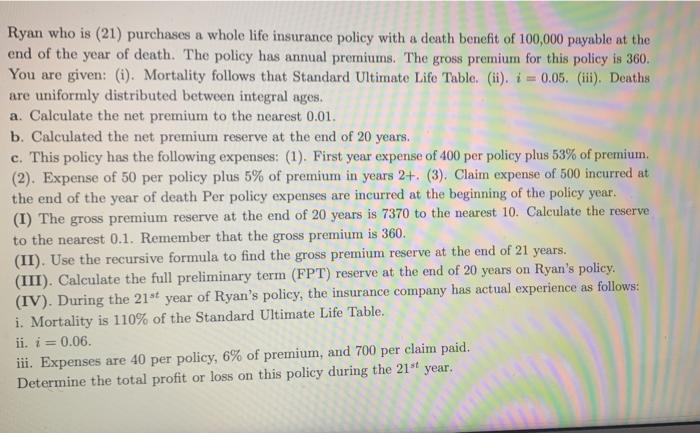

Ryan who is (21) purchases a whole life insurance policy with a death benefit of 100,000 payable at the end of the year of death. The policy has annual premiums. The gross premium for this policy is 360. You are given: (i). Mortality follows that Standard Ultimate Life Table. (ii). i = 0.05. (ii). Deaths are uniformly distributed between integral ages. a. Calculate the net premium to the nearest 0.01. b. Calculated the net premium reserve at the end of 20 years. c. This policy has the following expenses: (1). First year expense of 400 per policy plus 53% of premium (2). Expense of 50 per policy plus 5% of premium in years 2+. (3). Claim expense of 500 incurred at the end of the year of death Per policy expenses are incurred at the beginning of the policy year. (1) The gross premium reserve at the end of 20 years is 7370 to the nearest 10. Calculate the reserve to the nearest 0.1. Remember that the gross premium is 360. (II). Use the recursive formula to find the gross premium reserve at the end of 21 years. (III). Calculate the full preliminary term (FPT) reserve at the end of 20 years on Ryan's policy. (IV). During the 21st year of Ryan's policy, the insurance company has actual experience as follows: i. Mortality is 110% of the Standard Ultimate Life Table. ii. i=0.06. iii. Expenses are 40 per policy, 6% of premium, and 700 per claim paid. Determine the total profit or loss on this policy during the 21st year. Ryan who is (21) purchases a whole life insurance policy with a death benefit of 100,000 payable at the end of the year of death. The policy has annual premiums. The gross premium for this policy is 360. You are given: (i). Mortality follows that Standard Ultimate Life Table. (ii). i = 0.05. (ii). Deaths are uniformly distributed between integral ages. a. Calculate the net premium to the nearest 0.01. b. Calculated the net premium reserve at the end of 20 years. c. This policy has the following expenses: (1). First year expense of 400 per policy plus 53% of premium (2). Expense of 50 per policy plus 5% of premium in years 2+. (3). Claim expense of 500 incurred at the end of the year of death Per policy expenses are incurred at the beginning of the policy year. (1) The gross premium reserve at the end of 20 years is 7370 to the nearest 10. Calculate the reserve to the nearest 0.1. Remember that the gross premium is 360. (II). Use the recursive formula to find the gross premium reserve at the end of 21 years. (III). Calculate the full preliminary term (FPT) reserve at the end of 20 years on Ryan's policy. (IV). During the 21st year of Ryan's policy, the insurance company has actual experience as follows: i. Mortality is 110% of the Standard Ultimate Life Table. ii. i=0.06. iii. Expenses are 40 per policy, 6% of premium, and 700 per claim paid. Determine the total profit or loss on this policy during the 21st year