Answered step by step

Verified Expert Solution

Question

1 Approved Answer

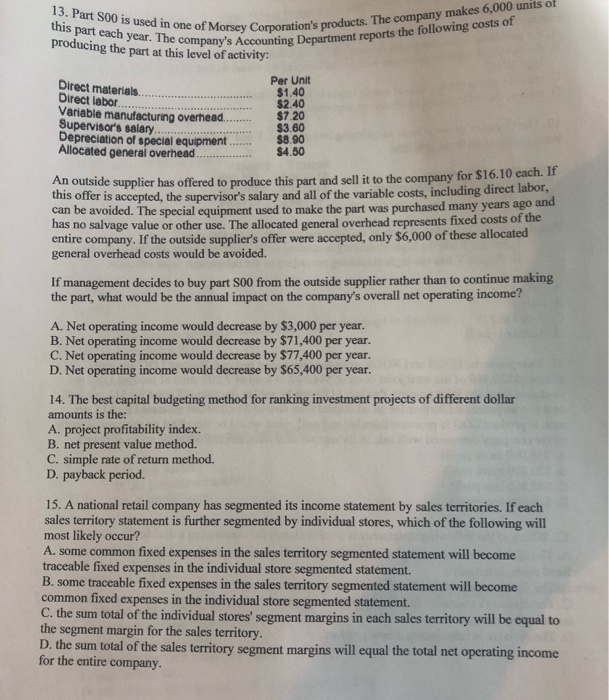

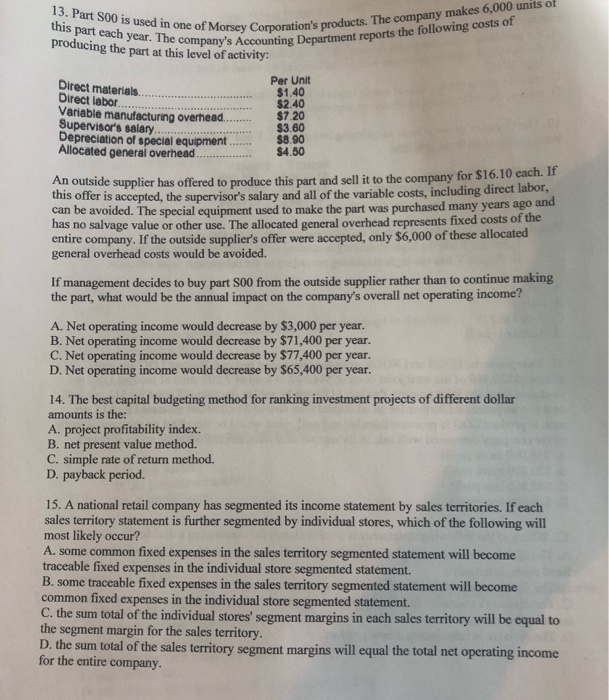

ry Corporation's products. The company makes 6,000 units of pany's Accounting Department reports the following costs of year. Th e t producing the part at

ry Corporation's products. The company makes 6,000 units of pany's Accounting Department reports the following costs of year. Th e t producing the part at this level of activity: Per Unit materials. $1.40 $2.40 Direct labor Variable manufacturing overhead. Supervisors salary $7.20 Depreciation of special equipment. $8.90 supplier has offered to produce this part and sell it to the company for $16.10 each. If offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago has no salvage value or other use. The allocated general overhead represents fixed costs and of the entire company,. If the outside supplier's offer were accepted, only $6,000 of these alloca general overhead costs would be avoided. If management decides to buy part S00 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income? A. Net operating income would decrease by $3,000 per year B. Net operating income would decrease by $71,400 per year. C. Net operating income would decrease by $77,400 per year D. Net operating income would decrease by $65,400 per year 14. The best capital budgeting method for ranking investment projects of different dollar amounts is the: A. project profitability index. B. net present value method. C. simple rate of return method. D. payback period. 15. A national retail company has segmented its income statement by sales territories. If each sales territory statement is further segmented by individual stores, which of the following will most likely occur? A. some common fixed expenses in the sales territory segmented statement will become traceable fixed expenses in the individual store segmented statement. B. some traceable fixed expenses in the sales territory segmented statement will become common fixed expenses in the individual store segmented statement. C. the sum total of the individual stores' segment margins in each sales the segment margin for the sales territory. D. the for the entire company. territory will be equal to sum total of the sales territory segment margins will equal the total net operating income

ry Corporation's products. The company makes 6,000 units of pany's Accounting Department reports the following costs of year. Th e t producing the part at this level of activity: Per Unit materials. $1.40 $2.40 Direct labor Variable manufacturing overhead. Supervisors salary $7.20 Depreciation of special equipment. $8.90 supplier has offered to produce this part and sell it to the company for $16.10 each. If offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago has no salvage value or other use. The allocated general overhead represents fixed costs and of the entire company,. If the outside supplier's offer were accepted, only $6,000 of these alloca general overhead costs would be avoided. If management decides to buy part S00 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income? A. Net operating income would decrease by $3,000 per year B. Net operating income would decrease by $71,400 per year. C. Net operating income would decrease by $77,400 per year D. Net operating income would decrease by $65,400 per year 14. The best capital budgeting method for ranking investment projects of different dollar amounts is the: A. project profitability index. B. net present value method. C. simple rate of return method. D. payback period. 15. A national retail company has segmented its income statement by sales territories. If each sales territory statement is further segmented by individual stores, which of the following will most likely occur? A. some common fixed expenses in the sales territory segmented statement will become traceable fixed expenses in the individual store segmented statement. B. some traceable fixed expenses in the sales territory segmented statement will become common fixed expenses in the individual store segmented statement. C. the sum total of the individual stores' segment margins in each sales the segment margin for the sales territory. D. the for the entire company. territory will be equal to sum total of the sales territory segment margins will equal the total net operating income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started