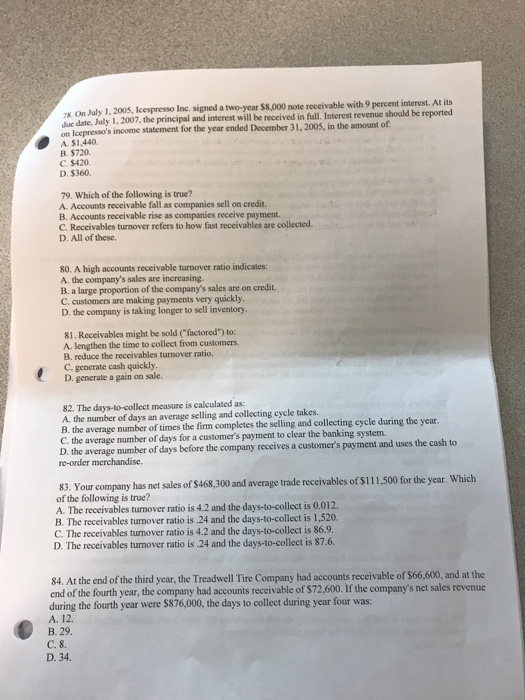

s On July 1, 2005, lcespresso Inc. signed a two-year $8,000 note receivable with 9 percent interest. At its due date, July 1, 2007, the principal and interest will be received in full. Interest revenue should be reported on Icepresso's income statement for the year ended December 31, 2005, in the amount of A. $1,440. S720. C. $420 D. $360. 79. Which of the following is true? A. Accounts receivable fall as companies sell on credit. B. Accounts receivable rise as companies receive payment. C. Receivables turnover refers to how fast receivables are collected D. All of these. 80. A high accounts receivable turnover ratio indicates: A. the company's sales are increasing. B. a large proportion of the company's sales are on credit. C. customers are making payments very quickly D. the company is taking longer to sell inventory 81. Receivables might be sold (factored") to: A. lengthen the time to collect from customers. B. reduce the receivables turnover ratio. C. generate cash quickly D. generate a gain on sale. 82. The days-to-collect measure is calculated as: A. the number of days an average selling and collecting cycle takes. B. the average number of times the firm completes the selling and collecting cycle during the year C. the average number of days for a customer's payment to clear the banking system. D. the average number of days before the company receives a customer's payment and uses the cash to re-order merchandise Your company has net sales of $468,300 and average trade receivables of $111,500 for the year. Which of the following is true? A. The receivables turnover ratio is 4.2 and the days-to-collect is 0.012. B. The receivables turnover ratio is .24 and the days-to-collect is 1,520. C. The receivables turnover ratio is 4.2 and the days-to-collect is 86.9 D. The receivables turnover ratio is 24 and the days-to-collect is 87.6 84. At the end of the third year, the Treadwell Tire Company had accounts receivable of $66,600, and at the end of the fourth year, the company had accounts receivable of $72,600. If the company's net sales revenue during the fourth year were $876,000, the days to collect during year four was: A. 12. B. 29. D. 34