Answered step by step

Verified Expert Solution

Question

1 Approved Answer

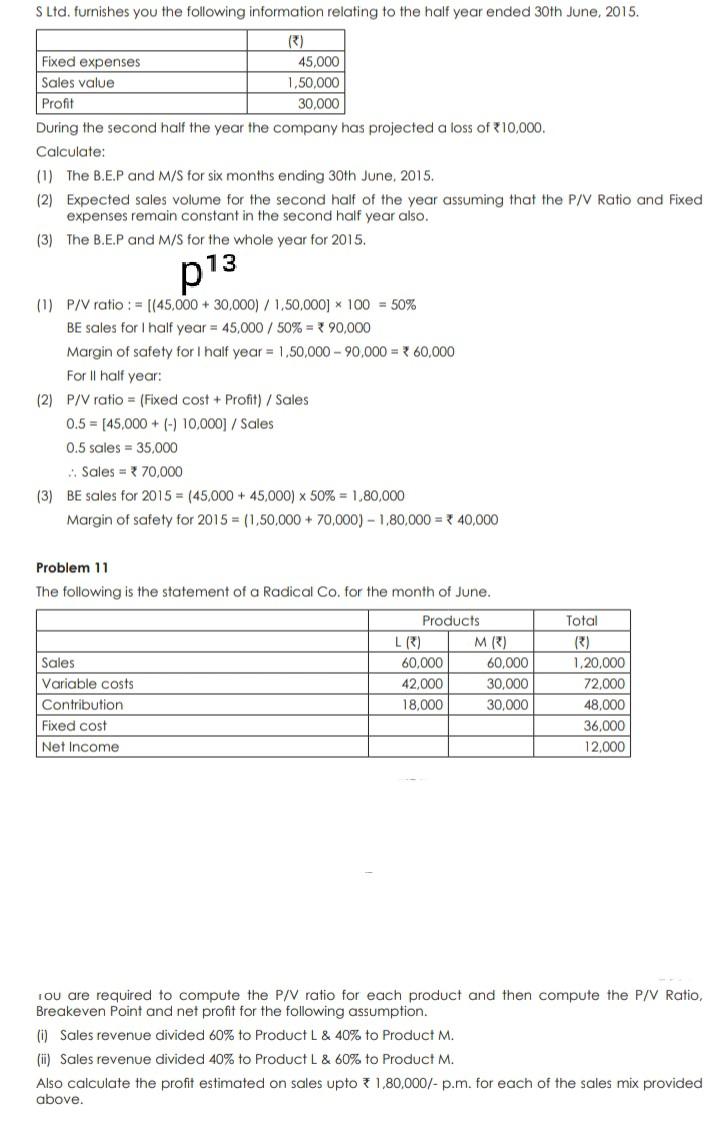

S Ltd. furnishes you the following information relating to the half year ended 30th June, 2015. Fixed expenses 45,000 Sales value 1,50,000 Profit 30,000 During

S Ltd. furnishes you the following information relating to the half year ended 30th June, 2015. Fixed expenses 45,000 Sales value 1,50,000 Profit 30,000 During the second half the year the company has projected a loss of 10,000. Calculate: (1) The B.E.P and M/S for six months ending 30th June, 2015. (2) Expected sales volume for the second half of the year assuming that the P/V Ratio and Fixed expenses remain constant in the second half year also. (3) The B.E.P and M/S for the whole year for 2015. 13 p13 (1) P/V ratio : = [(45,000 + 30,000) / 1.50,000) * 100 = 50% BE sales for I half year = 45,000 / 50% = 90,000 Margin of safety for I half year = 1.50,000 - 90,000 = 60,000 For II half year: (2) P/V ratio = (Fixed cost + Profit) / Sales 0.5 = [45,000 + (-) 10,000] /Sales 0.5 sales = 35.000 . Sales - 70,000 (3) BE sales for 2015 = (45,000 + 45,000) 50% = 1,80,000 Margin of safety for 2015 = (1.50,000 + 70,000) - 1,80,000 = 40,000 Problem 11 The following is the statement of a Radical Co. for the month of June. Sales Variable costs Contribution Fixed cost Net Income Products LR) MR) 60,000 60,000 42,000 30,000 18,000 30,000 Total R) 1.20,000 72.000 48.000 36,000 12.000 Tou are required to compute the P/V ratio for each product and then compute the P/V Ratio, Breakeven Point and net profit for the following assumption. (i) Sales revenue divided 60% to Product L & 40% to Product M. (i) Sales revenue divided 40% to Product L & 60% to Product M. Also calculate the profit estimated on sales upto 1,80,000/- p.m. for each of the sales mix provided above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started