of the note. On September 1, prepare the journal entry if Mona receives the payment of the note, at payment date. (Honor of a note receivable) If on September 1, Mona does not receives the payment of the note, at payment date. (Dishonor of a note receivable) Value 16 pts. NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". Value 1-May Account Account Value Value 1-Sep Account Account Account Value Value Value 1-Sep Account Account ValueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started