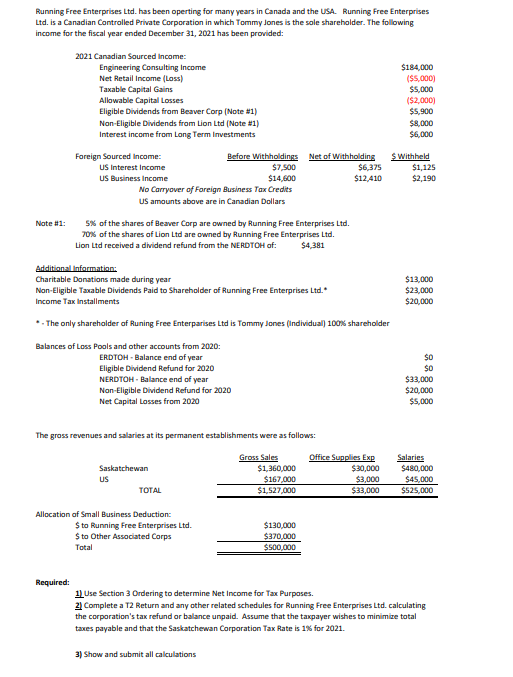

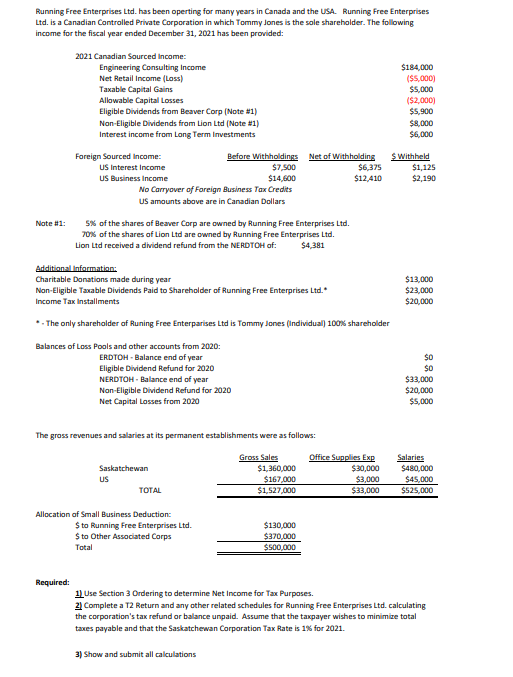

Running Free Enterprises Ltd. has been operting for many years in Canada and the USA. Running Free Enterprises Ltd. is a Canadian Contralled Private Corporation in which Tommy Jones is the sale sharehalder. The following income for the fiscal year ended December 31,2021 has been provided: Nate \#1: S\% of the shares of Beaver Corp are owned by Running Free Enterprises Ltd. Tors of the shares af Lion Ltd are owned by Running Free Enterprises Ltd. Lion Ltd received a dividend refund fram the NEROTOH of: $4,381 Additional Information: Charitable Donations made during year Nan-Eligible Taxable Dividends Paid to Shareholder of Running Free Enterprises Ltd. $23,000 Income Tax installments $20,000 *- The only shareholder af Runing Free Enterparises Ltd is Tommy Jones (Individual) 1000 shareholder Ba The gross revenues and salaries at its permanent establishments were as follows: Allocation of Small Business Deduction: \begin{tabular}{lr} \$ to Bunning Free Enterprises Ltd. & $130,000 \\ $ to Other Associated Corps & $370,000 \\ \hline Total & $500,000 \\ \cline { 2 - 2 } \end{tabular} Required: 1) Use Section 3 Ordering to determine Net Income for Tax Purpases. 2) Complete a T2 Return and any other related schedules for Running Free Enterprises Ltd. calculating the corporation's tax refund or balance unpaid. Assume that the taxpayer wishes to minimise tatal taxes payable and that the Saskatchewan Corporation Tax Rate is 1% for 2021. 3) Show and submit all calculations Running Free Enterprises Ltd. has been operting for many years in Canada and the USA. Running Free Enterprises Ltd. is a Canadian Contralled Private Corporation in which Tommy Jones is the sale sharehalder. The following income for the fiscal year ended December 31,2021 has been provided: Nate \#1: S\% of the shares of Beaver Corp are owned by Running Free Enterprises Ltd. Tors of the shares af Lion Ltd are owned by Running Free Enterprises Ltd. Lion Ltd received a dividend refund fram the NEROTOH of: $4,381 Additional Information: Charitable Donations made during year Nan-Eligible Taxable Dividends Paid to Shareholder of Running Free Enterprises Ltd. $23,000 Income Tax installments $20,000 *- The only shareholder af Runing Free Enterparises Ltd is Tommy Jones (Individual) 1000 shareholder Ba The gross revenues and salaries at its permanent establishments were as follows: Allocation of Small Business Deduction: \begin{tabular}{lr} \$ to Bunning Free Enterprises Ltd. & $130,000 \\ $ to Other Associated Corps & $370,000 \\ \hline Total & $500,000 \\ \cline { 2 - 2 } \end{tabular} Required: 1) Use Section 3 Ordering to determine Net Income for Tax Purpases. 2) Complete a T2 Return and any other related schedules for Running Free Enterprises Ltd. calculating the corporation's tax refund or balance unpaid. Assume that the taxpayer wishes to minimise tatal taxes payable and that the Saskatchewan Corporation Tax Rate is 1% for 2021. 3) Show and submit all calculations