Answered step by step

Verified Expert Solution

Question

1 Approved Answer

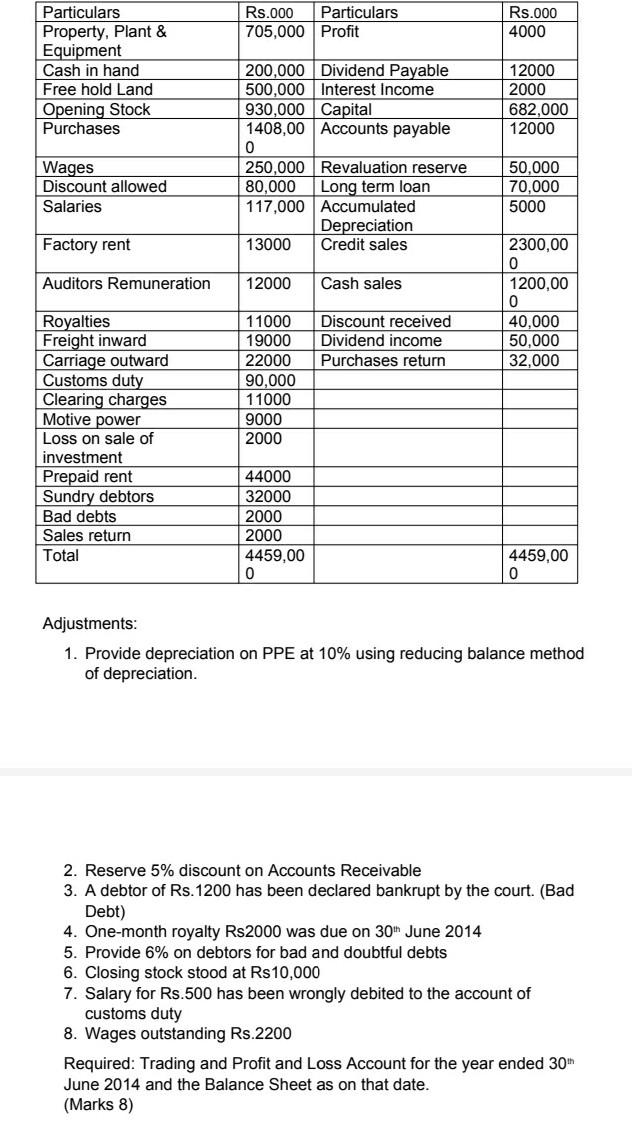

Rs.000 Particulars 705,000 Profit Rs.000 4000 Particulars Property, Plant & Equipment Cash in hand Free hold Land Opening Stock Purchases 12000 2000 682,000 12000 200,000

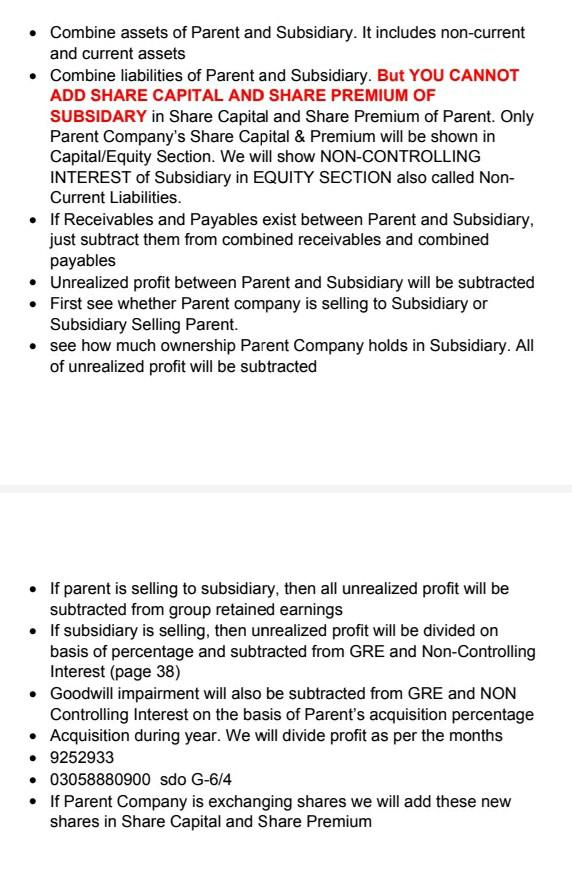

Rs.000 Particulars 705,000 Profit Rs.000 4000 Particulars Property, Plant & Equipment Cash in hand Free hold Land Opening Stock Purchases 12000 2000 682,000 12000 200,000 Dividend Payable 500,000 Interest Income 930,000 Capital 1408,00 Accounts payable 0 250,000 Revaluation reserve 80,000 Long term loan 117,000 Accumulated Depreciation 13000 Credit sales Wages Discount allowed Salaries 50.000 70,000 5000 Factory rent Auditors Remuneration 12000 Cash sales 2300,00 0 1200,00 0 40,000 50,000 32,000 Discount received Dividend income Purchases return Royalties Freight inward Carriage outward Customs duty Clearing charges Motive power Loss on sale of investment Prepaid rent Sundry debtors Bad debts Sales return Total 11000 19000 22000 90,000 11000 9000 2000 44000 32000 2000 2000 4459,00 0 4459,00 0 Adjustments: 1. Provide depreciation on PPE at 10% using reducing balance method of depreciation. 2. Reserve 5% discount on Accounts Receivable 3. A debtor of Rs. 1200 has been declared bankrupt by the court. (Bad Debt) 4. One-month royalty Rs 2000 was due on 30 June 2014 5. Provide 6% on debtors for bad and doubtful debts 6. Closing stock stood at Rs 10,000 7. Salary for Rs.500 has been wrongly debited to the account of customs duty 8. Wages outstanding Rs.2200 Required: Trading and Profit and Loss Account for the year ended 30+ June 2014 and the Balance Sheet as on that date. (Marks 8) Combine assets of Parent and Subsidiary. It includes non-current and current assets Combine liabilities of Parent and Subsidiary. But YOU CANNOT ADD SHARE CAPITAL AND SHARE PREMIUM OF SUBSIDARY in Share Capital and Share Premium of Parent. Only Parent Company's Share Capital & Premium will be shown in Capital/Equity Section. We will show NON-CONTROLLING INTEREST of Subsidiary in EQUITY SECTION also called Non- Current Liabilities. If Receivables and Payables exist between Parent and Subsidiary, just subtract them from combined receivables and combined payables Unrealized profit between Parent and Subsidiary will be subtracted First see whether Parent company is selling to Subsidiary or Subsidiary Selling Parent. see how much ownership Parent Company holds in Subsidiary. All of unrealized profit will be subtracted If parent is selling to subsidiary, then all unrealized profit will be subtracted from group retained earnings If subsidiary is selling, then unrealized profit will be divided on basis of percentage and subtracted from GRE and Non-Controlling Interest (page 38) Goodwill impairment will also be subtracted from GRE and NON Controlling Interest on the basis of Parent's acquisition percentage Acquisition during year. We will divide profit as per the months 9252933 03058880900 sdo G-6/4 If Parent Company is exchanging shares we will add these new shares in Share Capital and Share Premium

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started