Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RWP7-1 (Algo) Great Adventures Continuing Case (GL) Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide

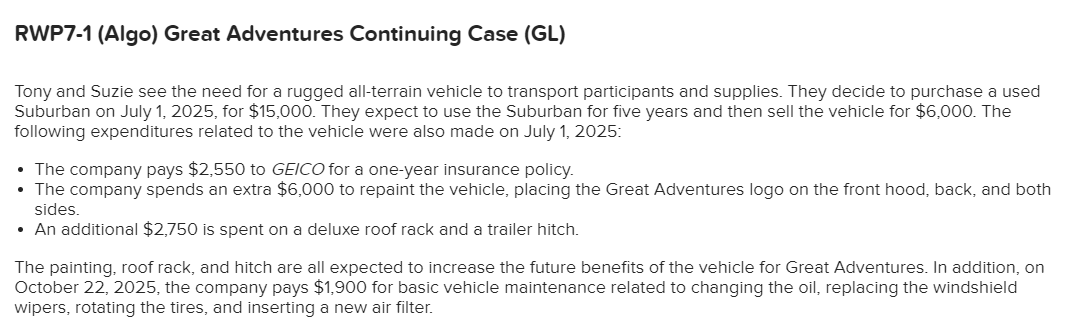

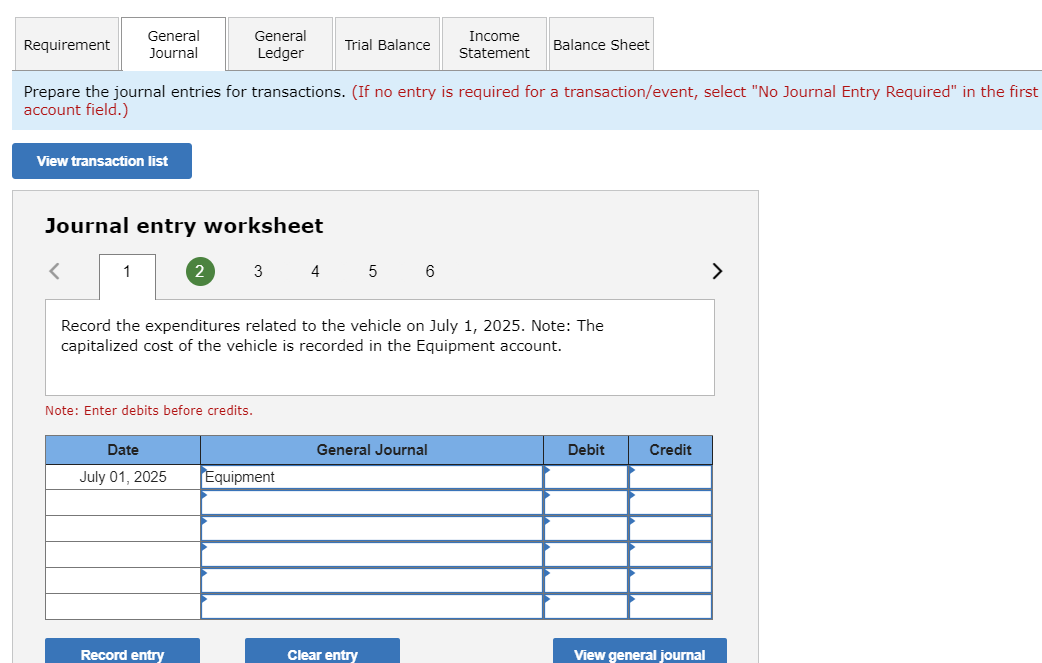

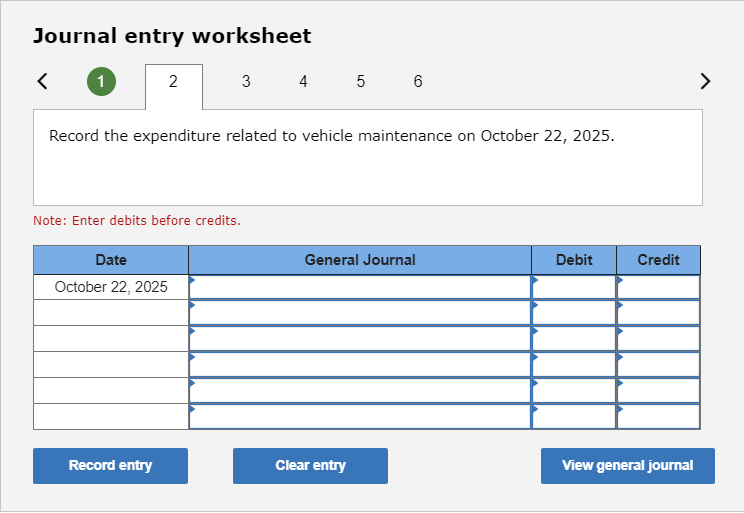

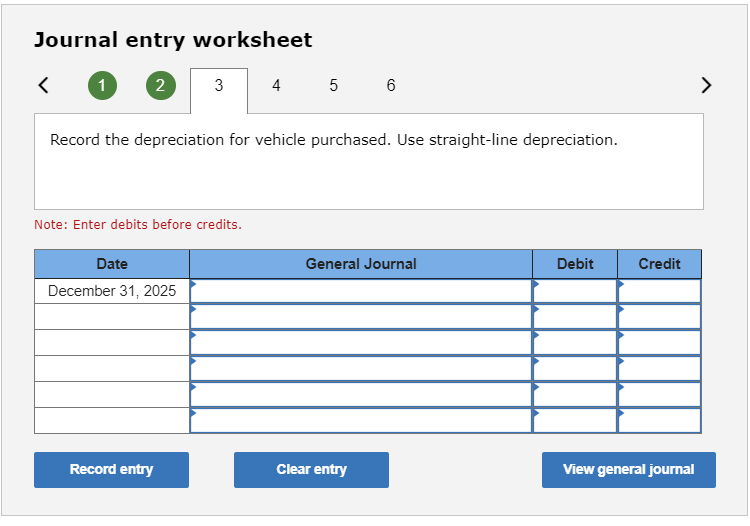

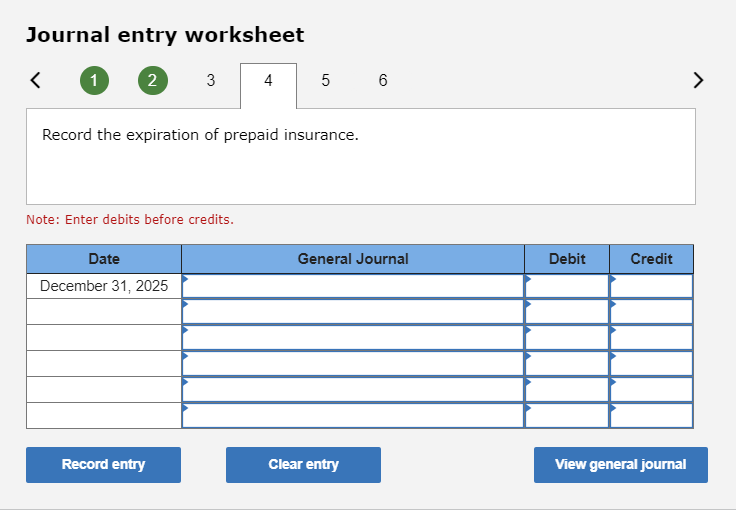

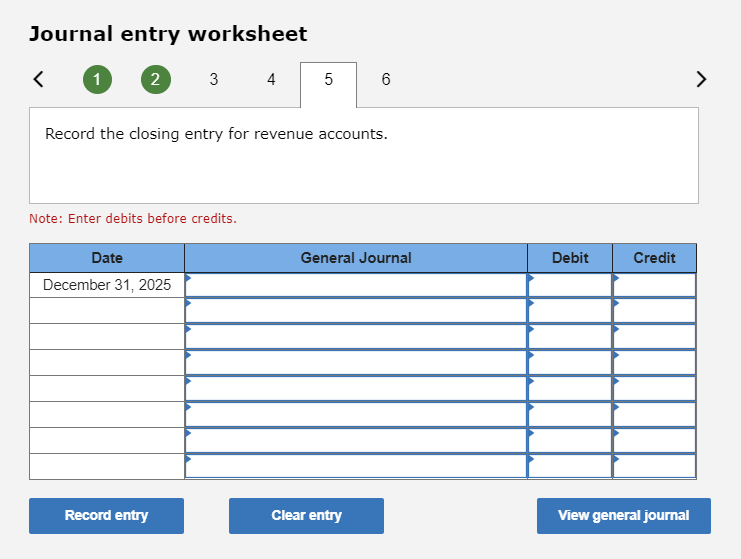

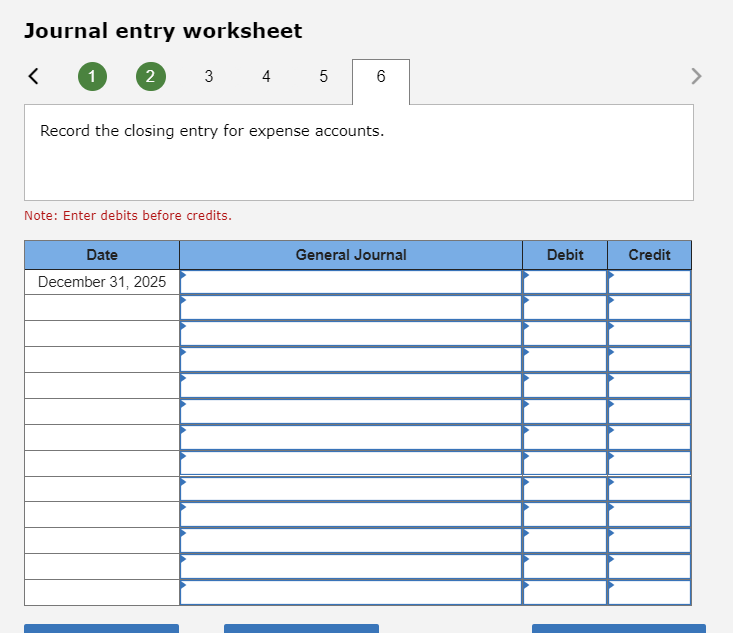

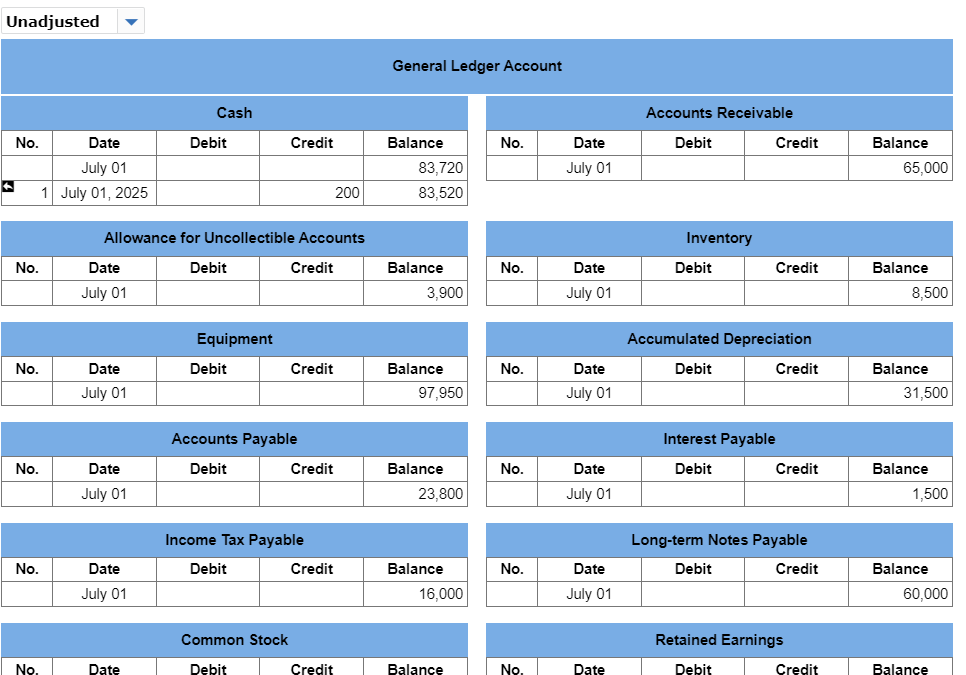

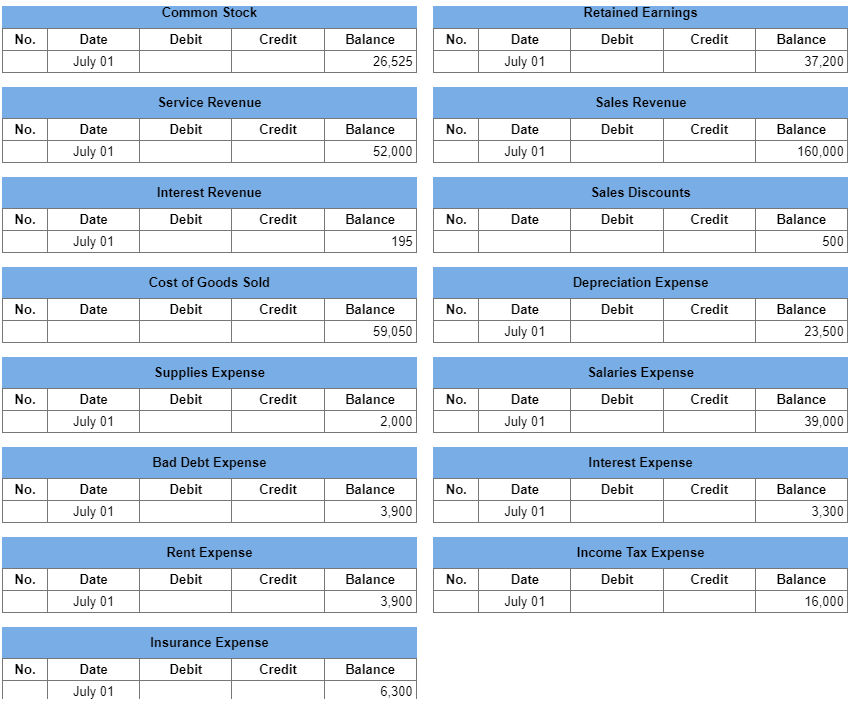

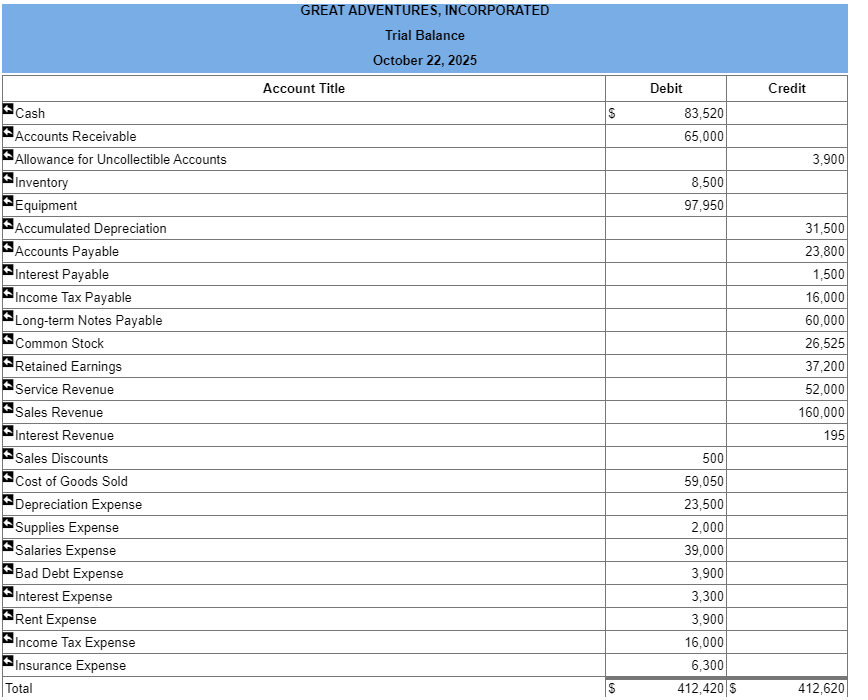

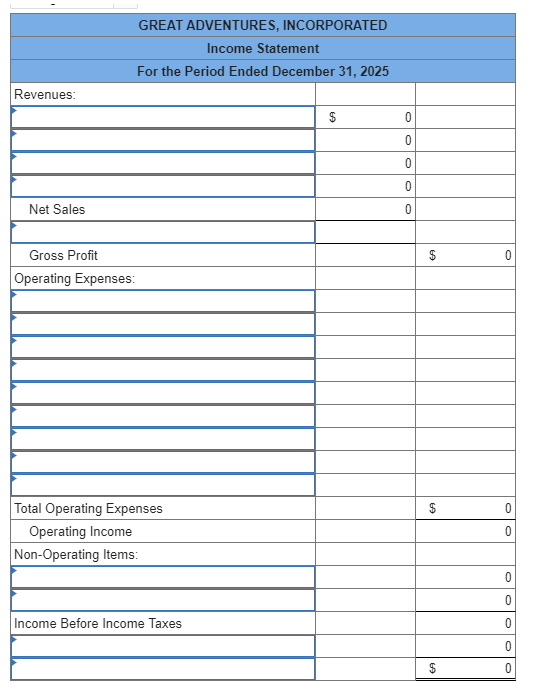

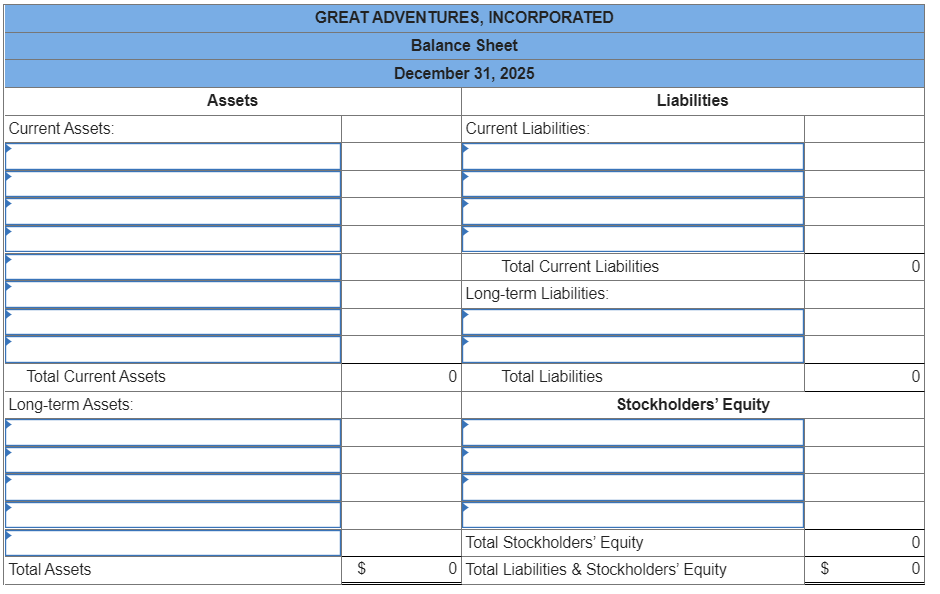

RWP7-1 (Algo) Great Adventures Continuing Case (GL) Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2025, for $15,000. They expect to use the Suburban for five years and then sell the vehicle for $6,000. The following expenditures related to the vehicle were also made on July 1,2025 : - The company pays $2,550 to GEICO for a one-year insurance policy. - The company spends an extra \$6,000 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. - An additional $2,750 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22 , 2025 , the company pays $1,900 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the firs account field.) Journal entry worksheet 456 Record the expenditures related to the vehicle on July 1, 2025. Note: The capitalized cost of the vehicle is recorded in the Equipment account. Note: Enter debits before credits. Journal entry worksheet Record the expenditure related to vehicle maintenance on October 22, 2025. Note: Enter debits before credits. Journal entry worksheet Record the depreciation for vehicle purchased. Use straight-line depreciation. Note: Enter debits before credits. Journal entry worksheet Record the expiration of prepaid insurance. Note: Enter debits before credits. Journal entry worksheet 6 Record the closing entry for revenue accounts. Note: Enter debits before credits. Journal entry worksheet 1 4 5 Record the closing entry for expense accounts. Note: Enter debits before credits. Unadjusted General Ledger Account Accounts Receivable \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Allowance for Uncollectible Accounts } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 3,900 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Inventory } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 8,500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{6}{|c|}{ Equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 97,950 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accumulated Depreciation } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 31,500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Accounts Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 23,800 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Interest Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 1,500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Income Tax Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 16,000 \\ \hline \end{tabular} Long-term Notes Payable \begin{tabular}{|c|c|c|c|r|} \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 60,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \multicolumn{4}{c}{ Common Stock } & \multicolumn{4}{c}{ Retained Earnings } \\ No. & Date & Debit & Credit & Balance & No. & Date & Debit & Credit & Balance \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common Stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 26,525 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Retained Earnings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 37,200 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Service Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 52,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Sales Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 160,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Supplies Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 2,000 \\ \hline \end{tabular} Depreciation Expense \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 23,500 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Bad Debt Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 3,900 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Interest Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 3,300 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{6}{|c|}{ Rent Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 3,900 \\ \hline \end{tabular} Income Tax Expense \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 16,000 \\ \hline \end{tabular} Insurance Expense \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 6,300 \end{tabular} GREAT ADVENTURES, INCORPORATED Trial Balance October 22, 2025 GREAT ADVENTURES, INCORPORATED Income Statement For the Period Ended December 31, 2025 Revenues: GREAT ADVENTURES, INCORPORATED Balance Sheet December 31, 2025 RWP7-1 (Algo) Great Adventures Continuing Case (GL) Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2025, for $15,000. They expect to use the Suburban for five years and then sell the vehicle for $6,000. The following expenditures related to the vehicle were also made on July 1,2025 : - The company pays $2,550 to GEICO for a one-year insurance policy. - The company spends an extra \$6,000 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. - An additional $2,750 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22 , 2025 , the company pays $1,900 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the firs account field.) Journal entry worksheet 456 Record the expenditures related to the vehicle on July 1, 2025. Note: The capitalized cost of the vehicle is recorded in the Equipment account. Note: Enter debits before credits. Journal entry worksheet Record the expenditure related to vehicle maintenance on October 22, 2025. Note: Enter debits before credits. Journal entry worksheet Record the depreciation for vehicle purchased. Use straight-line depreciation. Note: Enter debits before credits. Journal entry worksheet Record the expiration of prepaid insurance. Note: Enter debits before credits. Journal entry worksheet 6 Record the closing entry for revenue accounts. Note: Enter debits before credits. Journal entry worksheet 1 4 5 Record the closing entry for expense accounts. Note: Enter debits before credits. Unadjusted General Ledger Account Accounts Receivable \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Allowance for Uncollectible Accounts } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 3,900 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Inventory } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 8,500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{6}{|c|}{ Equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 97,950 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accumulated Depreciation } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 31,500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Accounts Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 23,800 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Interest Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 1,500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Income Tax Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 16,000 \\ \hline \end{tabular} Long-term Notes Payable \begin{tabular}{|c|c|c|c|r|} \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 60,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \multicolumn{4}{c}{ Common Stock } & \multicolumn{4}{c}{ Retained Earnings } \\ No. & Date & Debit & Credit & Balance & No. & Date & Debit & Credit & Balance \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common Stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 26,525 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Retained Earnings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 37,200 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Service Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 52,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Sales Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 160,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Supplies Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 2,000 \\ \hline \end{tabular} Depreciation Expense \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 23,500 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Bad Debt Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 3,900 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Interest Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 3,300 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{6}{|c|}{ Rent Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 3,900 \\ \hline \end{tabular} Income Tax Expense \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 16,000 \\ \hline \end{tabular} Insurance Expense \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & July 01 & & & 6,300 \end{tabular} GREAT ADVENTURES, INCORPORATED Trial Balance October 22, 2025 GREAT ADVENTURES, INCORPORATED Income Statement For the Period Ended December 31, 2025 Revenues: GREAT ADVENTURES, INCORPORATED Balance Sheet December 31, 2025

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started