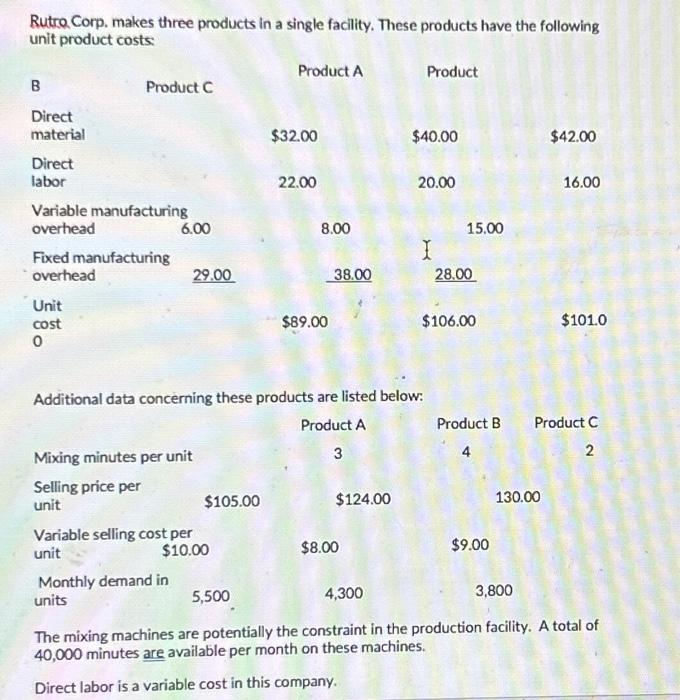

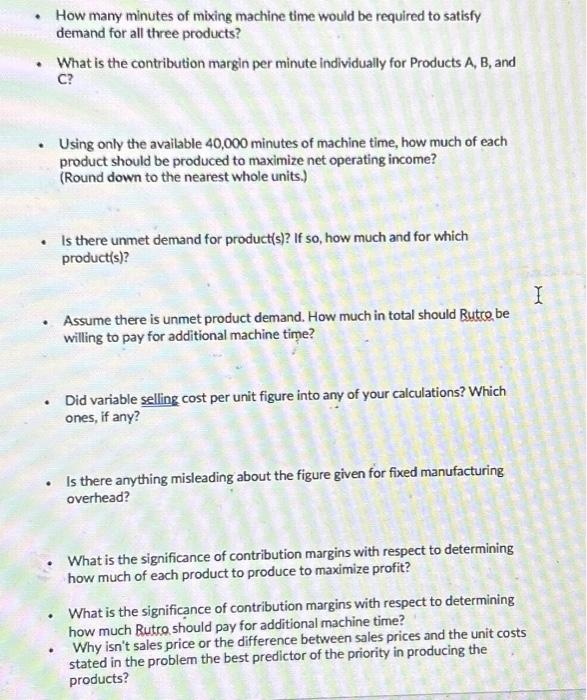

Rutra Corp. makes three products in a single facility. These products have the following unit product costs: Additional data concerning these products are listed below: The mixing machines are potentially the constraint in the production facility. A total of 40,000 minutes are available per month on these machines. Direct labor is a variable cost in this company. - How many minutes of mixing machine time would be required to satisfy demand for all three products? - What is the contribution margin per minute individually for Products A, B, and C? - Using only the available 40,000 minutes of machine time, how much of each product should be produced to maximize net operating income? (Round down to the nearest whole units.) - Is there unmet demand for product(s)? If so, how much and for which product(s)? - Assume there is unmet product demand. How much in total should Rutro be willing to pay for additional machine time? - Did variable selling cost per unit figure into any of your calculations? Which ones, if any? - Is there anything misleading about the figure given for fixed manufacturing overhead? - What is the significance of contribution margins with respect to determining how much of each product to produce to maximize profit? - What is the significance of contribution margins with respect to determining how much Rutro should pay for additional machine time? - Why isn't sales price or the difference between sales prices and the unit costs stated in the problem the best predictor of the priority in producing the products? Rutra Corp. makes three products in a single facility. These products have the following unit product costs: Additional data concerning these products are listed below: The mixing machines are potentially the constraint in the production facility. A total of 40,000 minutes are available per month on these machines. Direct labor is a variable cost in this company. - How many minutes of mixing machine time would be required to satisfy demand for all three products? - What is the contribution margin per minute individually for Products A, B, and C? - Using only the available 40,000 minutes of machine time, how much of each product should be produced to maximize net operating income? (Round down to the nearest whole units.) - Is there unmet demand for product(s)? If so, how much and for which product(s)? - Assume there is unmet product demand. How much in total should Rutro be willing to pay for additional machine time? - Did variable selling cost per unit figure into any of your calculations? Which ones, if any? - Is there anything misleading about the figure given for fixed manufacturing overhead? - What is the significance of contribution margins with respect to determining how much of each product to produce to maximize profit? - What is the significance of contribution margins with respect to determining how much Rutro should pay for additional machine time? - Why isn't sales price or the difference between sales prices and the unit costs stated in the problem the best predictor of the priority in producing the products