Answered step by step

Verified Expert Solution

Question

1 Approved Answer

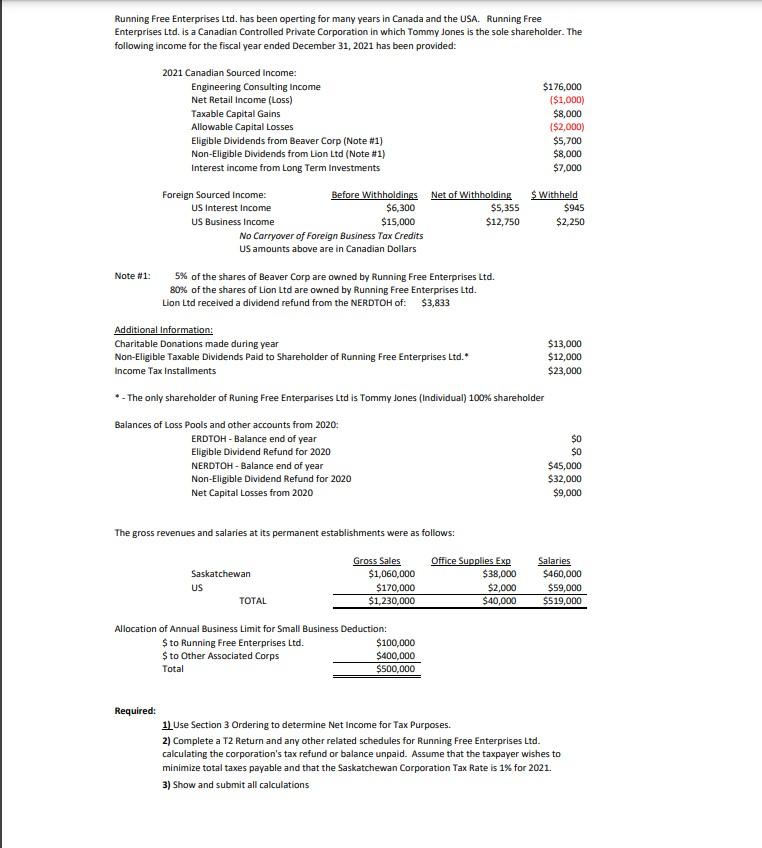

Running Free Enterprises Ltd. has been operting for many years in Canada and the USA. Running Free Enterprises Ltd. is a Canadian Controlled Private

Running Free Enterprises Ltd. has been operting for many years in Canada and the USA. Running Free Enterprises Ltd. is a Canadian Controlled Private Corporation in which Tommy Jones is the sole shareholder. The following income for the fiscal year ended December 31, 2021 has been provided: Note #1: 2021 Canadian Sourced Income: Engineering Consulting Income Net Retail Income (Loss) Taxable Capital Gains Allowable Capital Losses Eligible Dividends from Beaver Corp (Note #1) Non-Eligible Dividends from Lion Ltd (Note #1) Interest income from Long Term Investments Foreign Sourced Income: US Interest Income US Business Income Required: No Carryover of Foreign Business Tax Credits US amounts above are in Canadian Dollars Additional Information: Charitable Donations made during year Non-Eligible Taxable Dividends Paid to Shareholder of Running Free Enterprises Ltd.* Income Tax Installments Before Withholdings Net of Withholding $6,300 $15,000 5% of the shares of Beaver Corp are owned by Running Free Enterprises Ltd. 80% of the shares of Lion Ltd are owned by Running Free Enterprises Ltd. Lion Ltd received a dividend refund from the NERDTOH of: $3,833 NERDTOH - Balance end of year Non-Eligible Dividend Refund for 2020 Net Capital Losses from 2020 The gross revenues and salaries at its permanent establishments were as follows: *- The only shareholder of Runing Free Enterparises Ltd is Tommy Jones (Individual) 100% shareholder Balances of Loss Pools and other accounts from 2020: ERDTOH - Balance end of year Eligible Dividend Refund for 2020 Saskatchewan US TOTAL Gross Sales $1,060,000 $170,000 $1,230,000 Allocation of Annual Business Limit for Small Business Deduction: $ to Running Free Enterprises Ltd. $ to Other Associated Corps Total $5,355 $12,750 $100,000 $400,000 $500,000 Office Supplies Exp $38,000 $176,000 ($1,000) $8,000 ($2,000) $5,700 $8,000 $7,000 $2,000 $40,000 $ Withheld $945 $2,250 $13,000 $12,000 $23,000 $0 $0 $45,000 $32,000 $9,000 Salaries $460,000 $59,000 $519,000 1) Use Section 3 Ordering to determine Net Income for Tax Purposes. 2) Complete a T2 Return and any other related schedules for Running Free Enterprises Ltd. calculating the corporation's tax refund or balance unpaid. Assume that the taxpayer wishes to minimize total taxes payable and that the Saskatchewan Corporation Tax Rate is 1% for 2021. 3) Show and submit all calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started