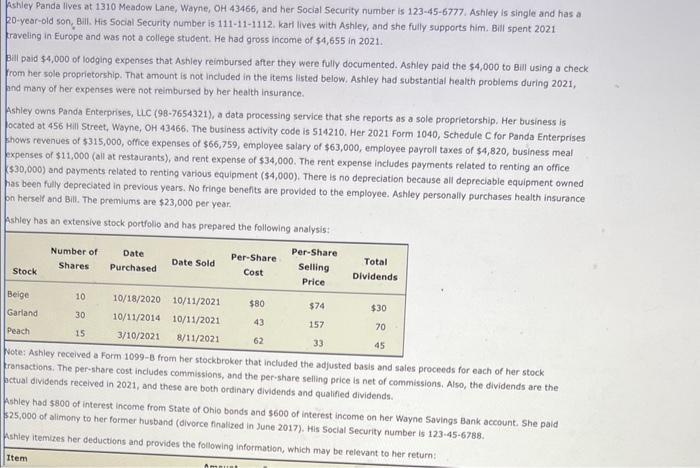

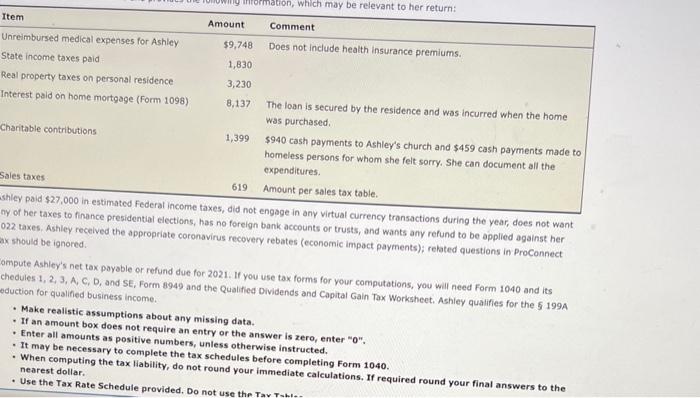

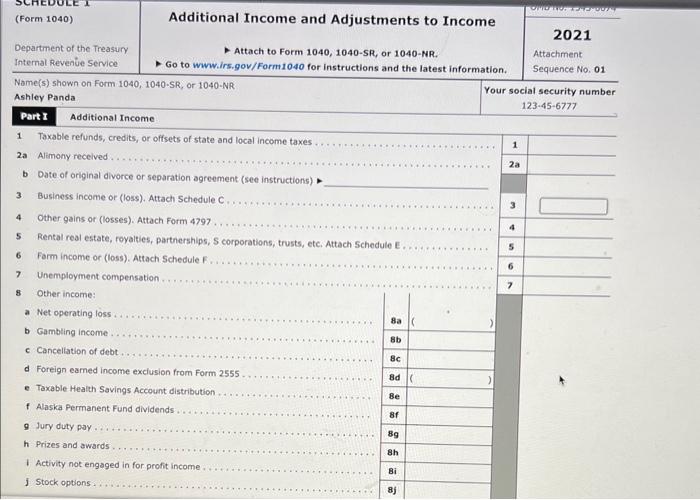

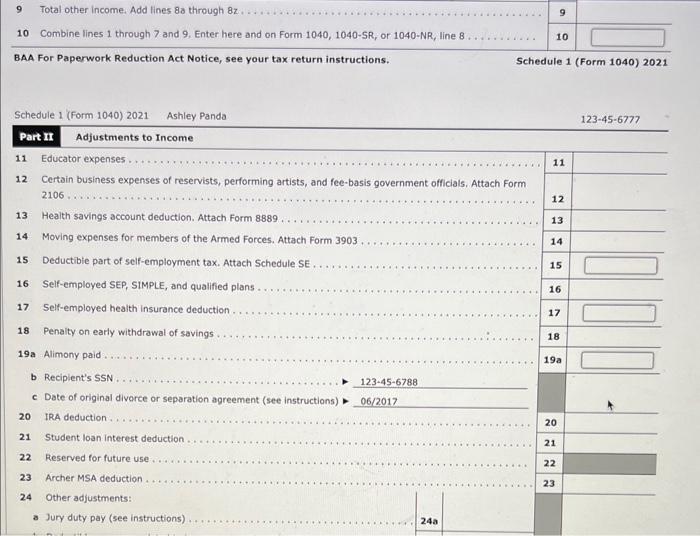

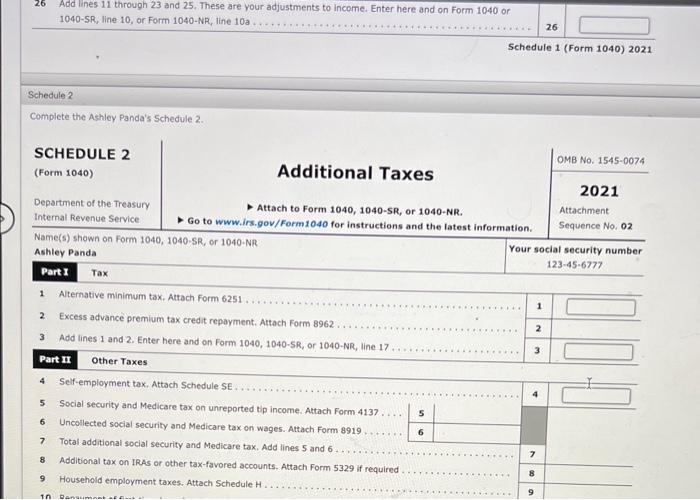

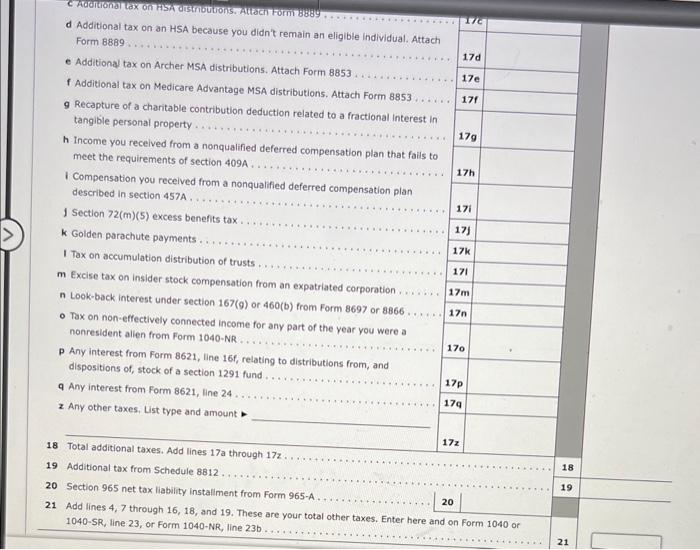

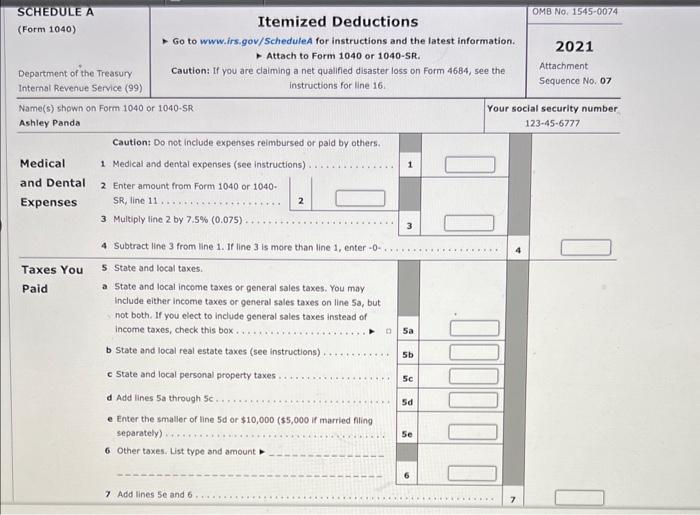

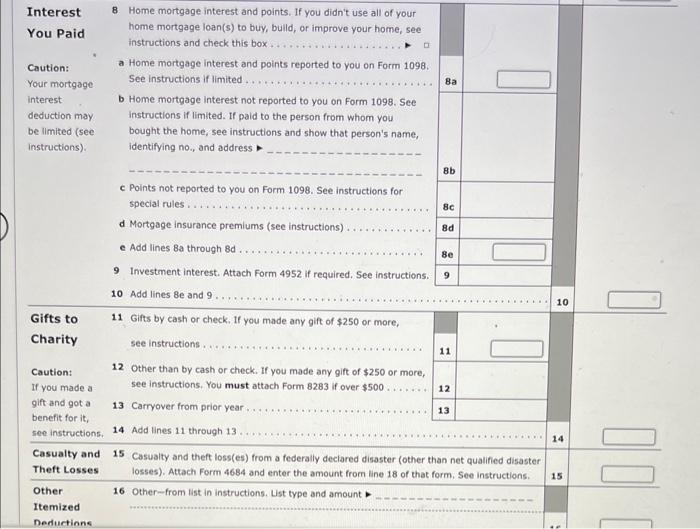

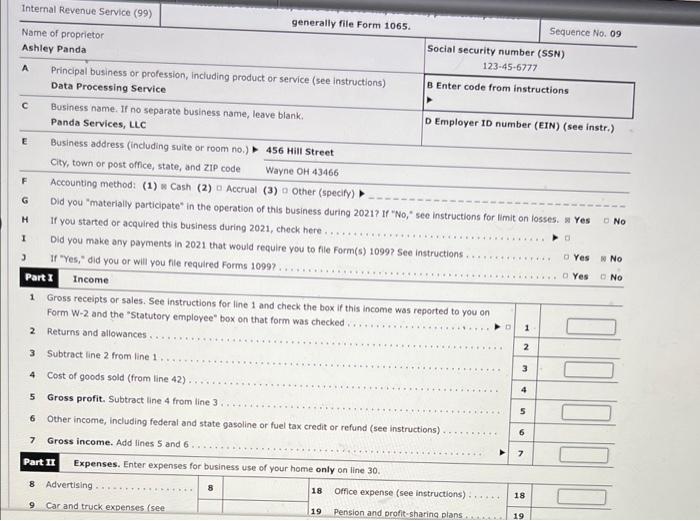

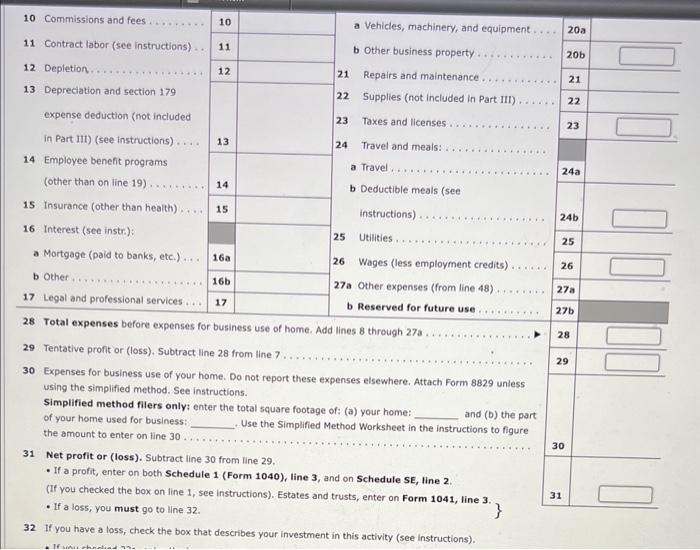

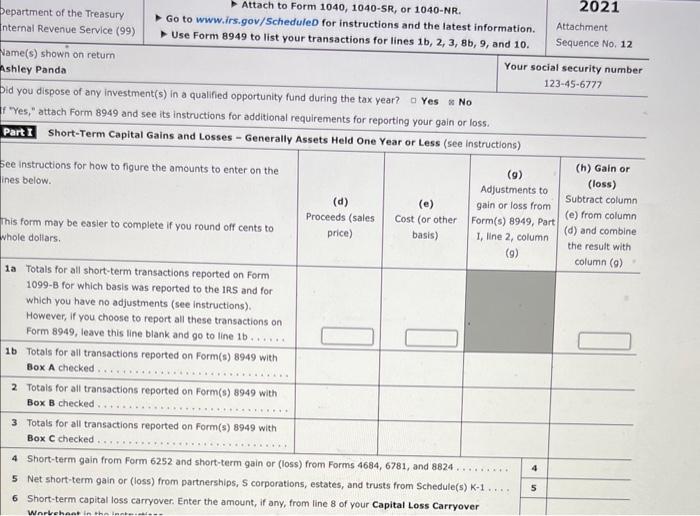

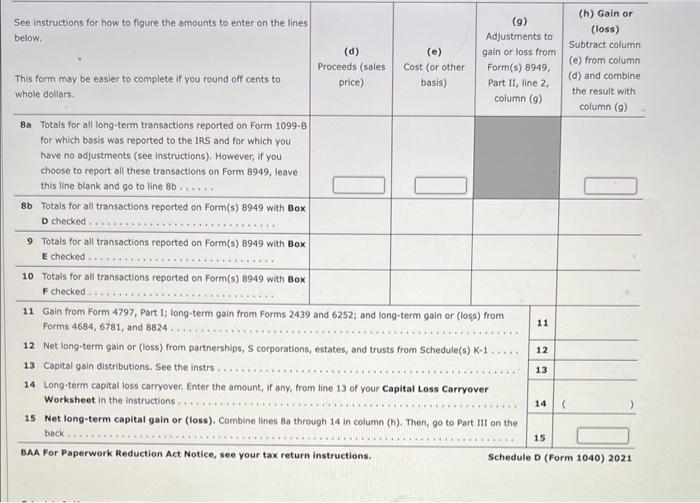

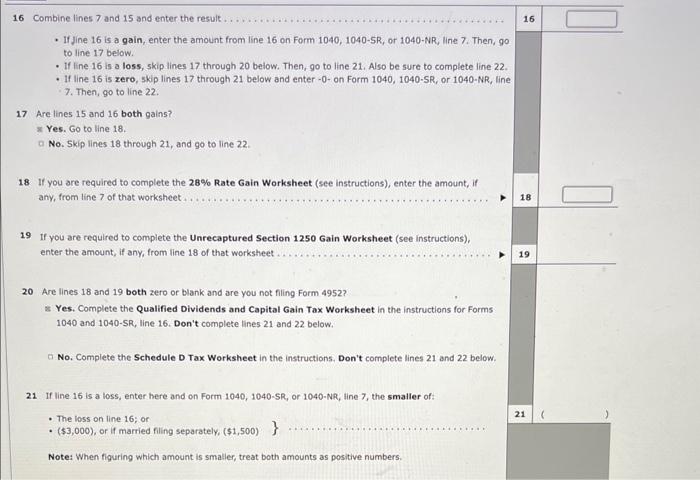

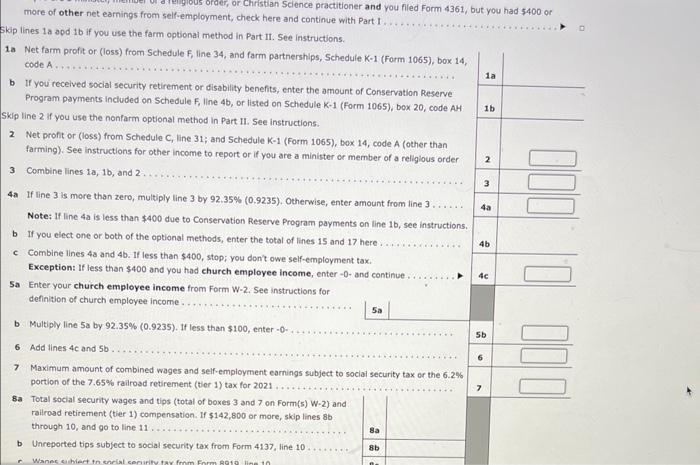

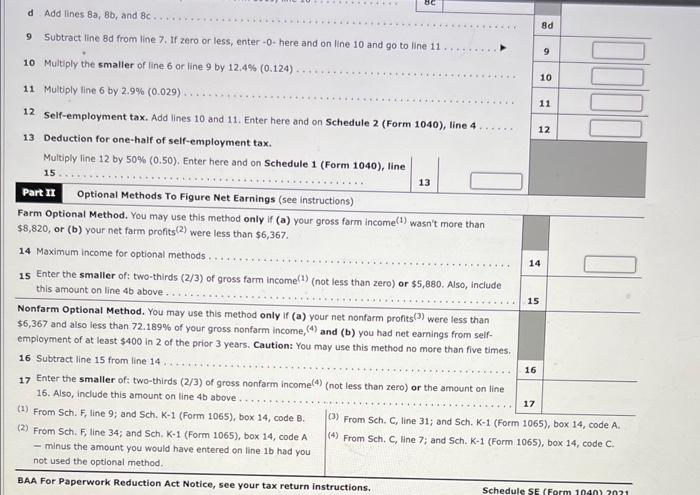

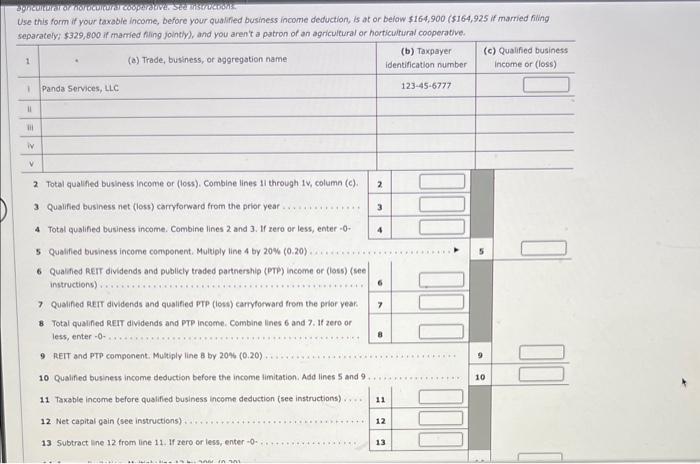

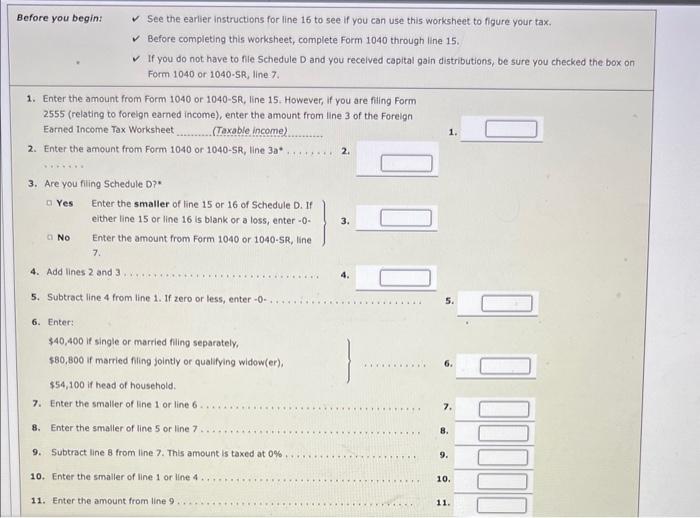

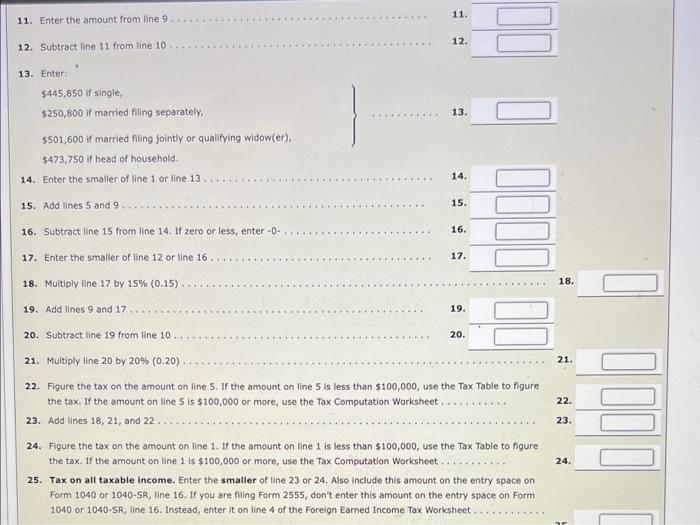

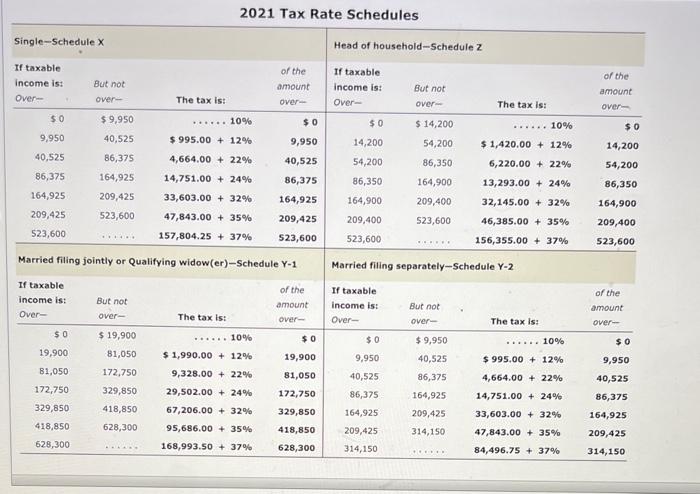

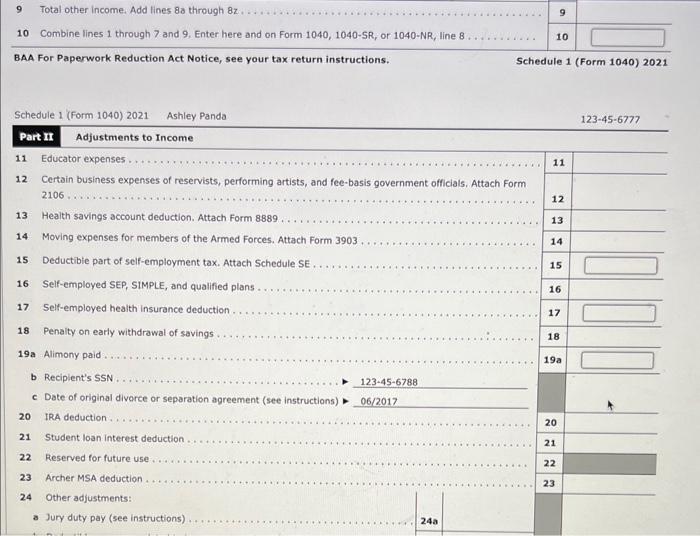

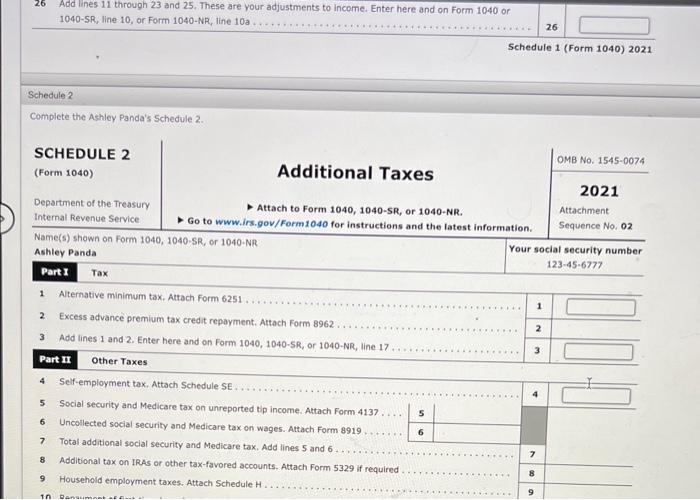

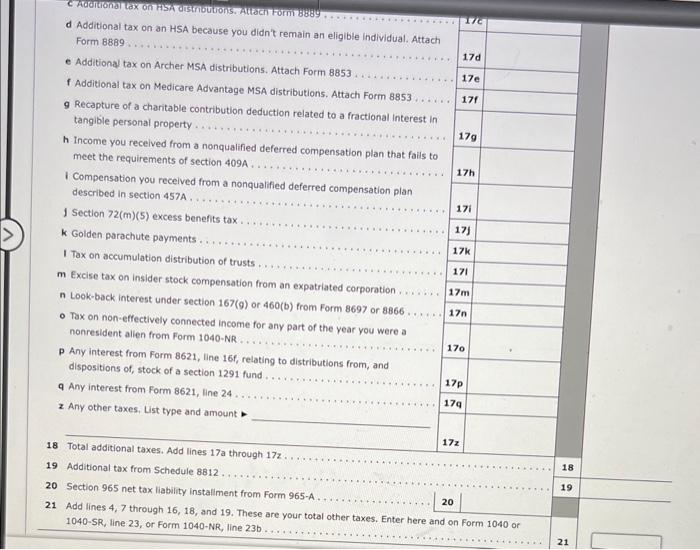

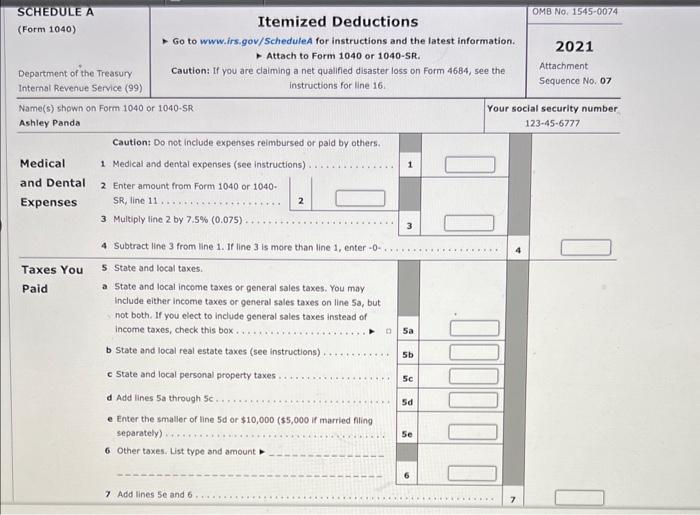

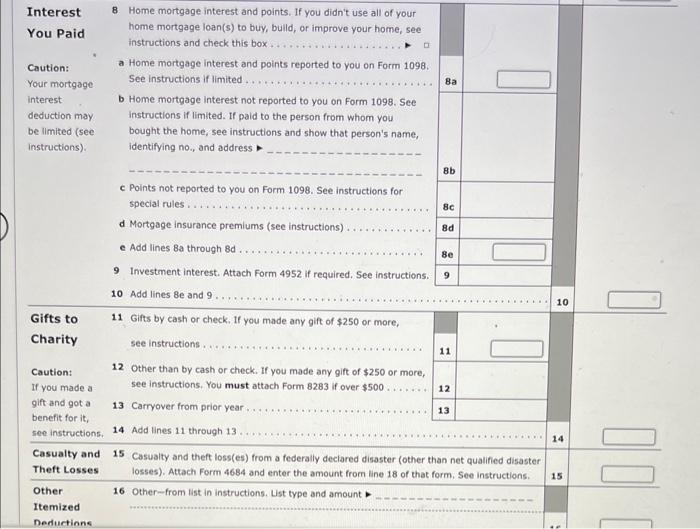

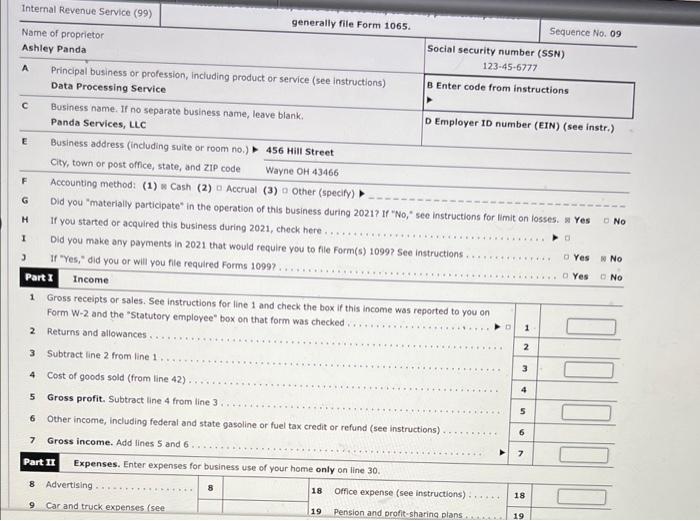

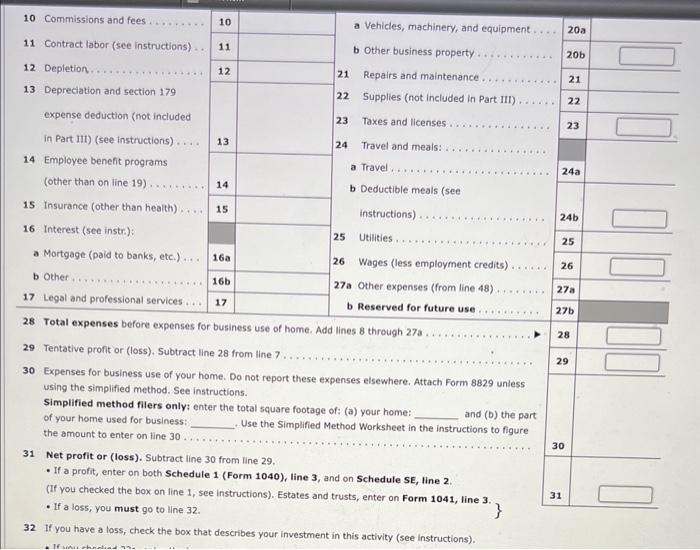

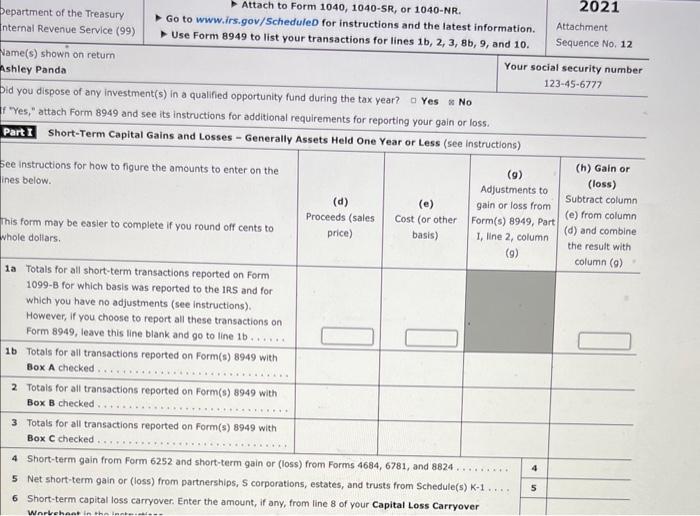

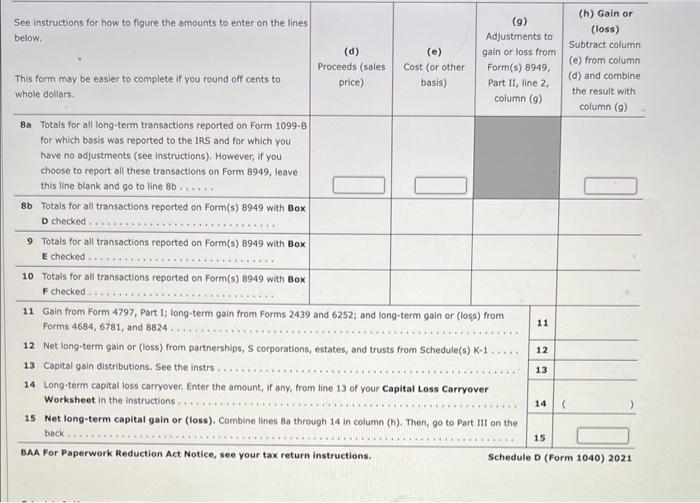

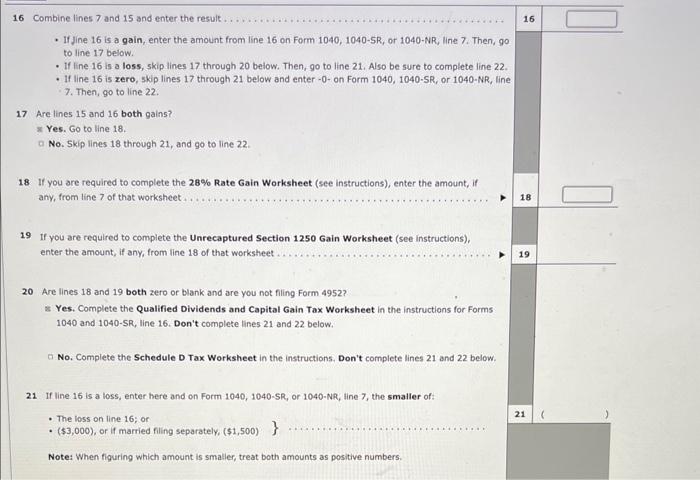

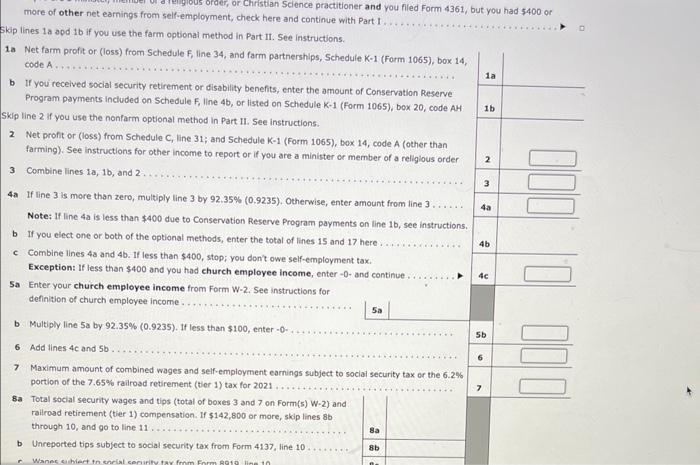

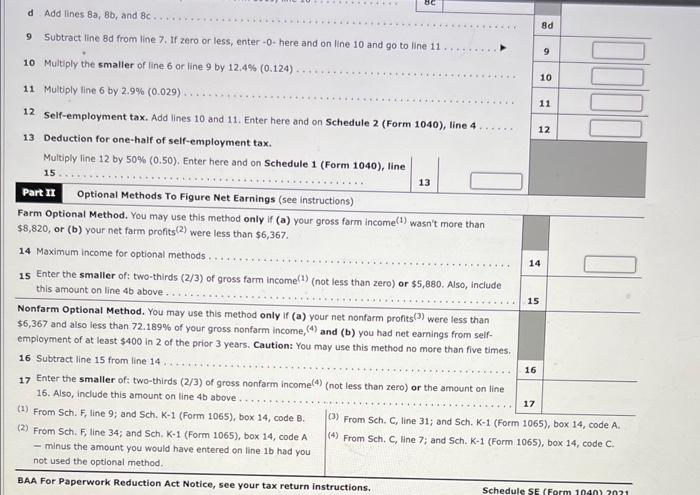

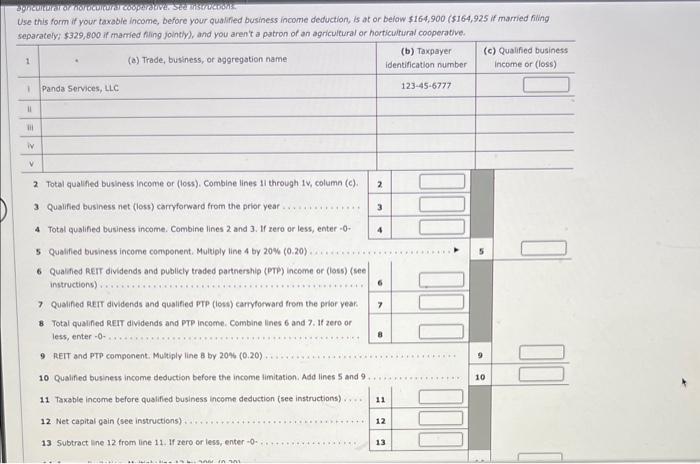

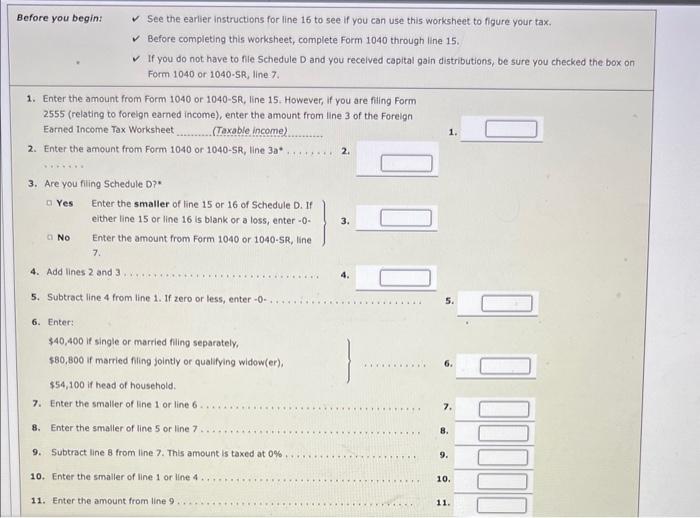

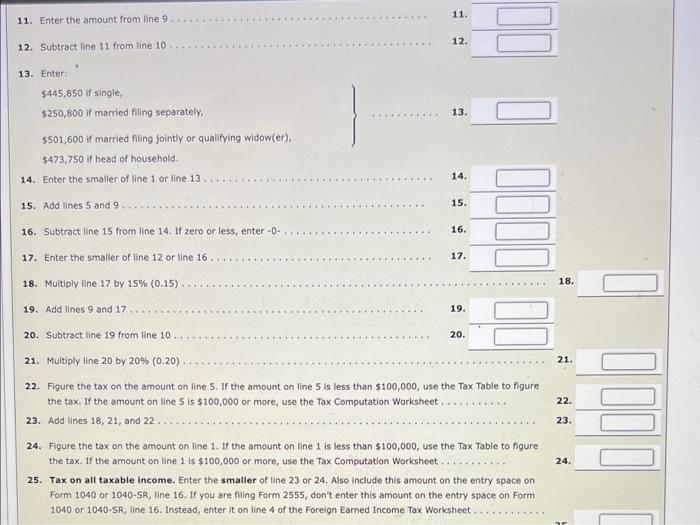

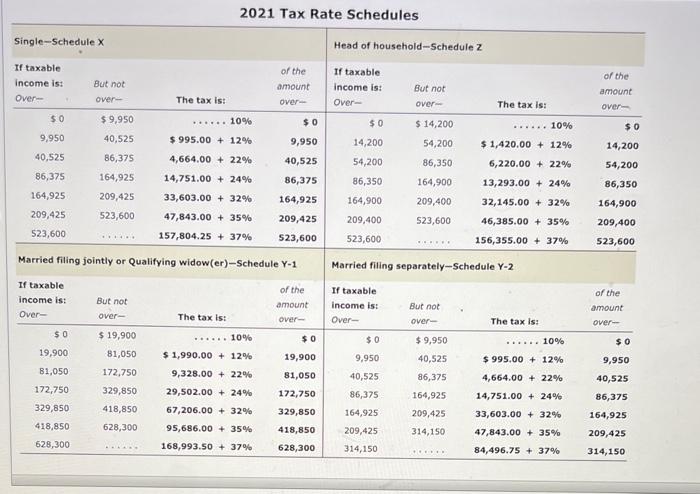

Rshley Panda lives at 1310 Meadow Lane, Wayne, OH43466, and her Social Security number is 123456777. Ashley is single and has a 20-year-old son, Bill. His Social Security number is 111-11-1112. karl lives with Ashley, and she fully supports him. Bill spent 2021 raveling in Europe and was not a college stucent. He had gross income of $4,655 in 2021. Bail paid \$4,000 of lodging expenses that Ashley reimbursed after they were fully documented. Ashley paid the $4,000 to Bill using a check rom her sole proprietorship. That amount is not included in the items listed below. Ashley had substantial health problems during 2021, and many of her expenses were not reimbursed by her health insurance. Ashley owns Panda Enterprises, LLC (987654321), a data processing service that she reports as a sole proprietorship. Her business is located at 456 Hill Street, Wayne, OH 43466. The business activity code is 514210. Her 2021 Form 1040, Schedule C for Panda Enterprises thows revenues of $315,000, office expenses of $66,759, employee salary of $63,000, employee payroll taxes of $4,820, business meal expenses of $11,000 (all at restaurants), and rent expense of $34,000. The rent expense includes payments related to renting an office ($30,000) and payments related to renting various equipment ($4,000). There is no depreciation because all depreciable equipment owned has been fully depreciated in previous years. No fringe benefits are provided to the employee. Ashley personally purchases health insurance on herself and Bill. The premlums are $23,000 per year. Ashiey has an extensive stock portfolio and has prepared the following analysis: Jransactions, The per-share cost includes comm stockbroker that included the adjusted basis and sales proceeds for each of her stock pre both ordinary dividends and qualifled dividends. tormer he from state of Ohio bonds and $600 of interest income on her Wayne 5avings Bank account, She paid tintized in June 2017). His 5ocial Security number is 123-45-6788. Weving information, which may be relevant to her return: of her taxes to finance presidential election s, taxes, did not engage in any virtual currency transactions during the year, does not want ix should be ignored. bimpute Ashley's net tax payable or refund due for 2021. If you use tax forms for your computations, you will need Form 1040 and its thedules 1,2,3,A,C,D, and SE, Form 8949 and the Qualified Dividends and Capital Gain Tax Worksheet. Ashiey qualifies for the 5199A - Make realistic assumptions about any missing data. - If an amount box does not require an entry or the answer is zero, enter " 0 ". - Enter all amounts as positive numbers, uniess otherwise instructed. - It may be necessary to complete the tax schedules before completing Form 1040 . - When computing ty, do not round your immediate calculations, If required round your final answers to the 1 Taxable refunds, credits, or offsets of state and local income taxes. 2a. Alimony recelved. b Date of original divorce or separation agreement (see instructions) - 3 Business income or (loss). Attach Schedule C 4 Other gains or (losses). Attach Form 4797. 5 Rental real estate, foyalties, partnerships, S corporations, trusts, etc. Attach Schedule 6 Farm income or (loss). Attach Schedule F. 7 Unempioyment compensation 8 Other income: a Net operating loss. b Gambling income . c Cancellation of debt. d Foreign eamed income exciusion from Form 2555 e Taxable Health Savings Account distribution f Alaska Permanent Fund dividends . 9 Jury duty pay h Prizes and awards 1 Activity not engaged in for profit income j Stock options. Scnedule 1 (Form 1040 ) 2021 Complete the Ashley Panda's Schedule 2. d Additional tax on an HSA because you didn't remain an eligible individual. Attach Form B889 e Additional tax on Archer MSA distributions. Attach Form 8853 . f Additional tax on Medicare Advantage MSA distributions. Attach Form 8853... g Recapture of a charitable contribution deduction related to a fractional interest in tangible personal property ....t... h Income you recelved from a nonqualified deferred compensation plan that fails to meet the requirements of section 409A I Compensation you recelved from a nonqualified deferred compensation plan described in section 457A. j Section 72(m)(5) excess ben I Tax on accumulation distribution of trusts. m Excise tax on insider stock compensation from an expatriated corporation . n Look-back interest under section 167(9) or 460(b) from Form 8697 or 8866. - Tax on non-effectively connected income for any part of the year you were a nonresident alien from Form 1040-NR. p Any interest from Form 8621 , line 166 , relating to distributions from, and dispositions of, stock of a section 1291 fund q Any interest from Form 8621, line 24 . z. Any other taxes, List type and amount 18 Total additional taxes, Add lines 17 a th 1040-SR, line 23, or Form 1040-NR, line 23b .... Eorm 1040 SCHEDULE A (Form 1040) Itemized Deductions OMB No, 1545-0074 Go to www.irs.gov/ScheduleA for instructions and the latest information. 2021 Attach to Form 1040 or 1040 -SR. Department of the Treasury Caution: If you are claiming a net qualifled disaster loss on form 4684 , see the Intemal Revenue Service (99) instructions for line 16 . Attachment Name(s) shown on Form 1040 or 1040 -SR Sequence No, 07 Ashley Panda Your social security number Medical 1 Medical and dental expenses (see instructions). and Dental 2 Enter amount from Form 1040 or 1040- Expenses SR, line 11 3 Multiply line 2 by 7.5%(0.075) 4 Subtract line 3 from line 1 . If line 3 is more than line 1 , enter 0.., Taxes You 5 state and local taxes. Paid a State and local income taxes or general sales taxes. You may Include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box. b State and local real estate taxes (see instructions) d Add lines 5 a through 50 e Enter the smaller of line 5d or $10,000($5,000 if married fling 6 Other toxes. List type and amount 7 Add lines 5e and 6 Interest 8 Home mortgage interest and points. If you didn't use all of your You Paid home mortgage loan(s) to buy, bulld, or improve your home, see instructions and check this box . Caution: a Home mortgage interest and points reported to you on Form 1098. Your mortgage See instructions if limited. interest b Home mortgage interest not reported to you on Form 1098. See deduction may instructions if limited. If paid to the person from whom you be limited (see bought the home, see instructions and show that person's name, instructions). identifying no., and address c Points not reported to you on Form 1098. See instructions for d Mortgage insurance premlums (see instructions) ............... 8d e Add lines 8 a through 8d. 9 Investment interest. Attach Form 4952 if required. See instructions. 10 Add lines 8e and 9 Gifts to 11 Gifts by cash or check, If you made any gift of $250 or more, Charity see instructions . Caution: 12 other than by cash or check. If you made any gift of $250 or more, If you made a see instructions. You must attach Form 8283 if over $500... . gift and got a 13 Carryover from prior year benefit for it, Casualty and 15 Casualty and theft loss(es) from a federally deciared disaster (other than net qualified disaster Theft Losses losses). Attach Form 4684 and enter the amount from line 18 of that form, See instructions. other 16 Other-from list in instructions. List type and amount Itemized Deductione Internal Revenue Service (99) generally file Form 1065 . Name of proprietor Ashley Panda Sequence No, 09 Social security number (SSN) E Business address (including suite or room no.) 456 Hill street City, town or post office, state, and Z1P code Wayne 0H43466 F Accounting method: (1) w Cash (2) - Accrual (3) D Other (specify) G Did you "materially participate" in the operation of this business H Wor if you started or acquired this business during 2021 , check here 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked, 2 Returns and allowances. 3 Subtract line 2 from line 1 4 Cost of goods sold (from line 42 ) 5 Gross profit. Subtract line 4 from line 3 . 6 Other income, including federal and 7 Gross income. Add lines 5 and 6 . 7 Gross income. Add lines 5 and 6 Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising 9 Car and truck expenses (see 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method. See instructions. Simplified method filers only: enter the total square footage of: (a) your home: of your home used for business: the amount to enter on line 30. - If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. - If a loss, you must go to line 32. 32 If you have a loss, check the box that describes your investment in this activity (see instructions). Attach to Form 1040,10405R, or 1040-NR. 16 Combine lines 7 and 15 and enter the result. - If Jine 16 is a gain, enter the amount from line 16 on Form 1040, 1040-5R, or 1040-NR, line 7. Then, go to line 17 below. - If ine 16 is a loss, skip lines 17 through 20 below. Then, go to line 21 , Also be sure to complete line 22. - If line 16 is zero, skip lines 17 through 21 below and enter - 0 - on Form 1040, 1040-5R, or 1040-NR, line 7. Then, go to line 22. 17 Are lines 15 and 16 both gains? * Yes. Go to line 18 . No. 5kip lines 18 through 21 , and go to line 22 . 18 If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the amount, if any, from line 7 of that worksheet 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet . 20 Are lines 18 and 19 both zero or blank and are you not filing Form 4952? * Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040SR, line 16 . Don't complete lines 21 and 22 below, No. Complete the Schedule D. Tax Worksheet in the instructions. Don't complete lines 21 and 22 below. 21 If line 16 is a loss, enter here and on Form 1040 , 1040-5R, or 1040-NR, line 7, the smaller of: - The loss on line 16; or - ($3,000), or if married filing separately, ($1,500)} Note: When figuring which amount is smatier, treat both amounts as positive numbers. Stience practitioner and you flied Form 4361 , but you had $400 or Skip lines 1a apd 1b if you use the farm optional method in Part II. See instructions. 1 a Net farm profit or (loss) from Schedule F, line 34, and farm partrierships, Schedule K-1 (Form 1065), box 14, codeA. b If you recelved social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH Skip line 2 if you use the nonfarm optional method in Part II. See instructions. 2 Net profit or (loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). See instructions for other income to report or if you are a minister or member of a religlous order 3 Combine lines 1a,1b, and 2 . 4a If line 3 is more than zero, multiply line 3 by 92.35%(0.9235). Otherwise, enter amount from line 3 Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 10 , see instructions. b If you elect one or both of the optional methods, enter the total of lines 15 and 17 here. c Combine lines 4a and 46 . If less than $400, stop; you don't owe self-employment tax, b Multiply line 5a by 9 6 Add tines 4c and 5b 7 Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2021 Total social security wages and tips (total of boxes 3 and 7 on Form(5) W-2) and railroad retirement (tier 1 ) compensation. If $142,800 or more, skip lines 86 through 10 , and go to line 11 . b Unreported tips subject to social security tax from Form 4137 , line 10. d Add lines 8a,8b, and 8c. 9 Subtract line 8d from line 7. If zero or less, enter 0 - here and on line 10 and go to line 11... 10 Multiply the smaller of line 6 or line 9 by 12.4%(0.124). 11 Multiply line 6 by 2.9%(0.029) 12 Self-employment tax, Add lines 10 and 11. Enter her Multiply line 12 by 50%(0.50). Enter here and on Schedule 1 (Form 1040), line Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method, You may use this method only if (a) your gross farm income(1) wasn't more than $8,820, or (b) your net farm profits (2) were less than $6,367. 14 Maximum income for optional methods. 15 Enter the smaller of: two-thirds (2/3) of gross farm income (1) (not less than zero) or $5,880. Also, include this amount on line 4b above . Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits (3) were less than $6,367 and also less than 72.189% of your gross nonfarm income, (4) and (b) you had net eamings from selfemployment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times. 16 Subtract line 15 from line 14 . 17 Enter the smaller of: two-thirds (2/3) of gross nonfarm income (4) (not less than zero) or the amount on line 16. Also, include this amount on line 4b above. (1) From Sch. F, line 9; and Sch. K-1 (Form 1065), box 14, code B. (2) From Sch. F, line 34; and Sch. K-1 (Form 1065), box 14, code A (3) From Sch. C, line 31; and Sch. K-1 (Form 1065), box 14, code A. - minus the amount you would have entered on line 16 had you (4) From Sch. C, lline 7; and Sch. K-1 (Form 1065), box 14, code C. not used the optional method. BAA For Paperwork Reduction Act Notice, see your tax return instructions. Use this form if your taxable income, before your qualifed business income deduction, is at or belaw $164,900 ( $164,925 if married filling separately; $329,800 if mamied fling jointiy), and you aren't a patron of an agricultural or horticultural cooperative. 2 Total qualified business income or (loss), Combine lines 11 through 1v, column (c). 3 Qualified business net (loss) carryforward from the prior year - 4 Total qualified business income. Combine lines 2 and 3 . If zero or less, enter 0 - 5 Qualified business income component. Multiply line 4 by 20%(0.20) 6 Qualifed Reit dividends and publicly traded partnership (PTP) income or (loss) (see instructions) 7 Qualifed ReIT dividends and qualified PTP (lest) carryforward from the priof yeak. 8. Total qualifed REIT dividends and PTP incoene. Combine lines 6 and 7. If zero or less, enter - 0- 9 ReIt and PTP component. Multiply line B by 20%(0.20). 10 Qualified business income deduction before the income limitation. Add lines 5 and 9 . 11 Taxable income before qualified business income deduction (see instructions). 12. Net capital gain (see instructions) 13 5ubtract line 12 from line 11 . If zero or less, enter 0... Before you begin: See the earlier instructions for line 16 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 15. 22. Figure the tax on the amount on line 5. If the amount on line 5 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 5 is $100,000 or more, use the Tax Computation Worksheet. 24. Figure the tax on the amount on line 1 . If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet. 25. Tax on all taxable income. Enter the smaller of line 23 or 24 . Also include this amount on the entry space on Form 1040 or 1040-5R, line 16. If you are filing Form 2555, don't enter this amount on the entry space on Form 1040 or 10405R, line 16. Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet. 2021 Tax Rate Schedules Rshley Panda lives at 1310 Meadow Lane, Wayne, OH43466, and her Social Security number is 123456777. Ashley is single and has a 20-year-old son, Bill. His Social Security number is 111-11-1112. karl lives with Ashley, and she fully supports him. Bill spent 2021 raveling in Europe and was not a college stucent. He had gross income of $4,655 in 2021. Bail paid \$4,000 of lodging expenses that Ashley reimbursed after they were fully documented. Ashley paid the $4,000 to Bill using a check rom her sole proprietorship. That amount is not included in the items listed below. Ashley had substantial health problems during 2021, and many of her expenses were not reimbursed by her health insurance. Ashley owns Panda Enterprises, LLC (987654321), a data processing service that she reports as a sole proprietorship. Her business is located at 456 Hill Street, Wayne, OH 43466. The business activity code is 514210. Her 2021 Form 1040, Schedule C for Panda Enterprises thows revenues of $315,000, office expenses of $66,759, employee salary of $63,000, employee payroll taxes of $4,820, business meal expenses of $11,000 (all at restaurants), and rent expense of $34,000. The rent expense includes payments related to renting an office ($30,000) and payments related to renting various equipment ($4,000). There is no depreciation because all depreciable equipment owned has been fully depreciated in previous years. No fringe benefits are provided to the employee. Ashley personally purchases health insurance on herself and Bill. The premlums are $23,000 per year. Ashiey has an extensive stock portfolio and has prepared the following analysis: Jransactions, The per-share cost includes comm stockbroker that included the adjusted basis and sales proceeds for each of her stock pre both ordinary dividends and qualifled dividends. tormer he from state of Ohio bonds and $600 of interest income on her Wayne 5avings Bank account, She paid tintized in June 2017). His 5ocial Security number is 123-45-6788. Weving information, which may be relevant to her return: of her taxes to finance presidential election s, taxes, did not engage in any virtual currency transactions during the year, does not want ix should be ignored. bimpute Ashley's net tax payable or refund due for 2021. If you use tax forms for your computations, you will need Form 1040 and its thedules 1,2,3,A,C,D, and SE, Form 8949 and the Qualified Dividends and Capital Gain Tax Worksheet. Ashiey qualifies for the 5199A - Make realistic assumptions about any missing data. - If an amount box does not require an entry or the answer is zero, enter " 0 ". - Enter all amounts as positive numbers, uniess otherwise instructed. - It may be necessary to complete the tax schedules before completing Form 1040 . - When computing ty, do not round your immediate calculations, If required round your final answers to the 1 Taxable refunds, credits, or offsets of state and local income taxes. 2a. Alimony recelved. b Date of original divorce or separation agreement (see instructions) - 3 Business income or (loss). Attach Schedule C 4 Other gains or (losses). Attach Form 4797. 5 Rental real estate, foyalties, partnerships, S corporations, trusts, etc. Attach Schedule 6 Farm income or (loss). Attach Schedule F. 7 Unempioyment compensation 8 Other income: a Net operating loss. b Gambling income . c Cancellation of debt. d Foreign eamed income exciusion from Form 2555 e Taxable Health Savings Account distribution f Alaska Permanent Fund dividends . 9 Jury duty pay h Prizes and awards 1 Activity not engaged in for profit income j Stock options. Scnedule 1 (Form 1040 ) 2021 Complete the Ashley Panda's Schedule 2. d Additional tax on an HSA because you didn't remain an eligible individual. Attach Form B889 e Additional tax on Archer MSA distributions. Attach Form 8853 . f Additional tax on Medicare Advantage MSA distributions. Attach Form 8853... g Recapture of a charitable contribution deduction related to a fractional interest in tangible personal property ....t... h Income you recelved from a nonqualified deferred compensation plan that fails to meet the requirements of section 409A I Compensation you recelved from a nonqualified deferred compensation plan described in section 457A. j Section 72(m)(5) excess ben I Tax on accumulation distribution of trusts. m Excise tax on insider stock compensation from an expatriated corporation . n Look-back interest under section 167(9) or 460(b) from Form 8697 or 8866. - Tax on non-effectively connected income for any part of the year you were a nonresident alien from Form 1040-NR. p Any interest from Form 8621 , line 166 , relating to distributions from, and dispositions of, stock of a section 1291 fund q Any interest from Form 8621, line 24 . z. Any other taxes, List type and amount 18 Total additional taxes, Add lines 17 a th 1040-SR, line 23, or Form 1040-NR, line 23b .... Eorm 1040 SCHEDULE A (Form 1040) Itemized Deductions OMB No, 1545-0074 Go to www.irs.gov/ScheduleA for instructions and the latest information. 2021 Attach to Form 1040 or 1040 -SR. Department of the Treasury Caution: If you are claiming a net qualifled disaster loss on form 4684 , see the Intemal Revenue Service (99) instructions for line 16 . Attachment Name(s) shown on Form 1040 or 1040 -SR Sequence No, 07 Ashley Panda Your social security number Medical 1 Medical and dental expenses (see instructions). and Dental 2 Enter amount from Form 1040 or 1040- Expenses SR, line 11 3 Multiply line 2 by 7.5%(0.075) 4 Subtract line 3 from line 1 . If line 3 is more than line 1 , enter 0.., Taxes You 5 state and local taxes. Paid a State and local income taxes or general sales taxes. You may Include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box. b State and local real estate taxes (see instructions) d Add lines 5 a through 50 e Enter the smaller of line 5d or $10,000($5,000 if married fling 6 Other toxes. List type and amount 7 Add lines 5e and 6 Interest 8 Home mortgage interest and points. If you didn't use all of your You Paid home mortgage loan(s) to buy, bulld, or improve your home, see instructions and check this box . Caution: a Home mortgage interest and points reported to you on Form 1098. Your mortgage See instructions if limited. interest b Home mortgage interest not reported to you on Form 1098. See deduction may instructions if limited. If paid to the person from whom you be limited (see bought the home, see instructions and show that person's name, instructions). identifying no., and address c Points not reported to you on Form 1098. See instructions for d Mortgage insurance premlums (see instructions) ............... 8d e Add lines 8 a through 8d. 9 Investment interest. Attach Form 4952 if required. See instructions. 10 Add lines 8e and 9 Gifts to 11 Gifts by cash or check, If you made any gift of $250 or more, Charity see instructions . Caution: 12 other than by cash or check. If you made any gift of $250 or more, If you made a see instructions. You must attach Form 8283 if over $500... . gift and got a 13 Carryover from prior year benefit for it, Casualty and 15 Casualty and theft loss(es) from a federally deciared disaster (other than net qualified disaster Theft Losses losses). Attach Form 4684 and enter the amount from line 18 of that form, See instructions. other 16 Other-from list in instructions. List type and amount Itemized Deductione Internal Revenue Service (99) generally file Form 1065 . Name of proprietor Ashley Panda Sequence No, 09 Social security number (SSN) E Business address (including suite or room no.) 456 Hill street City, town or post office, state, and Z1P code Wayne 0H43466 F Accounting method: (1) w Cash (2) - Accrual (3) D Other (specify) G Did you "materially participate" in the operation of this business H Wor if you started or acquired this business during 2021 , check here 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked, 2 Returns and allowances. 3 Subtract line 2 from line 1 4 Cost of goods sold (from line 42 ) 5 Gross profit. Subtract line 4 from line 3 . 6 Other income, including federal and 7 Gross income. Add lines 5 and 6 . 7 Gross income. Add lines 5 and 6 Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising 9 Car and truck expenses (see 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method. See instructions. Simplified method filers only: enter the total square footage of: (a) your home: of your home used for business: the amount to enter on line 30. - If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. - If a loss, you must go to line 32. 32 If you have a loss, check the box that describes your investment in this activity (see instructions). Attach to Form 1040,10405R, or 1040-NR. 16 Combine lines 7 and 15 and enter the result. - If Jine 16 is a gain, enter the amount from line 16 on Form 1040, 1040-5R, or 1040-NR, line 7. Then, go to line 17 below. - If ine 16 is a loss, skip lines 17 through 20 below. Then, go to line 21 , Also be sure to complete line 22. - If line 16 is zero, skip lines 17 through 21 below and enter - 0 - on Form 1040, 1040-5R, or 1040-NR, line 7. Then, go to line 22. 17 Are lines 15 and 16 both gains? * Yes. Go to line 18 . No. 5kip lines 18 through 21 , and go to line 22 . 18 If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the amount, if any, from line 7 of that worksheet 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet . 20 Are lines 18 and 19 both zero or blank and are you not filing Form 4952? * Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040SR, line 16 . Don't complete lines 21 and 22 below, No. Complete the Schedule D. Tax Worksheet in the instructions. Don't complete lines 21 and 22 below. 21 If line 16 is a loss, enter here and on Form 1040 , 1040-5R, or 1040-NR, line 7, the smaller of: - The loss on line 16; or - ($3,000), or if married filing separately, ($1,500)} Note: When figuring which amount is smatier, treat both amounts as positive numbers. Stience practitioner and you flied Form 4361 , but you had $400 or Skip lines 1a apd 1b if you use the farm optional method in Part II. See instructions. 1 a Net farm profit or (loss) from Schedule F, line 34, and farm partrierships, Schedule K-1 (Form 1065), box 14, codeA. b If you recelved social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH Skip line 2 if you use the nonfarm optional method in Part II. See instructions. 2 Net profit or (loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). See instructions for other income to report or if you are a minister or member of a religlous order 3 Combine lines 1a,1b, and 2 . 4a If line 3 is more than zero, multiply line 3 by 92.35%(0.9235). Otherwise, enter amount from line 3 Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 10 , see instructions. b If you elect one or both of the optional methods, enter the total of lines 15 and 17 here. c Combine lines 4a and 46 . If less than $400, stop; you don't owe self-employment tax, b Multiply line 5a by 9 6 Add tines 4c and 5b 7 Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2021 Total social security wages and tips (total of boxes 3 and 7 on Form(5) W-2) and railroad retirement (tier 1 ) compensation. If $142,800 or more, skip lines 86 through 10 , and go to line 11 . b Unreported tips subject to social security tax from Form 4137 , line 10. d Add lines 8a,8b, and 8c. 9 Subtract line 8d from line 7. If zero or less, enter 0 - here and on line 10 and go to line 11... 10 Multiply the smaller of line 6 or line 9 by 12.4%(0.124). 11 Multiply line 6 by 2.9%(0.029) 12 Self-employment tax, Add lines 10 and 11. Enter her Multiply line 12 by 50%(0.50). Enter here and on Schedule 1 (Form 1040), line Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method, You may use this method only if (a) your gross farm income(1) wasn't more than $8,820, or (b) your net farm profits (2) were less than $6,367. 14 Maximum income for optional methods. 15 Enter the smaller of: two-thirds (2/3) of gross farm income (1) (not less than zero) or $5,880. Also, include this amount on line 4b above . Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits (3) were less than $6,367 and also less than 72.189% of your gross nonfarm income, (4) and (b) you had net eamings from selfemployment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times. 16 Subtract line 15 from line 14 . 17 Enter the smaller of: two-thirds (2/3) of gross nonfarm income (4) (not less than zero) or the amount on line 16. Also, include this amount on line 4b above. (1) From Sch. F, line 9; and Sch. K-1 (Form 1065), box 14, code B. (2) From Sch. F, line 34; and Sch. K-1 (Form 1065), box 14, code A (3) From Sch. C, line 31; and Sch. K-1 (Form 1065), box 14, code A. - minus the amount you would have entered on line 16 had you (4) From Sch. C, lline 7; and Sch. K-1 (Form 1065), box 14, code C. not used the optional method. BAA For Paperwork Reduction Act Notice, see your tax return instructions. Use this form if your taxable income, before your qualifed business income deduction, is at or belaw $164,900 ( $164,925 if married filling separately; $329,800 if mamied fling jointiy), and you aren't a patron of an agricultural or horticultural cooperative. 2 Total qualified business income or (loss), Combine lines 11 through 1v, column (c). 3 Qualified business net (loss) carryforward from the prior year - 4 Total qualified business income. Combine lines 2 and 3 . If zero or less, enter 0 - 5 Qualified business income component. Multiply line 4 by 20%(0.20) 6 Qualifed Reit dividends and publicly traded partnership (PTP) income or (loss) (see instructions) 7 Qualifed ReIT dividends and qualified PTP (lest) carryforward from the priof yeak. 8. Total qualifed REIT dividends and PTP incoene. Combine lines 6 and 7. If zero or less, enter - 0- 9 ReIt and PTP component. Multiply line B by 20%(0.20). 10 Qualified business income deduction before the income limitation. Add lines 5 and 9 . 11 Taxable income before qualified business income deduction (see instructions). 12. Net capital gain (see instructions) 13 5ubtract line 12 from line 11 . If zero or less, enter 0... Before you begin: See the earlier instructions for line 16 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 15. 22. Figure the tax on the amount on line 5. If the amount on line 5 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 5 is $100,000 or more, use the Tax Computation Worksheet. 24. Figure the tax on the amount on line 1 . If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet. 25. Tax on all taxable income. Enter the smaller of line 23 or 24 . Also include this amount on the entry space on Form 1040 or 1040-5R, line 16. If you are filing Form 2555, don't enter this amount on the entry space on Form 1040 or 10405R, line 16. Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet. 2021 Tax Rate Schedules